EUR/USD now Forecast above 1.20 as "Genie is out of the Bottle" say Danske Bank

A big upgrade for the Euro to Dollar exchange rate (EUR/USD) has been announced by Danske Bank who believe a perfect combination of events have transpired over recent weeks that will allow the single-currency to race higher.

Analysts at the Scandinavian banking giant say recent ECB communication and the balance of political risks “have shifted in favour of the Euro”.

In a briefing to clients dated July 25, Danske Bank’s Senior Analyst Morten Helt says he and his team are lifting their one, three, six and twelve month forecasts in tandem.

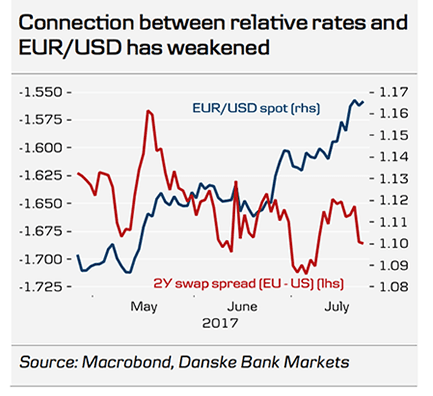

“Over the past month, EUR/USD has witnessed a kind of perfect storm, starting with Draghi’s hawkish speech at the ECB Forum in Sintra in late June. In our view, Draghi and the ECB have already let the ‘EUR/USD genie’ out of the bottle – and basically paved the way for a continued correction in the FX market of some of the long-standing undervaluation in EUR/USD,” says Helt.

The balance of political risks has shifted in favour of the Euro with the French elections passing by without offering any negative surprises and expectations for future German elections suggesting the status quo will win out.

So while the skies are seen clearing in the Eurozone, politics in the US has been a USD negative recently.

The inability of US President Donald Trump to stamp his authority on his Republican lawmakers suggest the President’s pro-Dollar policies on tax and spending will likely have to be watered down significantly.

Meanwhile, the Russian scandal simply won’t die and therefore continues to undermine confidence in the executive branch of Government.

EUR/USD Still Undervalued

Helt also notes that a combination of valuation, growth momentum and flows remains EUR supportive.

“Fundamentally, EUR/USD is still undervalued, according to our MEVA model, and we expect the pull effect from this ‘reverse gravity’ to remain a key driver for EUR appreciation,” says Helt.

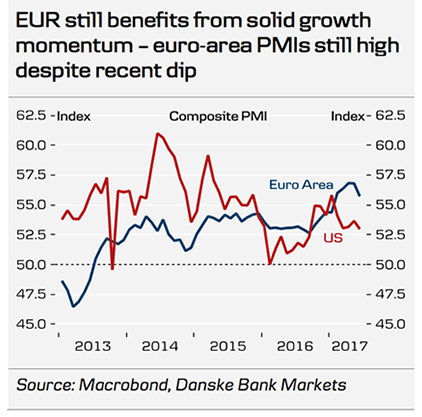

Moreover, the EUR still benefits from solid growth momentum despite the recent dip in the PMI figures, indicating that growth momentum could ease in the coming quarters; PMI levels in the euro area remain high by historical standards.

Danske Bank also expect foreign equity inflows and a solid current account surplus in the Eurozone to continue to drive EUR appreciation.

However, Danske Bank say we should not be surprised if momentum behind the Euro fades in the near-term; after all it has been a meteoric rise for the single-currency of late.

In terms of ECB communication, the next pivotal event will be Draghi’s speech at Jackson Hole on 24-26 August, which will be monitored closely for any signals about a shift in the ECB’s monetary policy.

If a shift to a world of higher interest rates and reduced quantitative easing is signaled the Euro's rally will be justified. If not, a rude downward correction might occur.

Danske still think it is most likely that at its September meeting the ECB will announce a review of its monetary policy at the October meeting.

Forecast Upgrades

Danske lift their 1- and 3-month forecasts from 1.13 to 1.17, “reflecting that we expect

the level shift higher in EUR/USD to persist, while expecting momentum to ease near term amid stretched technicals, short-term valuations and positioning (IMM),” says Helt.

Longer-term, analysts still expect a higher EUR/USD supported by fundamentals and less Fed-ECB divergence. They lift their 6- and 12-month targets to 1.18 in 6M and 1.22 in 12M (from 1.15 and 1.18 respectively).

Others Agree

The move by Danske is not a unique one amongst the foreign exchange analyst community.

We have witnessed a sea-change in opinion towards the Euro as analysts race to update their forecasts in light of recent strength that has left their previous expectations looking very cautious indeed.

We have reported that analysts at Deutsche Bank are forecasting the Euro to strengthen another 5% against the British Pound from current levels while they say they expect the EUR/USD exchange rate is likely to rally to 1.20.

Also of note, the world’s largest investment bank JP Morgan has this month announced a raft of upgrades to the Euro exchange rate complex.