Euro-Dollar Eyes 1.0260 Next, Retail Sales Data Sends a Clear Message

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar (EUR/USD) exchange rate will test 1.0260 next ahead of a steady multi-day walk to the big 1.02 figure.

The Dollar has brushed of Wednesday's drop that followed a below-consensus inflation reading, with traders keeping the big picture in mind: the U.S. economy is too hot to bet against.

EUR/USD peaked at 1.0350 following the inflation data, but the strength merely attracted the sellers who reloaded and promptly took it down to 1.0285, where we find it at the time of writing Thursday.

Fresh dollar strength follows a strong U.S. retail sales figure of 0.4% month-on-month for December, which topped expectations.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The core measure - or the control group - which excludes autos, gasoline, building materials, and office supplies, rose 0.7% and speaks of solid demand in the economy.

"All told, this year's holiday shopping season was even stronger than last year's, as a resilient labor market has continued to support household income growth. As long as households remain employed and are earning income, they likely will continue to spend. That leaves the outlook for retail sales in a healthy place as we kick off 2025," says Tim Quinlan,

Senior Economist at Wells Fargo Economics.

Strong economic demand will ensure U.S. inflation remains strong enough to keep inflation ticking along well above the 2.0% level targetted by the Fed.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"The Federal Reserve's wait-and-see approach seems well-justified for now," says Karl Schamotta, analyst at Corpay. "Taken in combination with this week’s producer and import price data releases, it looks as if underlying inflation is stabilising just below the 3-percent level—well above pre-pandemic averages."

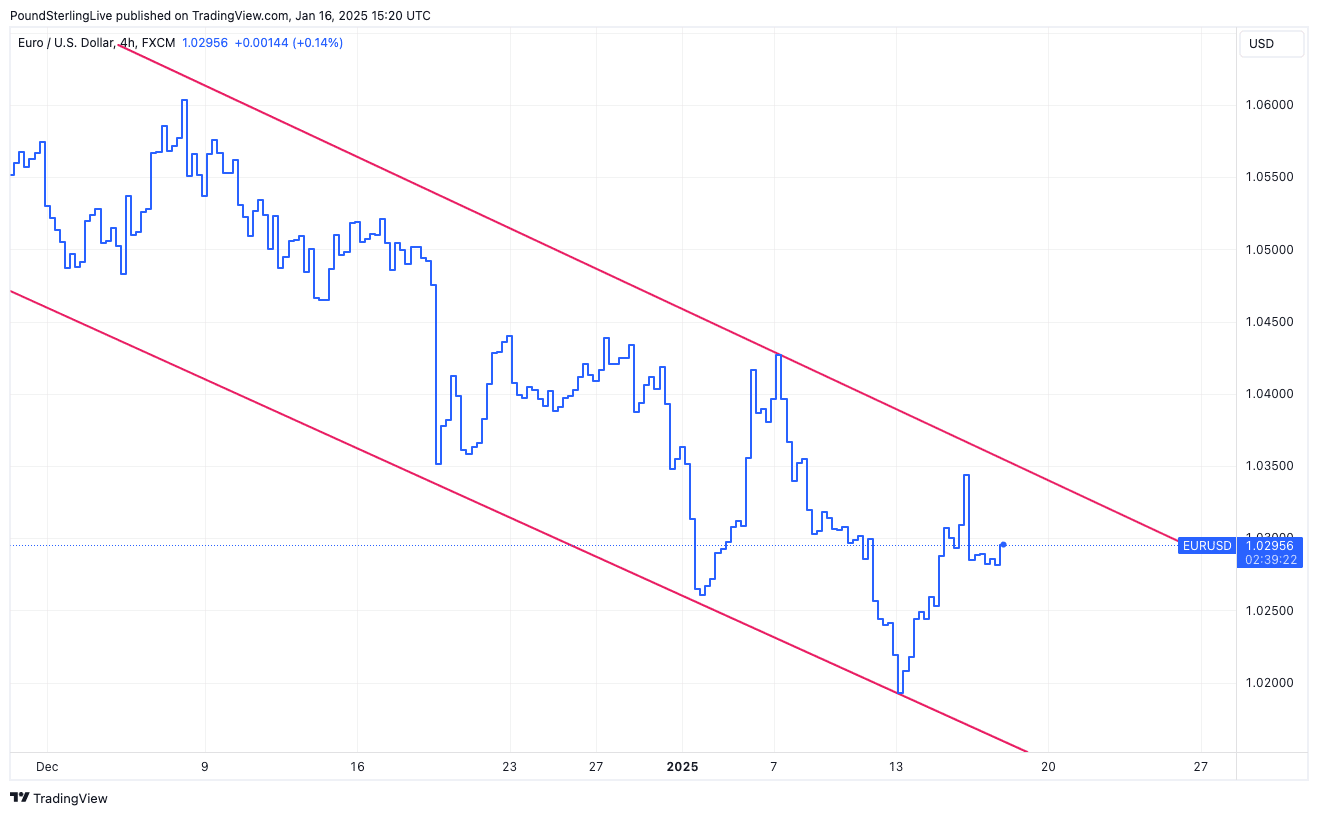

The Euro-Dollar has been entrenched in a well-defined downtrend since December, and recent market action only affirms this.

To break the trend, the U.S. economy must show clear signs of a slowdown that will encourage markets to 'price in' more by way of Fed interest rate cuts.

The next steps in the exchange rate's journey are 1.0260 ahead of 1.02.

By February, we could be seeing fresh multi-year lows, ahead of a test of parity.