Euro-Dollar Eyes December Recovery Ahead of Tough 2025

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate (EUR/USD) can fall below parity in 2025, but December can see it recover.

This is according to a new tactical note from analysts at HSBC.

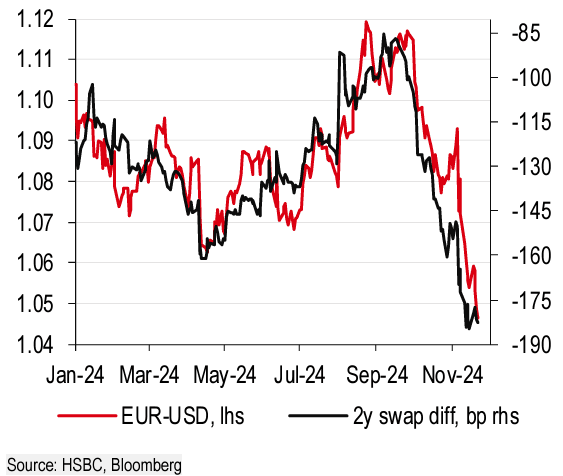

A look at near-term drivers of the exchange rate shows EUR/USD is "fairly priced relative to rates, so a further move lower will require an additional shift in rate differentials."

"The move beyond rates may be a 2025 story so consolidation in EUR-USD around 1.05 is likely to be the pattern into year-end 2024," it adds.

Euro-Dollar is 6.0% lower than where it was in October, which represents a significant sell-off that has raised questions about whether the exchange rate is on course to breach the psychologically significant 1.0 level.

Analysts say that the fall is significant by historical standards and that a cooling-off period for the Dollar is potentially likely over the remainder of the year.

"History suggests that a period of consolidation is likely after such runs – that was the case on the two previous occasions such runs were chalked up," says James Reilly, Senior Markets Economist at Capital Economics.

Above: On some measures, the EUR/USD selloff looks to have found its near-term limits. Image courtesy of HSBC.

The Dollar surged in value following Donald Trump's election win at the start of the month as investors raced to price in tariff hikes and USD-supportive domestic policies.

However, there are some signs of fatigue in the rally, with the Greenback failing to make any major headway following recent tariff threats by Trump.

Trump threatened Mexico, Canada and China with tariffs over domestic issues, confirming Trump will use tariffs as a foreign policy hammer.

Euro-Dollar was relatively unfazed by the news, even as analysts warned Trump would inevitably come after the Eurozone.

This confirms a near-term fatigue in the USD rally that can allow near-term EUR/USD consolidation.

"For the remainder of this year, it seems likely that the exchange rate will struggle to find the catalysts for a decisive break below support at 1.0450," says HSBC.

"While we remain EUR bears, the problem is that a lot of negativity is already in the price – at least in the context of rate differentials," analysts added.

Looking to 2025, HSBC tacticians say they remain EUR bears, "we believe EUR-USD will decline below parity."