December Pause in Dollar Rally Predicted by Strategists

- Written by: Gary Howes

Image © Adobe Images

Dollar exchange rates could fall in December, allowing those with USD payments an opportunity for better values.

This is according to several analysts we follow and an observation that the Dollar often declines in December.

James Reilly, Senior Markets Economist at Capital Economics, says, "history suggests that a period of consolidation is likely after such runs – that was the case on the two previous occasions such runs were chalked up."

The Dollar began to strengthen in October as a series of U.S. economic data releases pointed to ongoing strength in the world's largest economy, prompting investors to lower expectations for the number of times the Federal Reserve would cut interest rates.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The USD's gains accelerated in November after Donald Trump's and the Republican Party's victory prompted investors to prepare for major policy shifts under Trump 2.0.

The primary reasons to expect higher inflation (and subsequently higher interest rates at the Federal Reserve) under Trump 2.0 include the raising of import tariffs and the cutting of taxes.

"Strong economic growth and elevated inflation are fueling the US dollar against most currencies because their economies are struggling with falling economic growth and inflation. Fiscal stimulus and tariffs from Trump could fuel the dollar even more," says Philip Maldia Madsen, an analyst at Nordea Bank.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Most analysts we follow see USD strength as a theme of 2025. However, the pace of the gains leaves it looking overvalued over shorter-term timeframes, opening the door to a December setback.

"Investors' attitude towards Trump 2.0 led to the USD becoming significantly overvalued," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Reilly says to expect a period of consolidation by the Dollar ahead of renewed gains. "We suspect that is likely to happen again – we forecast the DXY Index to remain around its current level for the rest of 2024. But we think it will ultimately break higher, reaching 111 by end-2025," says Reilly."

Daragh Maher, Head of FX Strategy at HSBC, downgrades his tactical stance on the USD from buy to hold.

"A lot of 'good' news is now in the price; consolidation to persist," he says. "If the USD were an equity investment recommendation, we would most likely rate it as a 'hold' currently, a downgrade from our prior 'buy'."

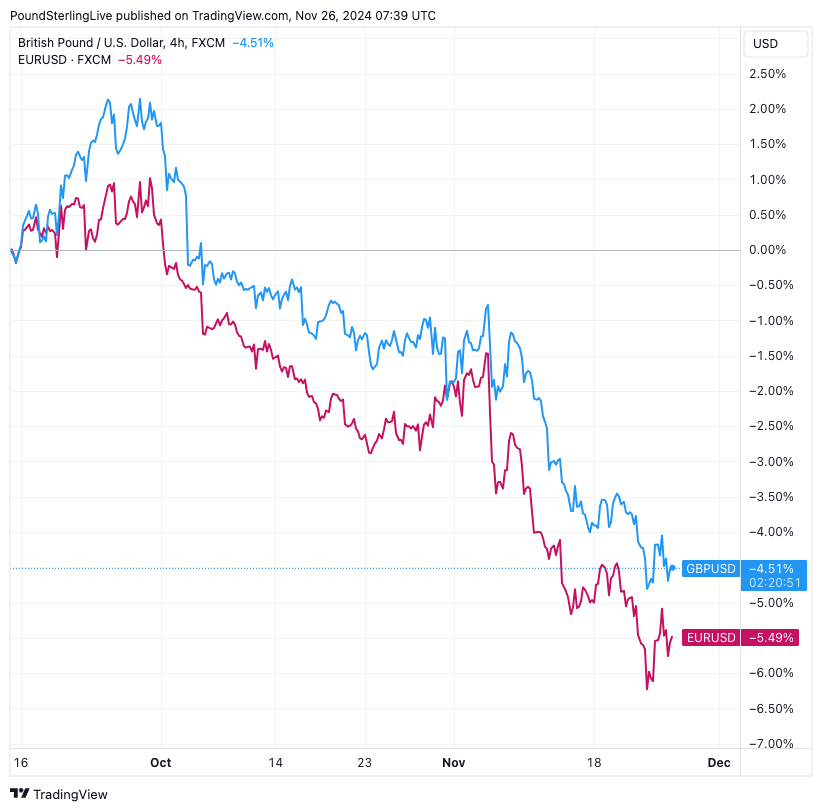

The GBP/USD exchange rate has fallen by 6.5% from its September peak and looks to be finding some short-term support at 1.25.

The EUR/USD exchange rate has fallen by a similar magnitude and is looking to form a base above 1.04.

Neither the Euro nor the Pound looks particularly firm against the Dollar, and from a technical perspective, there are no signals that an interim bottom has formed.

"We continue to expect sustained dollar resilience, with bullish momentum into 2025. EURUSD is already at our medium-term forecast of 1.04, with risks for still further downside," says a note from Barclays.