"Modestly Bullish EUR/USD Forecast Remains Intact" - City Index

- Written by: Sam Coventry

Image © Adobe Images

"Our modestly bullish EUR/USD forecast remains intact," says Fawad Razaqzada, FX analyst at City Index.

His call comes as the Euro to Dollar exchange rate (EUR/USD) - like many other dollar-based pairs - comes under pressure following a strong August.

For now, the weakness appears to be a pullback within a broader uptrend that could attract more buying interest before another leg higher evolves.

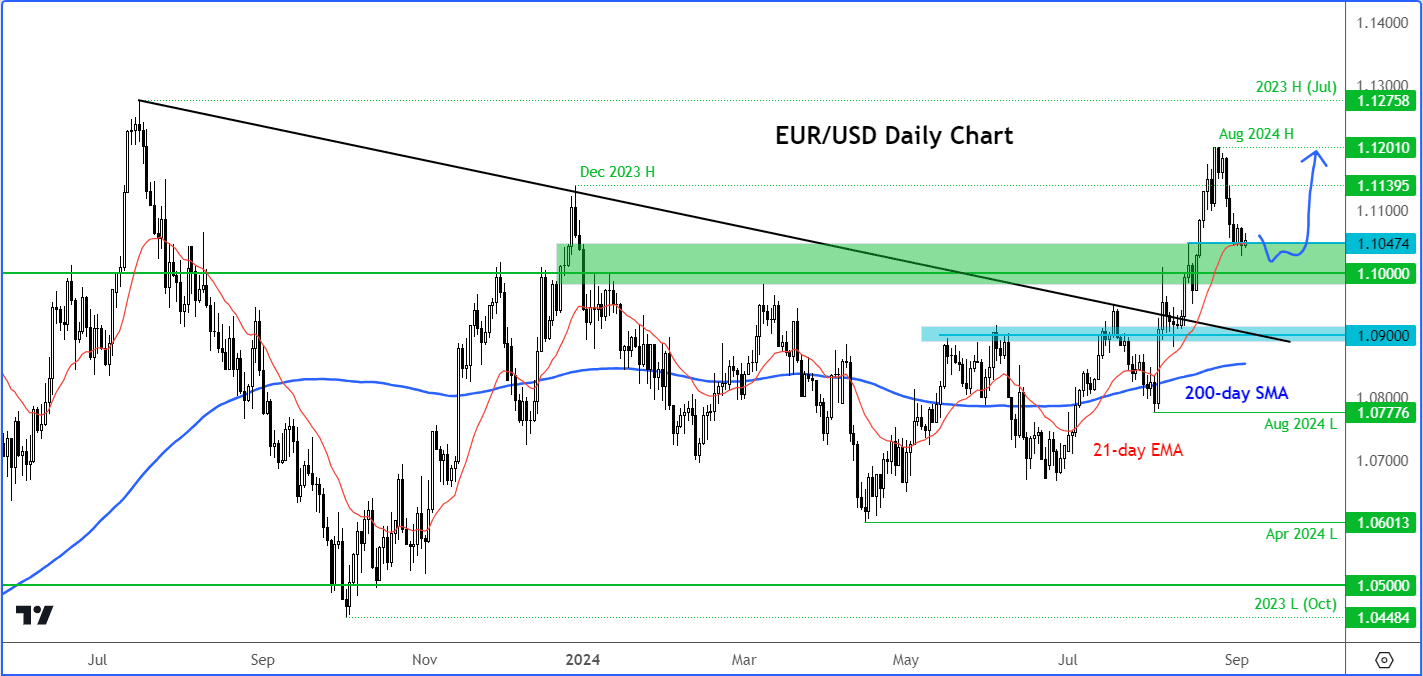

"Since bottoming in April, the EUR/USD has formed several higher lows and higher highs. The slope of the 200-day average has started to turn positive," says Razaqzada.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

He explains the Euro's rally has now broken several resistance levels and bearish trend lines. In other words, the path of least resistance on the EUR/USD has been bullish.

"It will remain that until we see a key reversal pattern or a break down in the market structure of higher lows," says Razaqzada. "So far, neither of these events have occurred, which means that the EUR/USD forecast remains bullish from a technical point of view and that we favour looking for bullish setups at or near support than bearish setups near resistance for trade ideas."

Regarding the technical forecast, the City Index analyst looks for the current pullback to potentially find support between 1.1000 and 1.1045, which was previously resistance.

"Here, we also have the 21-day exponential moving average come into play. We are on the lookout for the formation of a bullish price candle around this zone this week to signal the resumption of the bullish trend. If we don’t see that, say as a result of surprisingly strong US data, then that could pave the way for a deeper correction towards the next key support around the 1.09 handle," says Razaqzada.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

He adds that any near-term recovery could run into resistance at around 1.1100, followed by 1.1140. "The liquidity above the August high of 1.1200 is the next major objective for the bulls should the aforementioned resistance levels break."

The EUR/USD's will potentially see further volatility when the ISM services PMI is released on Thursday and the U.S. jobs report on Friday, where markets will be looking for any additional signs of a slowdown.

The Dollar's reaction function is hard to call: we saw USD strength and a market selloff following Tuesday's underwhelming data prints, which defied the typical rule that bad data = bad for the dollar.

Razaqzada thinks the rule still applies and that currency markets will show a more conventional reaction to the results.

"Weakness in US data is needed to keep the pressure on the US dollar, while the upside for the greenback should be limited on any data surprises because of the Fed’s strong indications that rate cuts are starting this month. This makes me bearish on the dollar and therefore bullish on the EUR/USD forecast," he says.