Euro-Dollar Set for Another Boost: HSBC

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Euro to Dollar exchange rate could be set for another boost if this week's release of Eurozone PMI's confirm economic improvements.

This is according to currency strategists at HSBC.

"If last week was the big data week for the US and the UK, this week looks slated to be a big data week for the Eurozone. Of note would be the flash Eurozone PMIs on Thursday, which would be released alongside those of the UK and the US," says Clyde Wardle, Senior EM FX Strategist at HSBC.

The call comes amidst a rally in the Euro-Dollar exchange rate that takes the pair back above the 1.10 level.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The rally can extend if PMI data for August shows an improvement in Eurozone economic activity, which would be consistent with a slow and steady rate cutting cycle at the European Central Bank (ECB).

HSBC's economists are looking for a bounce in the services components given the Paris Olympics and summer holidays.

"Any sign that Eurozone activity is starting to surprise to the upside again, after having broadly disappointed in the past weeks, could give EUR-USD another boost," says Wardle.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Further calendar risks include the release of the ECB's Q2 wage indicator, which HSBC Economics expects would show a slowdown of wage growth to 4.2% year-on-year (vs. 4.7% prior). This would bolster the odds for a September rate cut, potentially weighing on the Euro.

The Dollar side of the equation will be equally important, with focus firmly on Friday's speech by Federal Reserve Chair Jerome Powell.

"Powell is widely expected to telegraph a September rate cut in Friday’s appearance at the Jackson Hole Economic Policy Symposium. Yields are softer and the dollar is retreating to start the week as traders bet the Fed chair will acknowledge an ongoing shift in the balance of risks facing the US economy, suggesting that restrictive policy settings are no longer appropriate, and opening the door to an imminent easing decision," says Karl Schamotta, Chief Market Strategist at Corpay.

However, the Dollar could rebound if the market is disappointed by what Powell has to say.

"Powell is unlikely to put the central bank on a more aggressive easing trajectory without sustained evidence of a rollover in growth and employment, and investors may find themselves disappointed with the substance of his remarks," says Schamotta.

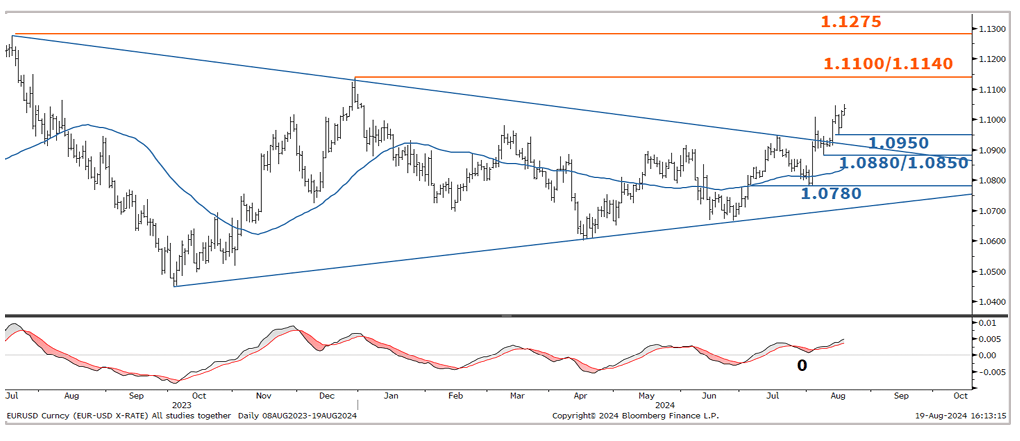

For now, any weakness will likely be shallow, with technical studies from Société Générale suggestingthe EUR/USD rally is likely to extend.

"EUR/USD has recently broken out from its symmetrical triangle, suggesting that it has regained upward momentum," says Tanmay Purohit, technical analyst at Société Générale. "This is also highlighted by daily MACD which remains anchored in positive territory since July."

The call comes as the Dollar falls to a seven-month low amidst a break higher in Euro-Dollar above 1.10.

"The move is a bit stretched but signals of pullback are not yet visible. The 50-DMA near 1.0880/1.0850 should be an important support in case a short-term down move develops," says Purohit.