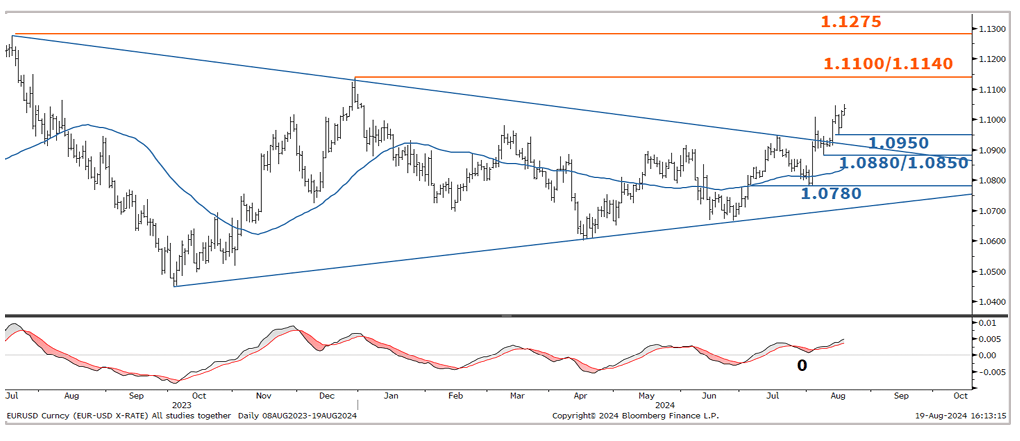

EUR/USD: "Marching Towards 1.1100/1.1140" says Soc Gen

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate's (EUR/USD) rally is likely to extend, according to a new technical analysis from Société Générale.

"EUR/USD has recently broken out from its symmetrical triangle, suggesting that it has regained upward momentum," says Tanmay Purohit, technical analyst at Société Générale. "This is also highlighted by daily MACD which remains anchored in positive territory since July."

The call comes as the Dollar falls to a seven-month low amidst a break higher in Euro-Dollar above 1.10.

"The move is a bit stretched but signals of pullback are not yet visible. The 50-DMA near 1.0880/1.0850 should be an important support in case a short-term down move develops," says Purohit.

Image courtesy of Société Générale.

The Dollar's weakness is the main driver of Euro-Dollar strength, a development that follows a build-up in expectations for a rapid pace of U.S. Federal Reserve rate cuts in the coming months.

Markets think the Fed will cut rates by up to 100 basis points this year. A downside risk for EUR/USD would be if the Fed disappointed and cut by less.

Yet, the technical picture suggests downside damage to the Euro would be limited at this juncture.

"Next objectives are located at projection of 1.1100/1.1140 and July 2023 peak of 1.1275," says Purohit.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.