EUR/USD Rate Forecast: 1.03 Possible

- Written by: Gary Howes

Image © Adobe Images

The Dollar rebound is tipped by a number of analysts we follow to extend through much of the first half of 2023, suggesting the Euro won't be able to get its skates on for some time yet.

But a crucial question for those looking to make currency payments is where the bottom might be for the Euro to Dollar exchange rate (EUR/USD).

Dollar strength rests with expectations for more interest rate hikes at the Federal Reserve than was previously expected owing to stronger-than-expected data, at the same time, the pro-Euro story is now well understood by markets and is therefore 'in the price'.

"The repricing of a higher terminal rate and scaling back of rate cut expectations later this year has breathed fresh life into last year's strong USD trade," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

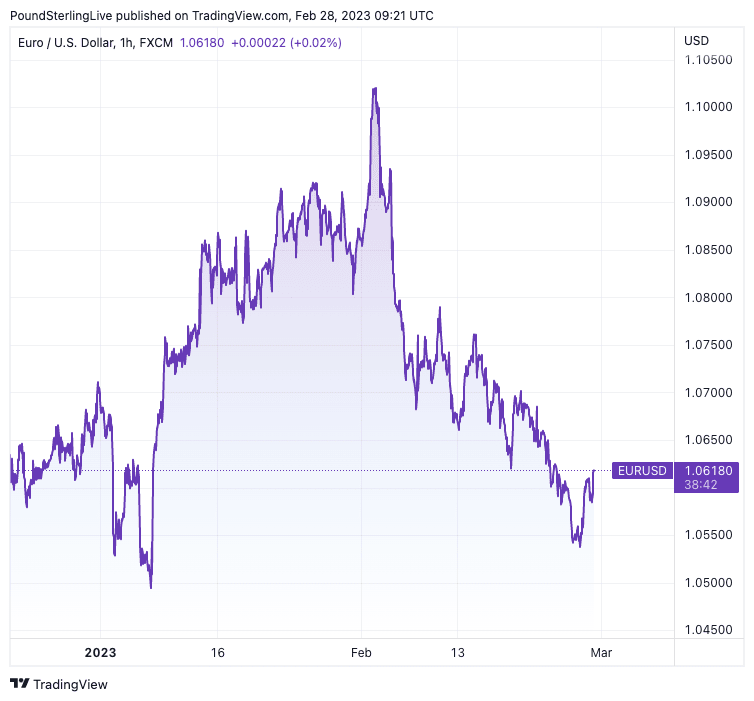

Jan von Gerich, Chief Analyst at Nordea Markets, says EUR/USD has behaved according to plan thus far: he expected a rally to 1.10 in the first part of the year, and this is what the market delivered, albeit somewhat earlier than expected.

"In the last couple of weeks, stronger US data has put renewed pressure on the Fed and led to EUR/USD falling to 1.06," he says.

Nordea Markets looks for EUR/USD to "periodically decline to 1.03 until the summer".

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The weakness rests on the assumption the Federal Reserve and other central banks will continue to raise rates more than previously anticipated to tighten financial conditions and bring inflation lower.

The Fed would therefore underpin the Dollar via higher rates, but the 'risk off' market conditions associated with rising interest rates can tend to weigh on equity markets, further aiding interest in the safe-haven Dollar.

"We are recommending a new short EUR/USD trade idea to reflect our view that there is room for the USD rebound to extend further," says MUFG's Halpenny.

John Shin, a strategist at Bank of America, says February's above-forecast inflation reading suggests the Dollar can expect further near-term support.

"Inflation is likely to imply near-term stability and upside for USD, given low unemployment and inertia for the core," he says in a recent note.

Above: EUR/USD at one-hour intervals. Consider setting a free FX rate alert here to better time your payment requirements.

Bank of America is looking for EUR/USD to remain focussed on 1.05 in the first half of the year. "We see risks for more and for longer EURUSD weakness, if inflation proves to be even sticker than in our baseline," says Shin.

MUFG sees the USD as remaining the key driver of the Euro to Dollar exchange rate and targets a fall to 1.0350.

"We are expecting the pair to fall back towards support from the 200-day moving average that comes in at around 1.0330," says Halpenny.

Dollar strength is meanwhile tipped to fade towards year-end, according to a majority of research notes seen by Pound Sterling Live.

"Looking longer out, we still see a weaker USD. We expect USD vs other G10 rate differentials to move broadly sideways after the summer until year-end and diminish longer-out," says von Gerich.

Nordea forecasts EUR/USD at 1.15 by the end of next year, as do Bank of America.

"Any signs of softening in the labor market (suggesting January payrolls was a one-off surprise) or accelerated disinflation could prompt a reversion to the dollar's downtrend," says Shin.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes