Dollar's Rebound Set to Run Through H1 2023

- Written by: Gary Howes

- GBP/USD retreating from 1.24 peak

- U.S. data strengthens unexpectedly

- Investors now see 3 more Fed hikes

- And odds of rate cut by year-end fade

- Developments to fuel USD rebound until H2

Image © Adobe Images

The Dollar is expected to maintain pressure on the Pound and Euro for the first half of 2023, say some analysts, a view that is gaining traction in the wake of stronger-than-expected U.S. data.

"The strength in US data has challenged the market's weaker dollar baseline," says Audrey Ong, an analyst at Barclays Bank. "More of the same can fuel fears of overtightening and hard landing, hurt risk sentiment and lift the dollar."

The GBP/USD and EUR/USD have 'topped out' for now with the Dollar gathering support as investors realise U.S. Federal Reserve interest rates have higher to climb than previously expected and the prospect of a 2023 rate cut becomes more remote.

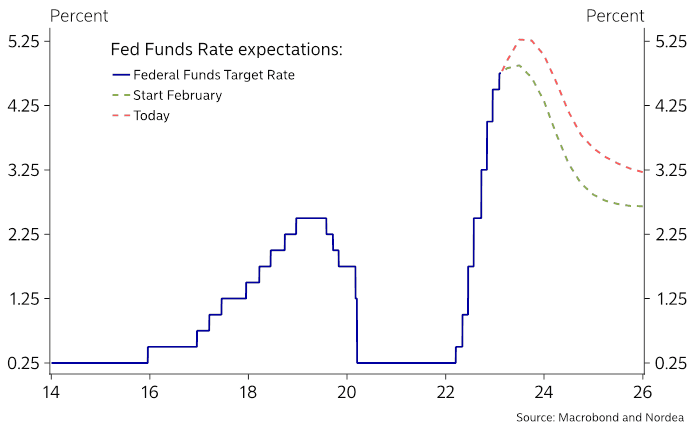

Money market pricing shows investors are now positioned for a Federal Reserve interest rate hike in both March and May.

A significant recent development, however, is the pricing of a third additional 25bp hike in June.

Money markets imply the outcome now has 70% odds attached.

"The real economy remains too strong in G10 for inflation to start approaching anywhere near the 2% target in the foreseeable future," says analyst Athanasios Vamvakidis at Bank of America Merrill Lynch.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Perhaps more important though is a realisation that the Fed is unlikely to cut rates anytime soon. The Fed itself has steadfastly refused to endorse such expectations, but money markets had foreseen the start of rate cuts as early as the third quarter.

But this expectation has all but been overturned at the time of writing with investors falling into line with Fed thinking. The resultant firming of Fed rate hike expectations coincides with renewed support for the Dollar exchange rate complex through February.

As support for the Greenback returns we see the Pound to Dollar exchange rate (GBP/USD) retreat from resistance in the 1.24 area and the Euro to Dollar rate (EUR/USD) retreat from highs just north of 1.10.

Dollar strength follows the release of a string of economic data that revealed the jobs market to be unexpectedly strong while inflation dynamics remain hot.

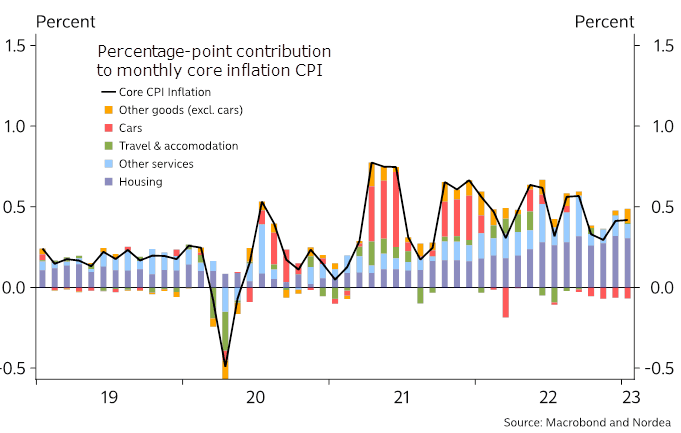

"The economy is running too hot," says Philip Maldia Madsen, Macro strategist at Nordea Bank. "With the disinflation process stalling and the labour market remaining tight, the latest signs of economic strength make it more likely that the Fed will need to lift interest rates even higher than anticipated."

U.S. CPI inflation figure rose 6.4% in the year to January, beating expectations for 6.2%

U.S. retail sales were meanwhile reported to have risen by 3% in month-on-month terms in January, far surpassing the consensus among economists, which had looked for a 1.9% increase.

But it was the rise in non-farm payrolls by 517k in January, far more than the 193k anticipated by consensus, that sent an initial warning to investors and ensured GBP/USD's soft February was now underway.

"The labour market remains in a state of accelerating inflation, one that is unlikely to induce the downwards pressure on wage and spending growth necessary to pull down inflation to the Fed’s 2% inflation goal on a sustained basis," says Madsen.

The Dollar rallied against the Pound and Euro in the wake of both the labour market and inflation reports as it dawned on investors that interest rates in the U.S. would likely need to go higher than expected.

"The euro dropped in reflection of US data," says Asmara Jamaleh, an economist at Intesa Sanpaolo. "As long as expectations stay in place for the fed to hike rates more than previously envisaged, upward momentum is unlikely to regain strength."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The same applies to GBP/USD which was another casualty of a dawning realisation that the Fed has more work to do, having lost 3.0% already in February.

"The broad USD has erased its losses since the start of the year. It is well telegraphed why with the US data pulse and Fed speak pushing back against the earlier thinking of rate cuts to come later this year," says Dominic Bunning, an analyst at HSBC.

EUR/USD is quoted at 1.0688 at the time of writing, GBP/USD is quoted at 1.2030, but further losses are possible if investors price further Fed rate hikes.

"Monetary policies may have to tighten more than markets are currently pricing," says Vamvakidis.

The Dollar rallied against both the Pound and Euro again last Thursday after another economic release cemented a view the economy is operating at inflationary levels.

The Producer Price Index (PPI) surprised to the upside with a +0.7% month-on-month reading in January, signalling inflationary pressures remained in the pipeline.

Above: "Goods disinflation is diminishing" - Nordea Markets.

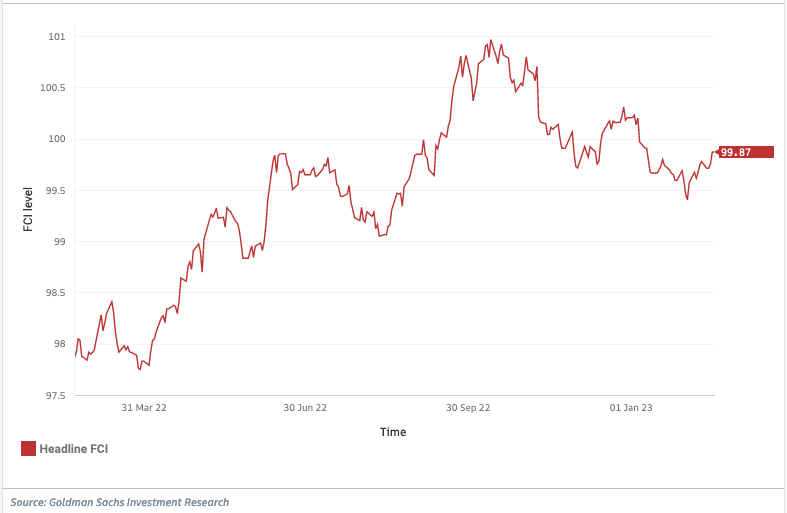

Prior to the release of February's stronger-than-expected data, the cost of finance across the economy had been falling as investors 'priced in' the prospect of a halt to Fed rate hikes, a development that obviously works against the Fed's agenda.

"Many measures of financial conditions are back to pre-tightening levels. Our economists have argued that a significant cooling of the job market is key to getting the Fed to stop hiking, which clearly will take time," says Vamvakidis.

But this loosening in conditions is reversing again as bond yields - a key measure of financial conditions - have reacted to the realisation that rates in the U.S. will stay higher for longer.

Above: Goldman Sachs' proprietary measure of U.S. financial conditions has started to rise again.

"Yields along the US curve moved further up (the 10Y UST yield has already reached 3.90%) and the USD further strengthened against the other majors. The further widening of yield spreads in favor of the USD has returned to being the main driver in the FX market," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

10-year Treasury yields rose to their highest level this year ahead of the weekend, boosted on Thursday by Federal Reserve board members Mester and Bullard, who both sounded particularly hawkish.

They said they advocated for a 50bp hike at the February FOMC meeting, raising the odds they will be at the vanguard of calls for further action at upcoming meetings.

According to Bank of America, these developments signal further Dollar strength over the coming weeks.

"We remain bullish on the USD for the first half of the year," says Vamvakidis. "We believe that the price action so far in February, with the USD appreciating again back to end-2022 levels, validates our views."

Madsen says financial markets are yet to fully accept the reality that the Fed might have to raise interest rates even higher than previously thought.

Bank of America remains bearish on the Dollar for later this year and next, but the view is subject to inflation coming sufficiently down eventually.

"The stickier inflation is, the stronger and for longer the USD will get," says Vamvakidis.

HSBC meanwhile says the market is currently in a USD 'chop' phase as uncertainties regarding the monetary policy outlook are confronted.

However, the bank says 2023 will still be a year of U.S. Dollar weakness.

"We still think it is likely to be late 1Q/early 2Q when the Fed and other uncertainties subside, which will open the door for the USD to renew its descent," says Bunning.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks