Stay Bullish on Euro vs Pound Sterling and Dollar say Credit Suisse Tech Strategists

- Spot market quotes:

- Euro to Dollar exchange rate today: 1.1818

- Euro to Pound Sterling exchange rate today: 0.9078

- Pound to Euro exchange rate today: 1.1001

The Euro’s impressive rally might be due a pause; but this will not see technical analysts at Credit Suisse deviate from their bullish stance on the single-currency.

Technical analysts form one section of the analyst community and have their own specific set of rules and techniques to follow when analysing and forecasting the market.

Readers should be aware that their views might differ from those of the quantitative and fundamental analysts within their own institution.

But when it comes to calling the Euro's future - it would seem most are in agreement - this is a winning horse. How far the Euro can go and how fast is however up for debate.

The Euro to Pound Sterling exchange rate (EUR/GBP) has seen a strong rally since April this year and has reinforced a large base set above 0.8852 to achieve Credit Suisse’s initial target at the November 2016 high at 0.9050:

For those inclined to view the pair from a Pound to Euro exchange rate angle, 0.8852 equates to 1.13 and 0.9050 equates to 1.1050.

“The extension above here keeps the risks directly higher for the 78.6% retracement of the

October/December 2016 fall at 0.9142/68 next,” says Credit Suisse technical strategist Christopher Hine.

So this would represent an extension lower to 1.0938/1.0908 in Sterling-Euro.

“Above here would see a price vacuum until our core target at 0.9400/14 – the measured objective from the base, and the October 2009/2016 spike highs,” says Hine.

Again, further targets on Sterling-Euro are therefore seen lower at 1.0638/1.0622.

“We would look for a ceiling to be found here and above here is required to see a move on to the March 2009 high at 0.9482, then the January 2009 peak at 0.9649, ahead of the all-time record high at 0.9803,” says the analyst.

So should the floor at 1.0638/1.0622 in Sterling-Euro break, Hine warns of a fall to subsequent targets at 1.0546, 1.0364, 1.02.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Euro / Dollar Outlook

EURUSD has found an initial cap at the low of 2010 at 1.1876 and is currently correcting gains.

“We allow for this phase of consolidation to extend, however, we view it as corrective and once it has run its course look for an extension above 1.1876 to target the recent high at 1.1911,” says Hine.

Extension above here would reinstate the core bull trend for the 2012 low a 1.2000/42 next, then the 50% retracement of the 2014/17 fall at 1.2167, with scope to test the “neckline” to the multi-year top at 1.2244:

Support for a setback is seen at 1.1732/15 initially. A break below here can see a deeper setback to 1.1636/13, potentially 1.1479/48.

The Broader Euro Exchange Rate (TWI)

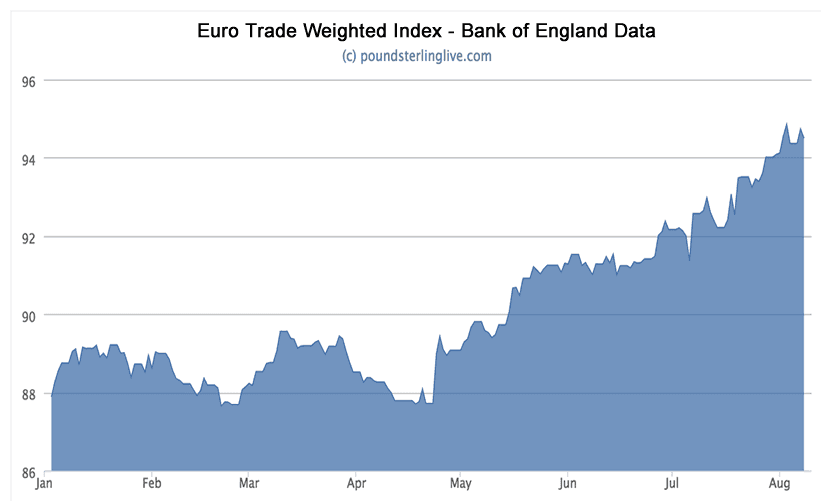

The EUR has experienced an aggressive broad based rally this year which has seen its

Trade Weighted Index (as given by Bank of England) overcome its medium-term downtrend.

The TWI is a measure of Euro strength according to the currency’s performance against a basket of other currencies - each selected according to its relative importance to the Eurozone based on trade.

Hine notes the Euro’s rally has taken it above also key resistance at 92.30/50 – the 38.2% retracement of the entire 2009/2015 decline and “neckline” to the 2014 top – and establish a large base.

But, “near-term it is vulnerable to a setback,” says Hine.

However, Credit Suisse are inclined to view any weakness as corrective and target 95.12 – the 50% retracement of the 2009/2015 decline – next.

Put all three together and we get a message that the Euro can still go higher, but patience is required as some decline might be due over coming days and mabye weeks.

Speculators Most Bullish on Euro Since 2011

The foreign exchange trading community might just have turned a little more optimistic on Pound Sterling according to the latest set of data into the workings of the foreign exchange market while bets for further Euro strength grew to their largest volume since 2011.

Weekly figures from the US Commodity Futures Trading Commission shows the speculative market holds bets against the Pound to the value of $2.043 BN.

While sizeable, this is however a decrease in contracts betting on Sterling weakness to the tune of $387 MN when compared to the previous week.

In short, negative positioning on Sterling decreased to the tune of $387 MN which represents a positive shift in sentiment.

Data from previous weeks suggested negativity was increasing; could the latest data suggest we have seen peak negativity in Sterling?

It is far too early to say what the data means for the Pound's outlook, particularly as the research community are expecting further declines in value of Sterling; for example this week Morgan Stanley researchers said the Pound to Euro exchange rate would fall below 1.0.

But the shift in sentiment is certainly one important clog in the engine of Sterling movement to keep in mind.

Sentiment towards the Euro remains unquestionably positive.

“EUR bulls upped exposure in net terms by 11k contracts (adding another USD1.6bn to the aggregate USD short) to 93.6k, the biggest bull bet on the EUR since 2011,” notes Shaun Osborne, Chief FX Strategist at Bank of Nova Scotia in Toronto.

This is the largest positive bet on the Euro since 2011.

And the Dollar continues to see increased negative sentiment:

“The latest snapshot of speculative FX positioning shows investors continue to add to USD short positioning in aggregate, with a further build in the overall USD short amounting to some USD4.5bn this week; the aggregate bear bet on the USD extends to USD15.6bn this week, the largest since 2013,” says Osborne.