EUR Tipped to Decline v GBP: Latest Analysis of Euro to Pound Exchange Rate

~ Faraday: Could this be the Euro's peak against Sterling

~ KBC Markets: Euro has done its bit, but could still go higher long-term

~ Nomura: Bet on a Pound recovery v the Euro

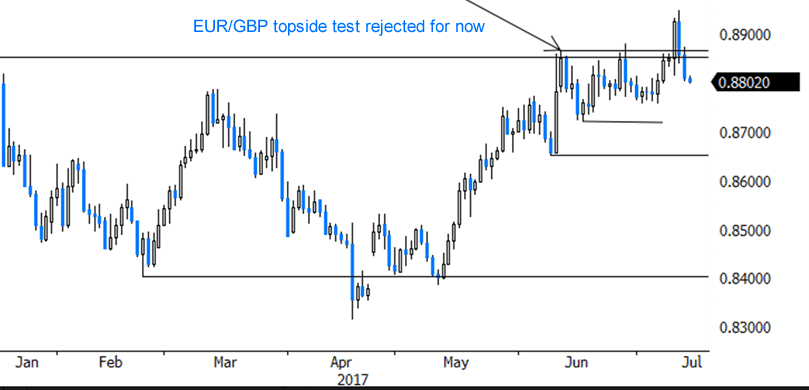

Jamie Dutta, Senior Market Analyst at Faraday Research says the Euro might have registered a potential 2017 high against Pound Sterling, and is now due to decline.

EUR/GBP has seen some interesting moves over the past few sessions.

Pressure has been building over the last few months for a strong break above 0.8850 and the Bank of England’s deputy governor, Ben Broadbent gave the market the ammunition it wanted to head higher when he said he was ‘not ready’ to tighten monetary policy.

"With the Bank of England's Monetary Policy Committee on a knife-edge in terms of hawks to doves for the first time in many years, the expectations were that Broadbent would be the swing voter that sided with the external members voting for a hike," says Dutta.

By also casting his concerns on Brexit ‘imponderables’, the analyst notes this was enough to push EUR/GBP through this long-term barrier.

The credit ratings agency, Moody’s also boosted the pair mid-week stating that it sees UK growth declining this year and next, and with it the UK sovereign rating could be downgraded if the ‘core elements’ of the UK’s current access to EU Single Market aren’t maintained.

"If we step back and look at the daily candle chart, this shows prices have bounced strongly from April’s year-to-date low at 0.8297 which also tied in with November’s low," says Dutta.

The gap after the first French Presidential election was filled but since May, the single currency has charged higher up 500 points.

The analyst notes EUR/GBP has made an ascending triangle over the course of last month and the break of this, whilst also being a long-term structural level, means we should head for October 2016 highs above 0.90.

That said, mid-week price action gives Faraday cause for concern.

"The strong rejection of Tuesday’s move looks like forming a classic 2 bar reversal pattern and it is notable that these reversal indicators are best found in strong trends where there is strong support or resistance," says Dutta.

With this in mind, Faraday will watch this pair with keen interest as the potential 2017 top made yesterday could well mean prices drift back to the 150 point range made over most of June.

"However, EUR/GBP has seen a strong ‘buy-on-dips’ mentality and with this, monitoring the Bank of England’s voting bias, especially the new member Tenrero will be key going forward," says Dutta.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

KBC Markets Confirm a Top in Place

It's not just Faraday that are questioning the Euro's ability to advance.

"From a technical point of view, EUR/GBP set a minor top north of 0.8854/66 resistance (2017 top) and finally broke below the 0.8 barrier earlier this week," notes Piet Lammens at KBC Markets in Brussels.

"Quite some sterling negative news should already be discounted at current levels," says Lammens.

Even so, the analyst says it is still too early to call time on the Euro's advance saying the short-term trend remains Euro positive/Sterling negative.

"A test of the 0.90 barrier might be on the cards," says Lammens.

Only a break below 0.8720 would suggest that upside momentum is easing.

Nomura: The Pound is a Buy Against the Euro

Taking a more aggressive stance against the Euro is strategist George Buckley at Nomura Securities.

Buckley is not content to simply call a near-term end to the Euro rally, he is quite confident on a more assertive Sterling comeback:

“Short EUR/GBP looks attractive from a tactical ECB/BoE trade,” says Buckley referencing how he thinks a potential August rate rise at the Bank of England will contrast with an European Central Bank keen to keep settings static for a while longer.

Such a contrast backs their bullish stance on the Pound.

“We see more than enough reason to expect an improvement in Sterling’s fortunes, or if anything a bias to expect further deterioration in EUR against GBP into next week’s ECB meeting,” says Buckley.

Nomura note this is an important meeting for the ECB as expectations of a ‘hawkish shift’ - i.e pointing to higher interest rates and exiting the quantitative easing programme - are high.

The market is hoping the ECB will remove its forward guidance that the “Governing Council stands ready to increase the programme in terms of size and/or duration.”

“Without a continuation of these small “baby steps to normalisation” or a further emphasis on the optimistic outlook, it would be a further removal of the support to what have come to be known as the ‘Sintra trades’” says Buckley.

At Sintra, Portugal, a host of central bankers took the chance to warn that a future of higher interest rates lay ahead. The likes of the Pound and Euro benefited while the Dollar fell as markets saw higher returns coming out of the UK and Eurozone in the future.

“Even though it has already moved lower in the past two days, we still see room for further EUR/GBP downside into the July ECB and August BoE meetings,” say Nomura.