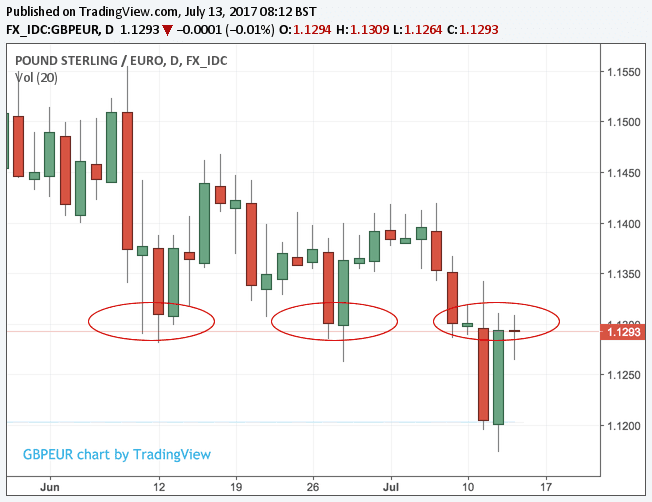

Battle for 1.13 is Key for GBP/EUR Exchange Rate Outlook

- Written by: Gary Howes

Pound Sterling continues to stage an impressive recovery against the Euro having plumbed fresh 8-month lows earlier in the week, but is the bounce enough to save Sterling from a long and painful journey lower?

This week has seen the Pound to Euro exchange rate fall through a significant support level at 1.13, hit an 8-month low, and then recover those losses.

While the exchange rate has recovered some ground following the release of better-than-forecast labour market data, the technical outlook remains relentlessley negative UNLESS the 1.13 can be reclaimed in convincing fashion.

By convincing, we mean the pair must close above there over coming days.

If not, then 1.13 turns from being a level of support and protection to being a barrier that stymies any attempts at strengthening.

Our bias is therefore negative at this stage but we will be watching the exchange rate's close on Thursday and will certainly find Friday's week-end close instructive.

Where Next for GBP/EUR?

Analyst Robin Wilkin at Lloyds Bank notes that GBP/EUR has dipped and is consolidating below 1.1236, “driven by post-Broadbent GBP weakness and EUR breaking above key 1.1450 range resistance,” against the Dollar.

Intra-day momentum is at oversold levels though, “but as long as retracements hold” below 1.1235-1.1299, Wilkin looks for a test of 1.11.

Wilkin is a technical strategist and his forecasts differ from the official forecasts for GBP/EUR held by economists at Lloyds who see the exchange rate holding around 1.13 into the end of 2017.

In fact, technical analysts are on the whole more bearish on Sterling than their fundamental counterparts.

Lucy Lillicrap, a technical analyst with Associated Foreign Exchange believes the entire recovery sequence seen in GBP/EUR from last October when it recovered from flash-crash lows below 1.10 back to 1.20 is merely corrective.

“Further deterioration is anticipated going forward,” says Lillicrap who believes the Pound's big move lower from the EU referendum vote is still playing out.

Lillicrap believes the psychological 1.1000 level should come into focus again thereafter as that longer term GBP downtrends resume.

Our technical analyst Joaquin Monfort noted that the sell-off in Sterling even cleared an obstacle in the form of the S1 monthly pivot at 1.1247 level.

Both Lillicrap and Monfort believed this would provide some temporary respite for Sterling, however this did not transpire.

“Although there is a bias to further downside, we would first want to see a clear break below this level, signalled by a move below 1.1200 for confirmation of a continuation of the bear trend down to the next target at round number support at 1.1100,” says Monfort.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Could Sterling Fall to 1:1?

The outlook is not constructive for those hoping for a stronger Pound if analysts at HSBC and UBS are correct.

HSBC have warned that they see the Pound to Euro exchange rate equalising over coming months.

UBS see the decline stopping before there but warn that it could go below 1:1 if some conditions are met.

We had thought these views to be a little extreme, but now that Sterling is breaking lower they suddenly look a little more possible.

Repeal Bill to Test UK Political Stability

Another political test confronts Pound Sterling - which now trades as a political currency in many respects - is the publication and passage through parliament of the Repeal Bill.

Publication is slated for today.

The bill seeks to convert EU law into British law and is a fundamental cornerstone in the UK’s exit from the European Union as it is required to legal stability.

Secretary for Exiting the European Union, David Davis, says he will "work with anyone" to make it a success, but he faces opposition.

Liberal Democrat leader Tim Farron told the government: "This will be hell."

Labour vowed to vote against the legislation unless there were significant changes to the details previously set out.

But, the Conservative Government have the Northern Irish Democratic Unionist Party at hand to support them which should see them win key votes, such as the passing of the bill.

But, any hiccups, stalling or outright failure on this front will surely undermine the UK currency, so keep abreast of developments here.

On a more constructive note, the UK’s Trade Secretary Liam Fox says the Government will seek to ensure no disruptive Brexit occurs in 2019.

Talking to Bloomberg, Fox says:

“We are under time pressure to get negotiations done, but if we have to have some kind of bridging mechanism that allows us greater time to get it right then of course we will look at that.”

Market continuity is a key issue for UK businesses as it allows the stable background from which to make investment decisions and is therefore good for the economy.

What is good for the economy is good for the Pound as a layer of uncertainty and the prospect of the UK defaulting into WTO rules are negated.

A Big Dip Below Support

The exchange rate hit an eight-month low after a batch of sell-orders were triggered in earnest after GBP/EUR fell through the 1.1250-1.1300 floor as traders were prompted to buy Euros to protect their books from potential losses.

The Bank of England’s Deputy Governor Ben Broadbent was seen as being behind the sell-off on Tuesday, July 12 after he failed to back calls for higher interest rates made by his fellow Bank of England policy-makers in a speech made in Aberdeen.

The Deputy Governor then went a step further in an interview with a regional Scottish newspaper following the event saying he does not believe the time is now right to raise interest rates.

The report, filed early mid-week, has allowed further follow-through selling of Sterling as the interview clears up any ambiguity concerning Broadbent's stance over the matter and confirms the bar to an interest rate rise in coming months remains high.

“If you look at the past six to 12 months, economic growth has been okay and the employment rate good. Unemployment has drifted down a little … and inflation is higher,” says Broadbent. “There is reason to see the committee moving in that direction (higher interest rates) – but there are still a lot of imponderables.”

Recall, the Pound has been under pressure through the course of June and early July as a mix of political uncertainty and slowing economic data take their toll.

Some respite was however provided by the Bank of England towards the end of June where a handful of key policy-makers suggested an interest rate rise might soon be necessary.

Both Governor Mark Carney and Chief Economist Andy Haldane said that were data to improve they believed a rate rise would be necessary.

But, this pillar of support has been kicked out from beneath the Pound. GBP/EUR has made big moves as it had been consolidating in a tight range between 1.13 and 1.14 of late.

Such consolidation tends to act as a coiled spring with big moves seen once the spring is released and we could well be witnessing such an outcome.