Pound to Stay in Neutral Against the Euro for a Little While Longer

The British Pound is tipped to endure its current period of consolidation against the Euro according to a number of noted technical analysts.

Karen Jones, Head of FICC Technical Analysis Research at Commerzbank, says the GBP/EUR exchange rate has ultimately been neutralised.

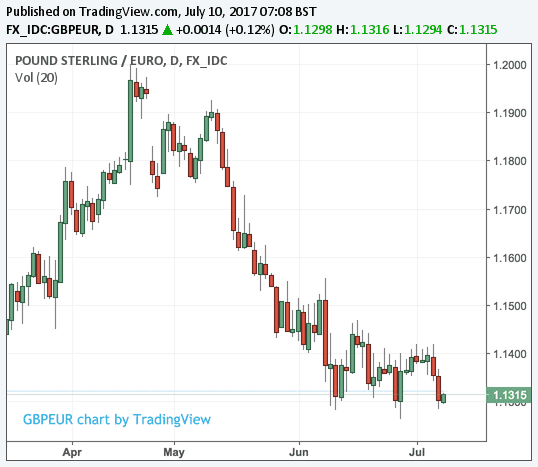

The call comes at the end of what has been a strong period of gains for the Euro against its UK counterpart having been in the ascendency since the start of July.

“EUR/GBP’s recent high of 0.8882 was not confirmed by the daily RSI and the market held sideways last week, neutralising this,” says Jones in a note to clients on Monday, July 10.

The Pound and Euro pairing are traditionally studied in the EUR/GBP format but for those more familiar with the GBP/EUR conversion the recent high at 0.8882 corresponds to a low at 1.1258.

Technical analysis is a rules-based study of the market’s underlying structure as this can give reliable clues on future direction.

Jones is a noted figure in this field boasting 20+ years of experience and has regularly been recognised for her accuracy in the field of technical forecasting.

While the immediate outlook should see the market settle into a consolidative pattern, Jones warns the fall below 1.13 on Friday has placed the recent low at 1.1258 under the spotlight.

"Some support is emerging at 1.1250 for now at least to keep Sterling prices here effectively range bound initially but the structure of prior advances still does not appear obviously trend like," says analyst Lucy Lillicrap at Associated Foreign Exchange.

So there is a risk of fresh multi-month lows being triggered if this level breaks.

A close below 1.1258 would potentially allow for further falls to 1.1127/1.1038.

This represents the 61.8% retracement and the lows from mid-October 2016.

Furthermore, Jones believes Pound Sterling will remain on offer below the 1.1469 16th June high.

If it moves above here we could see a recovery form to the 1.1544/1.1585 200 and 55 day moving averages.

The findings uncovered by Jones more-or-less gel with our expectations regarding the GBP/EUR.

However, we are more focussed on the 1.13 level having noted the Pound has not closed below this level on a daily basis for months now.

Therefore, would GBP/EUR to close below here at any point over coming days we would see this as a sign that the next leg of downside is unfolding.

“The UK currency has settled into a range versus the euro over the last few weeks, with resistance at around €1.14 and support at 1.13 or so – and it’s still not at all clear how this consolidation phase will be resolved," says Bill McNamara, an analyst with Charles Stanley, the London-based brokerage.

McNamara says the persistent demand for the single currency suggests that a break lower remains a realistic possibility.

"If support does give way the initial downside target will probably be last October’s low, at around €1.10,” warns McNamara.

The trigger for a big move lower could be found in the form of employment data, due on Wednesday, July 12.

The data comes amidst a generally soft tone to June's data releases thus far with the previous week's manufacturing data disappointing and sending Sterling lower.

"It's hard to see sterling thriving in that environment and last week's data was pretty solidly negative for the currency," says analyst Kit Juckes with Societe Generale.

However, note that the market is heavily geared against Sterling with CFTC data showing that the IMM speculative market has been short GBP for almost 8 months now.

"Positioning and valuation counter dismal news flow and the latter would need to get even more negative before GBP can fall significantly further," says Juckes.

Effectively, markets are so negative on Sterling, and expectations so poor it will take a notable disappointment to deliver a sizeable move lower.

If anything, we believe the prospect of a positive surprise is becoming more likely and the relief move higher could be quite notable.

We therefore expect the key support levels mentioned above to be in play by the time the week has ended.