Week-Ahead GBP/EUR Exchange Rate Outlook: Watch Monday's Close for Clues

- Pound to Euro rate today: 1.1303, day's best: 1.1322, low: 1.1287

- Euro to Pound Sterling rate today: 0.8856, day's best: 0.8859, day's low: 0.8832

Technical considerations are in charge of the GBP/EUR exchange rate at the start of the new week and should dominate trade until Wednesday when UK employment data is released.

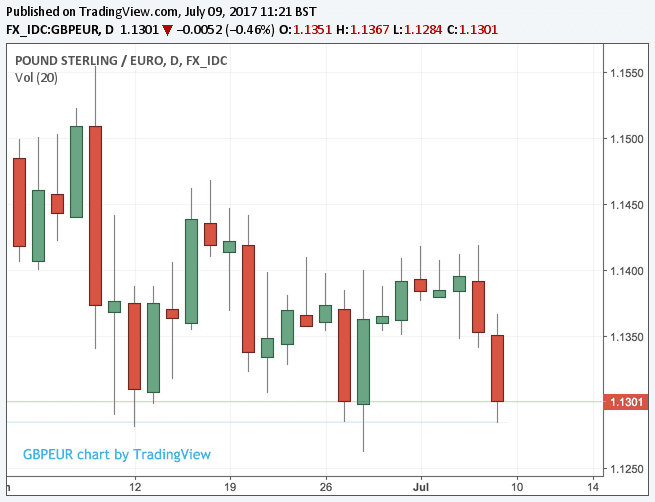

Monday's closing level is key as we are interested in seeing on which side of 1.13 the pair ends the day.

The exchange rate opened the week starting July 10 on 1.13, confirmation of just how important this round level is. In early trade the pair has nudged up to 1.1312.

As we have already noted here, this level is important for the outlook in that a break below 1.13 could finally open the door to weaker levels.

Note that since mid-June the 1.13 has provided bargain-hunters looking for Sterling a decent point to pick the currency up.

1.13 has been tested three times since mid-June yet we have not seen a close below here.

What has tended to happen is the currency recovers back up to 1.14:

“The UK currency has settled into a range versus the euro over the last few weeks, with resistance at around €1.14 and support at 1.13 or so – and it’s still not at all clear how this consolidation phase will be resolved (although the persistent demand for the single currency suggests that a break lower remains a realistic possibility). If support does give way the initial downside target will probably be last October’s low, at around €1.10,” says Bill McNamara, an analyst with brokers Charles Stanley.

So this pair is stuck in a tight range but a break below 1.13 could see the broader trend lower, in place since May extend.

Recall that back in May one Pound bought 1.20 on the inter-bank market.

We would need to see GBP/EUR break above 1.14 before we even consider any kind of recovery in the pair.

In short, the exchange rate is under pressure and the bias is lower if we look at longer-term timeframes.

But, as mentioned, if 1.13 can be defended, we have a solid base forming from which a recovery can build, so there is hope here for the bulls.

But coming days will be crucial in determining the evolution of this story.

And we won’t get excited if GBP/EUR breaks below 1.13 during the course of Monday - it is the daily close we will be watching as it is the daily chart that interests us and as a rule the closing level is the number that matters.

The Pound’s Week Ahead: A Rude Wake-up Call from Jobs Data?

What the below-par manufacturing data released on Friday, July 7 told us is that data still has the power to influence moves in a currency that has been a political one for some time now.

For that reason, we will certainly be watching the big-ticket releases due in the coming week.

First-up is the BRC’s retail sales monitor due on Tuesday July 11. This isn’t a headline release and will probably not shake Sterling. BUT, it will tell us whether UK retail sales are seeing an improvement. If so, then the more important ONS retail sales figure due for release later in the month will deliver a positive surprise.

Economists are looking for the BRC to report 0.5% growth.

Wednesday brings with it employment market data - look for wage growth. Average earnings, with bonus included are forecast to rise 1.8%.

Anything worse will be bad for the Pound as it confirms momentum in the economy is headed the wrong way with inflation continuing to erode earnings power.

“The May UK labour report will probably come as a disappointment to MPC hawks banking on the Phillips Curve - that is low unemployment rates translating into higher labour costs - coming good,” says Viraj Patel, an analyst with ING Bank N.V. in London.

In short, the UK’s low unemployment level is not resulting in stronger pay growth and the Bank of England therefore does not have to raise interest rates to counter home-grown inflation that is a side-effect of higher pay levels.

And, it’s an interest rate rise or two that will really get the Pound moving higher.

“With the BoE tightening debate more of a 2018 story, a dovish repricing at the front-end of the UK OIS curve remains a risk to GBP in the near-term,” says Patel.

Sell the Pound this Week

The Pound could be in trouble this week we are told.

RBC Capital Markets have announced a sell on GBP/USD as being their “thematic trade of the week”.

Chief Currency Strategist Adam Cole notes this is an important week for US and UK news and the market goes into it 50% priced for an 25bp rate hike by year-end in both cases.

“In our view, the former should ultimately go to 100% and the latter to zero,” says Cole.

Cole is not optimistic on the UK economy’s outlook saying the real inflation story is not the recent pickup in headline inflation, but the failure of earnings growth to follow.

This week’s labour market data - due on Wednesday - is expected by Cole to show headline earnings growth has fallen well below 2%, leaving wage growth more than 1% point below CPI inflation.

“This strongly suggests the rise in inflation is transitory and the resulting real income squeeze will depress consumer spending,” says Cole.

In the US, markets are seen as being too complacent when it comes to expectations for further Federal Reserve interest rate rises.

“With the forward curve so flat, the hurdle is low for Yellen’s semi-annual testimony to be taken as hawkish,” says Cole.

In addition, GBP’s failure to hold gains above 1.30 is a bearish technical backdrop.

RBC Capital Markets are targeting a fall to 1.2635 in the short-term as their trades have a maximum duration of one week.