GBP/EUR Week Ahead Forecast: German Vote Poses Limited Setback

- Written by: Gary Howes

Above: File image of Freidrich Merz. Image source & rights: EPP Official.

Pound Sterling retains a bullish tone against the Euro, although the rally risks a setback during the early stages of the week as German election results are digested.

The Pound-to-Euro exchange rate is lower by 0.20% on the day at 1.2050 following Sunday's election outcome in Germany, where the centre-right CDU/CSU of Freidrich Merz won the vote.

The outcome is largely as expected, but a stronger Euro confirms that some risk-related premium was built into the currency before the event.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Specifically, there will be some relief that a tail risk scenario in which the far-right AdP became the largest party was largely avoided.

"Stronger euro after the German election," says Olle Holmgren, Chief Strategist for Sweden at SEB. "Friedrich Merz has declared himself the winner."

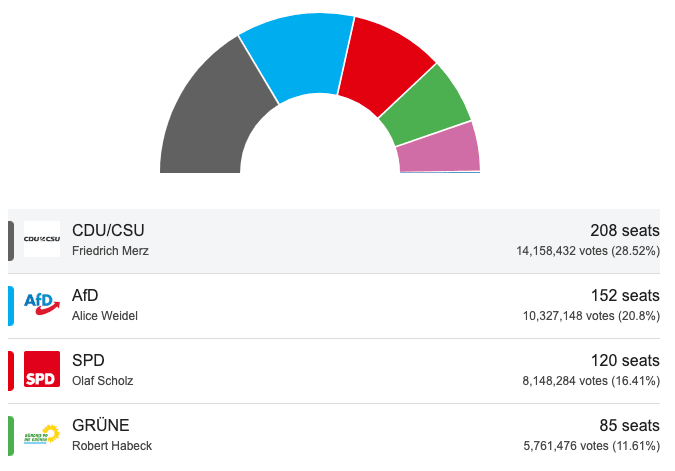

Merz's CDU looks to have won close to 29% of the vote, the AfD 20%, the Social Democrats (SPD) 16.4% and the Greens 12%.

Image courtesy of Google.

"A two-party coalition between CDU/CSU and SPD is now the most likely outcome," says Marion Muehlberger, Senior Economist at Deutsche Bank. "Having only one option may limit the Conservatives' leverage in negotiating tax cuts and supply-side reforms."

With little leverage over its potential coalition partner, Merz may be unable to deliver the reform his party promised, which could ultimately mean this is a status-quo result with limited upside implications for the economy and the Euro.

Given this and the prospect that a government will be formed in April at the earliest, Euro strength will be limited, and the Pound-Euro exchange rate's initial post-election dip will likely be shallow.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

We are targeting a test of the nine-day exponential moving average at 1.2044 for Monday, but we suspect weakness will be limited from here.

The dip could see some follow-through to 1.2020 in the first half of the week, with 1.20 even becoming possible, but dip buyers should be attracted to such moves.

The broader setup is constructive, and by the end of the week, the rally could be evolving once more with tests of last week's high at 1.2097 in prospect.

Looking to calendar risks in the UK, we will watch members of the Bank of England's Monetary Policy Committee who are due to give speeches and update us on where monetary policy is headed.

Deputy Governor for Monetary Policy Clare Lombardelli will give the opening remarks on Monday at the annual BEAR conference. Chief Economist Huw Pill will deliver the closing remarks to the same conference; his comments are always closely followed.

Above: File image of Huw Pill.

In the afternoon, Dave Ramsden will discuss the Bank’s balance sheet ahead of the Bank’s decision on its future balance sheet later in the year. Ramsden will deliver another speech on Friday, giving him ample scope to touch on interest rates.

Ramsden is important because he is 'dovish', and we will be interested to hear whether he would vote for another interest rate cut next month.

Swati Dhingra will also be speaking, and she will almost certainly confirm she will be voting to cut again next month. As her views are so predictable, she is not expected to be a market mover.

The market has lowered bets for the number of rate cuts to come from the Bank this year, following last week's consensus-beating economic data prints, and is now pricing in just two more cuts.

We know the Bank itself would prefer about three more cuts (maintaining its quarterly run rate), and it is therefore hard to see how this repricing can continue. Some 'dovish' MPC members will likely try to encourage the market to price in more cuts, which would technically weigh on Pound Sterling.

However, we would expect weakness to be limited, as the economy has a louder voice, and right now, it is warning that inflation risks are notably tilted to the upside, limiting the scope for Bank of England rate cuts.