Pound-to-Euro: Solid Support

- Written by: Gary Howes

Image © Adobe Images

The Bank of England is a solid source of support for Pound Sterling.

The message from the Bank of England's March decision is that it could keep interest rates unchanged in May as it awaits stronger signals of disinflation in the UK economy.

While this is not the news borrowers might want to hear, foreign exchange analysts agree that the development supports the British Pound.

"The GBP has strengthened modestly against the EUR since the MPC meeting, resulting in EUR/GBP dropping back below support from the 200-day moving average at around 0.8380," says Lee Hardman, an analyst at MUFG.

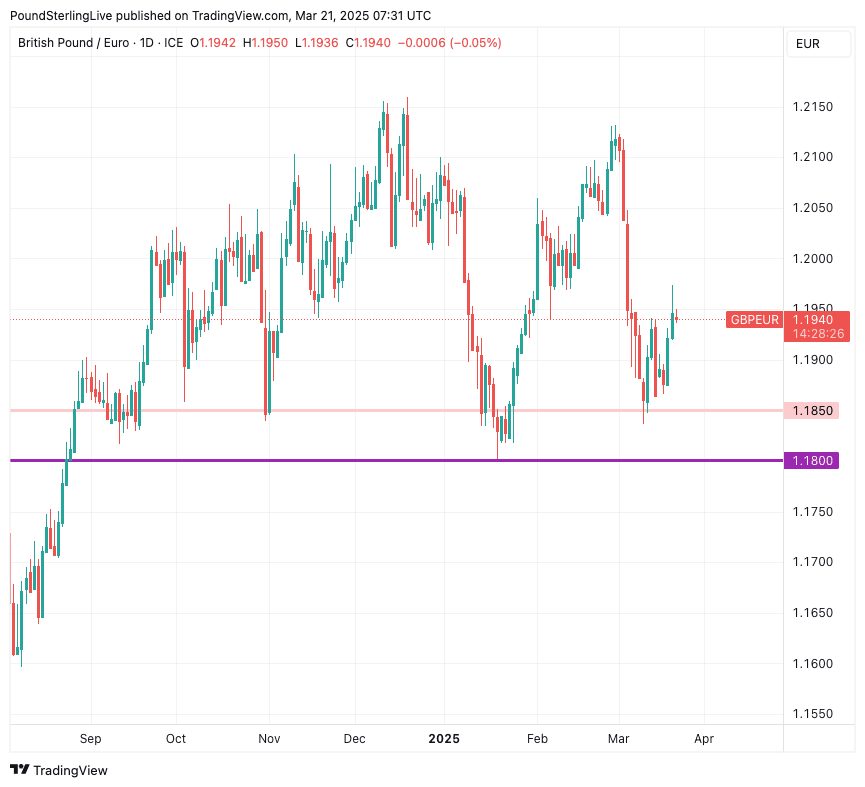

The inverse is a rise in the Pound-to-Euro exchange rate (GBP/EUR) back to 1.0935, placing it in the middle of a broad sideways range that has been intact since August of last year. The relief follows a tumble from 2025 highs that has been accompanied by a raft of GBP/EUR forecast downgrades at the major investment banks.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank said on Thursday that "there was no presumption that monetary policy was on a pre-set path over the next few meetings."

Analysts jumped on this statement as proof the Monetary Policy Committee (MPC) is no longer committed to cutting interest rates once a quarter, meaning there's an elevated possibility it will keep interest rates unchanged in May.

"Saying policy is not on a pre-set path gives the MPC the option to skip a cut at May’s meeting," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

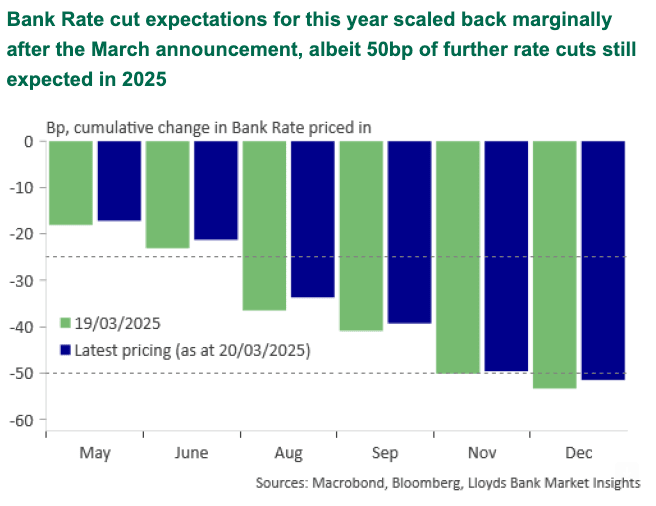

Image courtesy of Lloyds Bank.

Money markets have reacted by lowering the odds of a May cut to about two-thirds, while the odds of an August cut are down to about 50/50.

Rising doubts are reflected in higher UK bond market yields and a well-supported Pound right across the FX strip.

"The BoE’s continued caution over-delivering further rate cuts remains supportive for the GBP as it helps to keep yields on offer in the UK higher than in other major economies," says Hardman.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Rising UK bond yields come as a rise in German yields following the decision to boost borrowing to fund infrastructure and defence peaks, supping support from the Euro's rebound.

A solid area of support for GBP/EUR is confirmed at 1.18, and a break below here becomes more remote as this recovery to 1.1935 reinforces a multi-month floor.

But, saying the Pound is supported isn't the same as saying the Pound is in rally mode, and the 2025 highs at 1.2135 might be out of reach given the better supported Euro and lingering risks of a May rate cut.

Above: Support for GBP/EUR comes in at 1.1850 and then 1.18.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Analysts at Commerzbank say the risks to the UK economy suggest that a slightly less restrictive real interest rate may be appropriate.

"Our base case remains that the BoE will cut rates again in May," says Michael Pfister, a currency analyst at Commerzbank.

"We therefore expect market expectations to shift more towards a rate cut in the coming weeks, which should weigh on the pound," he adds.

Sam Cartwright, an economist at Société Générale says the upcoming data should show enough progress on disinflation for the MPC to deliver three more 25bp cuts this year in May, August and November.

"Given the hawkish shift in the MPC, further progress on disinflation is required to deliver the quarterly pace of cuts we forecast, especially on pay growth. We believe weak consumption is likely to limitfirms’ pricing power to pass on their higher labour costs, while rising unemployment puts downwards pressure on pay. This should allow the MPC to deliver three more 25bp cuts this year," he explains.