Citi Ramps Up Gold Price Forecast

- Written by: Sam Coventry

-

Image © Adobe Stock

Looming tariffs are a compelling reason to build exposure to gold says Citi.

"We believe the market could be significantly under-pricing the impact of the upcoming April 2 US reciprocal tariffs on growth and commodity prices, and strongly recommend clients take insurance against adverse outcomes, or take outright exposure to these risks," says Maximilian J Layton, an analyst at Citi.

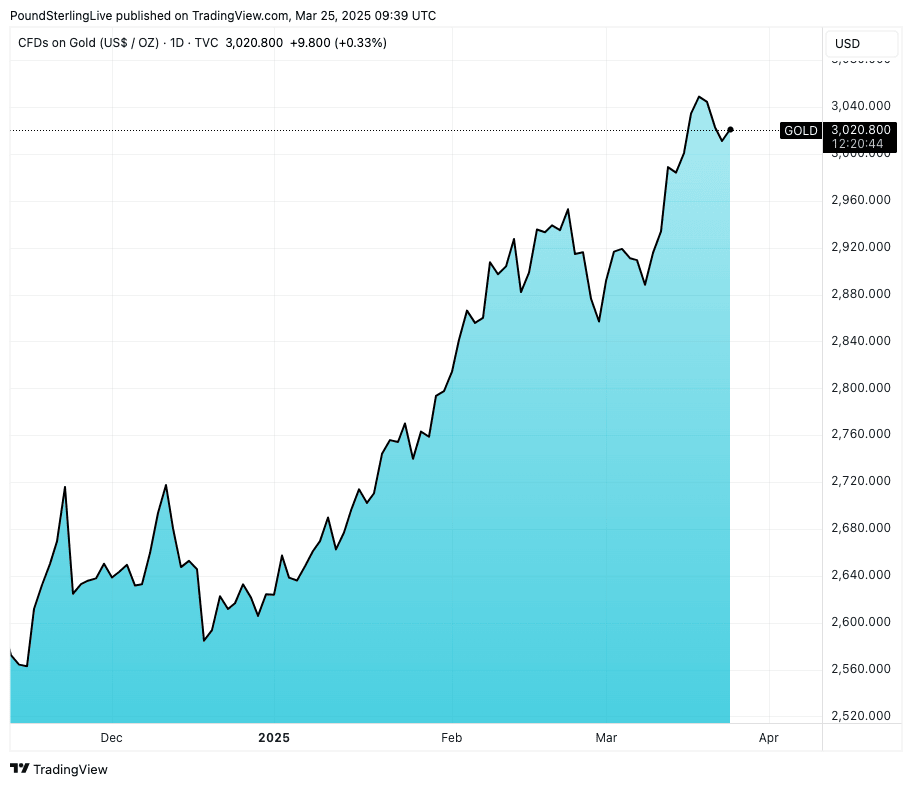

Layton's call comes amidst a surge in the value of gold to above $3000 an ounce and ahead of the April 02 "reciprocal tariff" announcement from the U.S.

The White House is set to announce tariffs on countries that tariff U.S. imports and against countries that are deemed to be applying 'non-trade' tariffs.

President Donald Trump has warned that countries that impose a Value-Added Tax (VAT) will also be subject to tariffs, which massively widens the net.

In anticipation of a potential tariff shock, Citi thinks gold remains an attractive prospect for investors.

"The impact of the upcoming April 2 reciprocal tariffs on global growth and the drive for the U.S. to lower the government budget deficit (bearish US growth) underpin our bullish GOLD view for the next 3 months," says Layton.

Above: Gold prices at daily intervals.

Citi upgrades its three-month target to $3,200/oz from $3,000/oz.

It also downgrades its Brent oil price forecast to $60-63/bbl in 2H'25.

"Further, we believe President Trump wants, needs, and will persist in his drive for lower OIL prices (including potential domestic oil subsidies/tax cuts) to mitigate the impact of the tariffs on inflation and help bring down interest rates," adds Layton.