Pound to Euro Week Ahead Forecast: Eyeing 2024 Highs, French Uncertainty Builds

- Written by: Gary Howes

Above: File image of Marine Le Pen. Source: Global Panorama, Flickr. Licensing: Creative Commons 2.0.

The Pound to Euro exchange rate (GBP/EUR) is trending higher at the start of the new week and could be on course to retest the 2024 highs in the coming days.

The Euro was under pressure on Monday following the weekend news that France's finance minister, Antoine Armand, said his government won’t accept artificial budget deadlines from the National Rally (RN). The RN is a key party that Prime Minister Michel Barnier needs on board if it is to pass its budget.

But RN leaders said on Sunday that the government had rebuffed its calls for more budget concessions.

The apparent deadlock makes a no-confidence vote in Barnier's government highly likely, raising the prospect of further rises in French government bonds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"French politics looks to be belatedly playing a role in FX and driving some euro underperformance," says Chris Turner, Head of FX Research at ING Bank. "It looks like the pressure may stay on the euro with a potential no-confidence vote coming on Wednesday."

RN figurehead Marine Le Pen had previously given the government until Monday to agree to RN's budget demands or face the threat that they would back a likely no-confidence motion against his government, which would trigger its collapse.

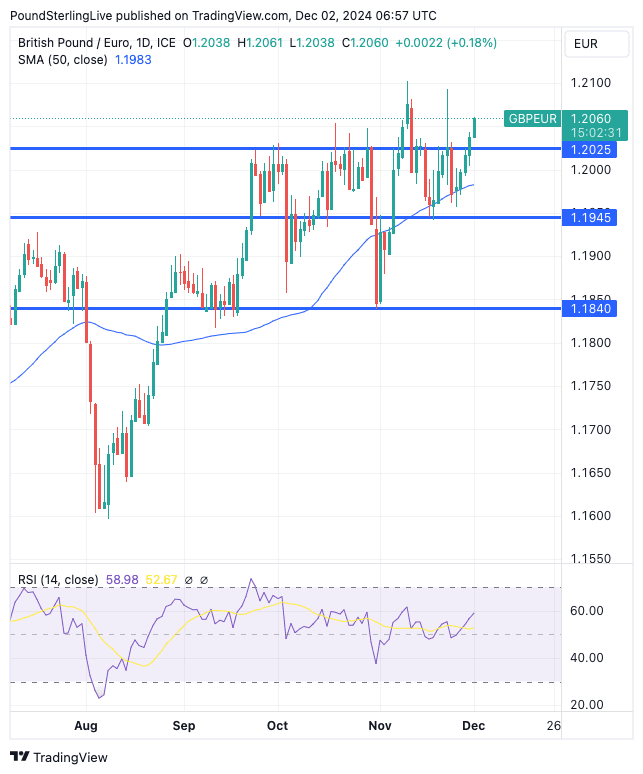

The Pound-Euro exchange rate trades at 1.2058 at the time of writing, putting it above the upper band of the post-September range in a sign of building technical momentum:

Above: GBP/EUR at daily intervals.

The clear objective from here is a retest of the 2024 high at 1.21.

However, we note that the exchange rate has failed to close above 1.2025 on a sustained basis in 2024 and there could be increased selling pressures born on Pound Sterling at these levels.

Certainly, the passing of the French budget would post a notable downside risk for the pair that would see it sucked back into the 1.2025-1.1945 range once again.

The pair is above key moving averages, which is consistent with the broader uptrend, weakness would likely find buying interest at the 50-day moving average at 1.1983.

The RSI is at 58 and pointed higher, which is a confirmatory signal that the upside is preferred at this juncture.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Looking ahead to the week's agenda, there are no major releases due from the Eurozone or the UK in the coming five days.

The global highlight will be the release of U.S. labour market statistics on Friday, but this tends to be a relatively neutral event for GBP/EUR.

Instead, we will be watching politics in France, where we will be anticipating a last-minute ditch by the Barnier government to get RN onside in order to pass the budget, which is needed to bring the country's finances back onto a sustainable footing.

RN on Sunday said that Barnier faced a choice of either negotiating new concessions or facing the threat that his government falls in a vote of no confidence.

To survive the vote in the fractured lower house, Barnier needs the RN to abstain in a confidence vote.