Euro-Pound Anchored by UK's Superior (For Now) Growth Expectations

- Written by: Gary Howes

Image © Adobe Images

What is driving the Pound's outperformance of the Euro?

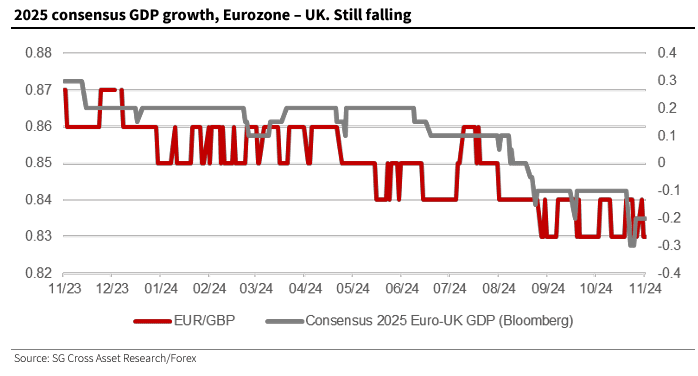

A new chart from Société Générale suggests it is the growth differential between the Eurozone and the UK.

This is the difference in growth expectations between the two regions, with data showing a steady move in favour of UK growth.

Analysts at Soc Gen have shown that as the UK's economic growth advantage over the Eurozone increases, so the Euro to Pound exchange rate declines (GBP strengthens):

"Eurozone growth forecasts being persistently revised lower relative to the UK, and the pound benefiting. Our forecast gap in 2025 is 0.5%, which leaves us favouring GBP over EUR," say analyst Kit Juckes at Société Générale.

Amid a fragile Eurozone recovery and slowing inflation, markets have already priced in aggressive easing by the European Central Bank in the coming months, which has apparently weighed on the Euro.

In addition, the victory of Donald Trump in this month's presidential election could mean fresh trade tariffs that would represent another blow to the Eurozone recovery.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Given the importance of relative economic growth rates, risks to the Pound would include a deterioration in the UK's growth outlook, something economists have been warning about following Labour's business-crushing tax rises.

Labour announced it would spend significantly more money in the coming years and would pay for it by increasing both taxes and borrowing.

"Some economists, including the Office for Budget Responsibility, believe that the extra spending will more than offset the drag from higher taxes in the next year or so, meaning that the economy will actually grow faster as a result of the Budget. I’m not so sure," says Steven Bell, Chief Economist for EMEA at Columbia Threadneedle.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Bell says businesses have taken a significant knock from the government's job tax increases, coupled with the other labour market measures that make it riskier for employers to take on staff.

"Unemployment looks set to increase. The NI rises will also raise inflation, putting upward pressure on interest rates. Given the weakness in growth that I expect, interest rates are likely to continue to fall, but the overall mix in the economy looks much less favourable," says Bell.

"With her first Budget, the Chancellor sought to restore credibility and stability in financial markets and to lay the foundations for a sustainable improvement in economic growth. To my mind, she has achieved neither," he adds.