Pound to Euro Eyes 1.21 in 'Trump Trade' Surge

- Written by: Gary Howes

File image of Donald Trump. Official White House Photo by Shealah Craighead.

Pound Sterling is closing on the 1.21 level as the 'Trump trade' enters another weak.

The Pound to Euro exchange rate (GBP/EUR) rose to 1.2095 on Monday, which offers the best rate of exchange for euro buyers since April 2022.

Gains followed Donald Trump's win in the presidential election, a victory shored up by his Republican Party's sweep of both houses of Congress, allowing him a stronger hand to pursue his agenda.

We were not anticipating GBP/EUR to show such a reaction to the red sweep, but it is clear investors think the Euro is particularly exposed to Trump's stated aim to raise import tariffs, owing to the Eurozone's significant goods export base.

"German bond yields have fallen along with other European sovereign yields in the past week, which has added to pressure on the euro. The single currency was the weakest performer in the G10 FX space last week, as the dollar was king. This is a reflection of how exposed Europe is to Trump, both economically and from a national defence standpoint," says Kathleen Brooks, research director at XTB.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The UK, on the other hand, is not a major exporter of goods. Instead, the UK is a services export powerhouse, and services tend to fall outside the scope of tariffs.

Is the Trump Trade complete, or is there more to come? This is an important question for GBP/EUR, as any extension of the trade can result in further upside.

To be sure, much of the Trump win is already factored into financial market valuations, and now we await Trump's policies.

Trump has a penchant for deal-making, which means there is a chance the tariffs raised are not as severe as expected. If it becomes clear he is in the mood for a deal, markets might unwind some of the Euro's recent losses.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

However, we think such good news is still some way off, leaving Pound-Euro to extend recent momentum.

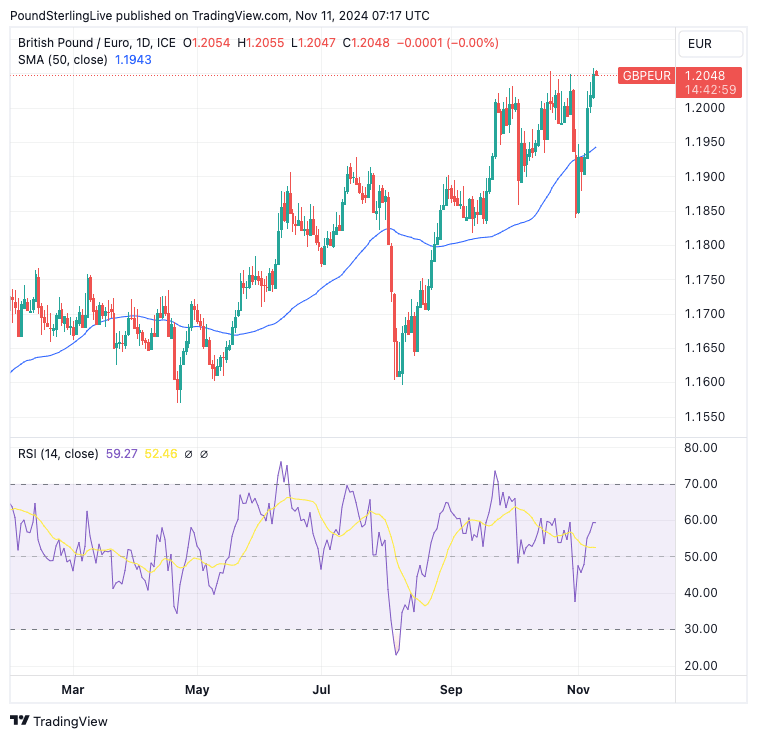

All technical indicators are pointing to further upside, with the exchange rate trading above the nine-day moving average which suggests near-term gains are possible in the next five days.

Last week's break above the 50-day moving average was emphatically confirmed, while the Relative Strength Index (RSI) is at 60 and pointed higher.

This suggests the pair is by no means particularly overbought despite the achievement of fresh two-year highs in recent sessions.

The 2022 highs at 1.2120-1.2190 are possible targets to aim for ahead of year-end.

This week's key event for Pound Sterling arrives on Tuesday when the UK releases wage and employment data.

These numbers are typically a key component of the Bank of England's decision on interest rates, and any sign that wage pressures are easing could bolster the case for a December rate cut.

The market looks for average earnings to have declined to 4.7% in September, with the figure falling to 3.9% for earnings with bonuses included. The unemployment rate is expected to have risen slightly to 4.1%.

The September data precede the budget, which looks to have been a job killer owing to the significant costs associated with employing staff (national insurance paid by employers was hiked, but the threshold at which they start paying the tax was lowered significantly).

The official data will only start covering the fallout of the decisions announced by Chancellor Rachel Reeves early in 2025.

We think the signal coming from more timely surveys, such as November's PMI survey, will be more important in this regard.

Would the Bank of England be in a position to cut interest rates if it thinks the labour market is deteriorating? Usually, the answer would be yes.

But Reeves' budget is also set to boost inflation well above 2.0% in the coming months which will tie the Bank's hands and keep interest rates higher for longer.

We will hear from Bank of England Governor Andrew Bailey midweek and then again on Thursday, where he should address last week's policy decision and matters concerning the budget's impact on policy.

His commentary could offer some near-term volatility.

The week concludes with a tranche of GDP data for the third quarter. This can provide some near-term price action. However, we don't think it will have a lasting impact on Sterling exchange rates.

This is because the third quarter is clearly in the rear view mirror, particularly given the changes to policy settings announced in the budget.