Pound to Euro Rate Challenged at 1.19 Resistance

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's recovery against the Euro ran into technical resistance ahead of the final day of trade in August. However, a potential test of 2024's highs looks to be on the cards for September.

The Pound to Euro exchange rate rallied to 1.19 on Thursday following the release of below-consensus German and Spanish inflation figures that raised the odds of a potential October interest rate cut at the European Central Bank (ECB).

"A September rate cut by the ECB is essentially a lock. The question for markets is whether October becomes likely," says Andrzej Szczepaniak, an analyst at Nomura. Germany's inflation surprised to the downside, printing at 2% year-on-year in August, down from 2.6% in July. Spain's inflation reading fell to 2.4% from 2.9% previously.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The prospect of two consecutive interest rate cuts at the ECB contrasts with expectations for the Bank of England to leave interest rates unchanged in September, with markets expecting the next rate cut in November.

These developments mean the ECB is cutting rates faster than the Bank of England and is doing so from a lower starting point. This should ensure investors continue to see value in UK interest rate-linked assets relative to those of the Eurozone for the foreseeable future.

This can generate supportive capital flows that would boost the Pound.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Ahead of month-end, we receive the Eurozone-wide HICP inflation release, which should come in lower than previously anticipated owing to the undershoots from Germany and Spain. However, this is now factored into euro exchange rates, and we think the impact of a softer-than-forecast reading will be limited.

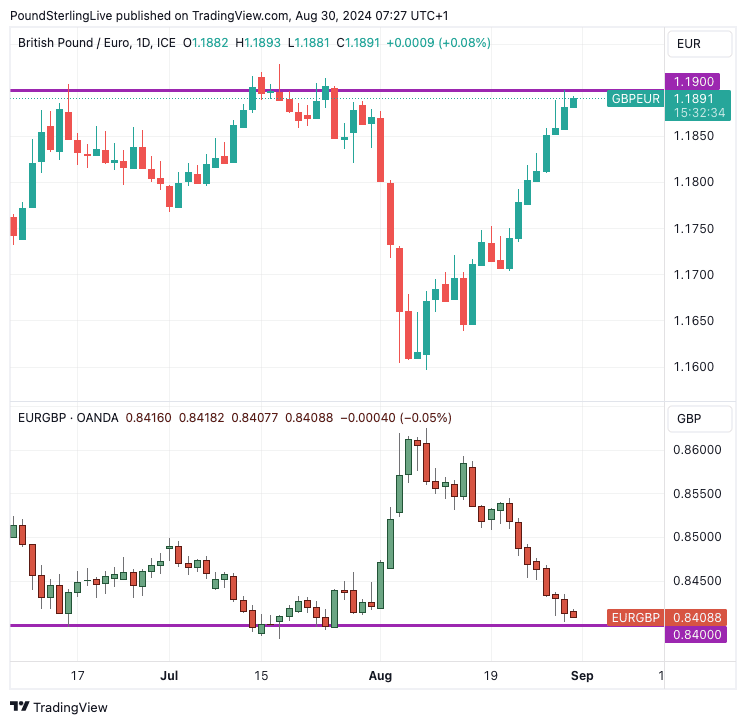

Technicals are also set to have an impact, with GBP/EUR potentially finding the upside more difficult to overcome resistance around 1.19. This equates to a support level in EUR/GBP at 0.84, which can entice euro buyers looking for a potential recovery in the single currency.

Above: GBP/EUR and EUR/GBP are shown with the key resistance/support area.

Nevertheless, momentum remains firmly routed in Pound Sterling's camp, and a test of the 2024 high at 1.1927 is possible in early September.

A move above here will depend on the tone of global equity markets, as the Pound is highly sensitive to overall sentiment and tends to fall when markets suffer a setback. With this in mind, next week's U.S. jobs report will be important.

Next week's data calendar in the UK and Eurozone is relatively light and we don't see any market-moving events, which can ensure some residual support for the Pound which will likely trade on technical considerations.

As such, consolidation around 1.19 is possible. A potential break higher - or a more notable pullback - is possible midmonth when the UK's inflation and wage figures are released.