40% Chance GBP/EUR Rate Unwinds All its French-Inspired Strength: Analyst

- Written by: Gary Howes

Above: File image of Marine Le Pen. Source: Marine Le Pen Officiel

Pound Sterling would give up all its recent France-inspired gains against the Euro if Marine Le Pen's right-wing party fails to secure a majority in the upcoming legislative elections.

The Pound to Euro exchange rate has breached a significant technical level at 1.1764, a move largely attributed to the unforeseen surge in political uncertainty following President Emmanuel Macron's decision to call legislative elections for the end of June.

The rally peaked at €1.19, the highest level for those buying euros in 22 months, meaning a long-running deadlock between the Pound and Euro was broken. For most of 2024, the GBP/EUR conversion has been locked between 1.1764 and approximately 1.16.

Can the Pound rise further, or is this it? Already on Friday and Monday, we saw Pound Sterling retreat from highs near €1.19 as French bond and stock markets calmed down. It suggests that 'peak fear' regarding the French outlook has passed, making a retest of 1.19 and moves above increasingly less likely without further surprising political developments.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

One analyst we follow says the Pound could give up all its recent gains and slide back into the 2024 range.

"The best outcome for the EUR would be the RN party disappoints in the elections by failing to become the largest party in France. It would trigger a bigger initial relief rally for the EUR," says a strategy note from MUFG Bank Ltd.

Here, EUR/USD is forecast to rise back up towards the top of the current 1.0500-1.1000 trading range. MUFG expects EUR/GBP to rise back up into the 0.8500-0.8600 trading range. (The 1.1764-1.1630 range for GBP/EUR).

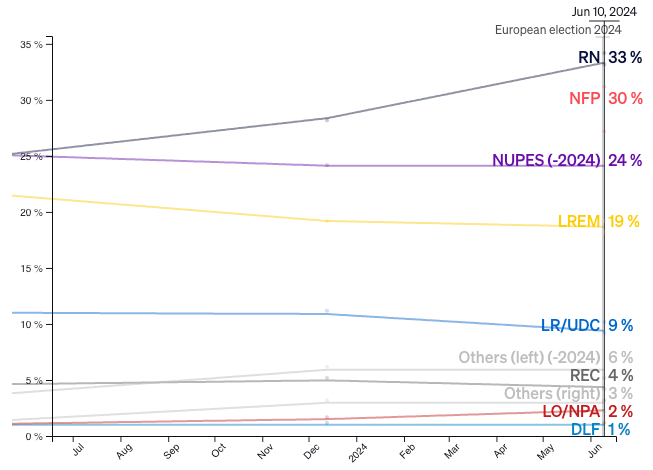

Above: Poll of polls, source: Politico.

MUFG says there is a 40% chance this will happen.

"That the far-right could win an outright majority of seats seems unlikely," says Holger Schmieding, an economist at Berenberg.

Politico's Poll of Polls says Le Pen's National Rally commands 33% of the vote, the left-wing alliance commands 24% and Emmanuel Macron's Renaissance 19%.

The polling suggests momentum must turn away from National Rally to avoid what Berenberg describes as a tail risk scenario.

"In a tail-risk scenario, a worsening French fiscal deficit, a breach of EU fiscal rules and noisy conflicts between Paris and Brussels could cause a major widening of French yield spreads and unsettle financial markets. The European Central Bank could ride to the rescue but would probably only do so if and when France returns to fiscal prudence," says Schmieding.

According to MUFG, this "worst outcome for the EUR" is a 5% likelihood. Here, Euro-Dollar falls into a 1.0-1.05 trading range and "EUR/GBP could fall to its lowest level since the Brexit referendum in 2016 as it moves to between 0.8000 and 0.8200."

This equates to a Pound-Euro exchange rate forecast range of 1.25-1.22.

"The outcome could initially trigger another leg lower for the EUR by increasing the risk of more disruptive policies being adopted in France," says MUFG.

Silvia Ardagna, an economist at Barclays, says a hung parliament leading to gridlocks or a 'cohabitation' between President Macron and a far-right government are the two likely outcomes.

"We think the latter would be more negative for markets and, at least over time, for European Union institutions and the prospect of further fiscal and political integration of European Union member states," says Ardagna.

MUFG reckons the most likely outcome (55% chance) is a 'muddle through' scenario, and the RN party becomes the largest party in France but falls short of being able to form a majority in parliament even with support from other parties.

"Without a clear majority in parliament, it becomes difficult to pass legislation. In this scenario, the EUR continues to trade at weaker levels closer to the bottom of the current 1.0500-1.1000 trading range. This is the policy grid-lock scenario of there being no clear path to stable government," says MUFG.

Here, MUFG expects EUR/GBP to fall towards the lows in early 2022 at closer to 0.8300 (GBP/EUR 1.2050).

"We need to consider the potential consequences of a risk scenario in which the far-right gains a decisive say over the government and legislation and implements major parts of its agenda in a “cohabitation” with President Emmanuel Macron," says Schmieding.

"A French government that is beholden to the far-right and pursues far-right policies could impair the workings of the EU. A partial reversal of Macron’s pro-growth reforms could hurt French growth," he adds.