Hawkish ECB Helps the Euro

- Written by: Gary Howes

ECB president Christine Lagarde giving the monetary policy statement during the ECB Governing Council Press Conference in Frankfurt, 6 June, 2024. Photo: © Angela Morant/ECB.

The Pound to Euro exchange rate's upside progress has been blocked by the European Central Bank's warning that there are no further interest rate cuts pencilled into the diary.

The ECB reduced its three main interest rates by 25 basis points on Thursday and said it was not committed to further cuts. The message was repeated on Friday as a bevvy of Governing Council members hit the airwaves.

Robert Holzmann, Austria's national bank governor, said on Friday he chose not to vote for a cut because the fight against inflation had not yet been won. The head of Germany's Bundesbank, Joachim Nagel, said, "we on the ECB Governing Council are not driving on auto-pilot when it comes to interest rate cuts."

Isabel Schnabel - a key member of the Governing Council - said in a speech on Friday, "we cannot pre-commit to a particular rate path."

The risk for the Euro was that the ECB would be minded to lower the deposit rate again in July, but based on the ECB's statement and press conference, this won't happen as the central bank sees inflation firming a little in the coming months. We expect the speakers to confirm this is the case, potentially offering the Euro further support.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ECB raised its inflation and growth forecasts, another signal that it was too soon to enter a committed rate cutting cycle. This is firming Euro exchange rates across the board.

"We expect the more gradual policy easing to support the euro going forward, and we adjust our three-month view to a stable exchange rate outlook, up from the euro weakening previously projected," says David Kohl, Chief Economist at Julius Baer.

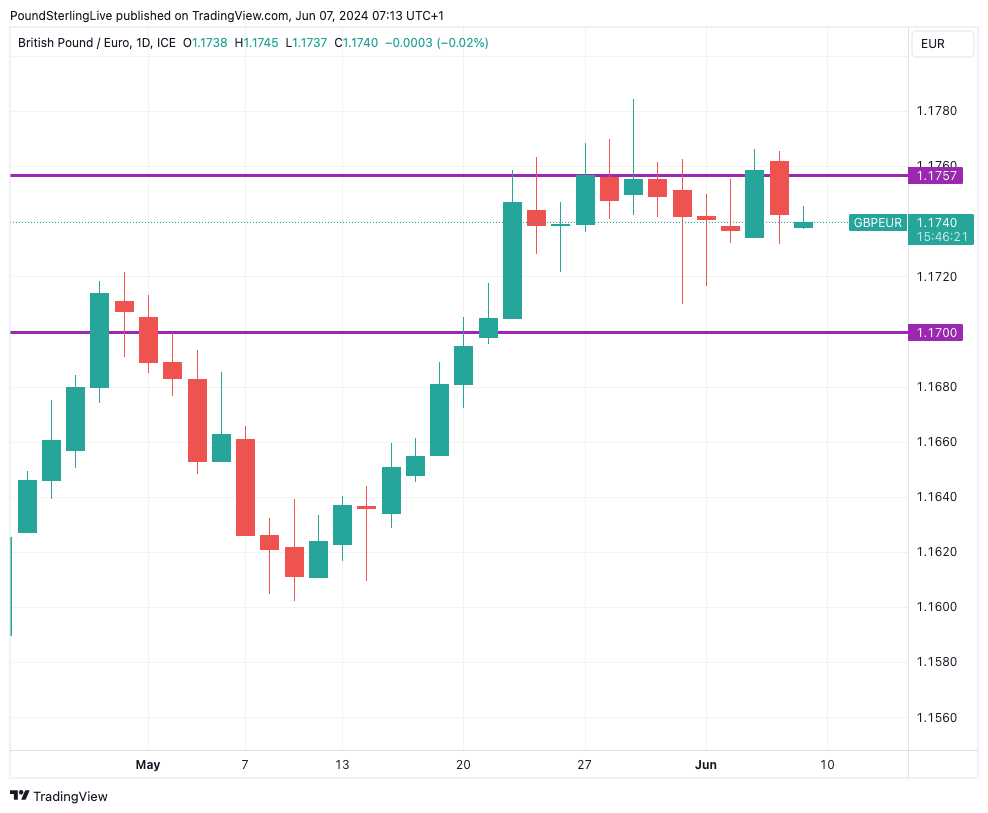

The Pound to Euro conversion rose into the ECB event - closing at its highest level in 21 months on Wednesday - but was sold in response to what analysts have branded a 'hawkish' cut, i.e. a reluctant cut that was accompanied by caveats that there is no likelihood of a successive move in July.

The exchange rate could settle below recent highs and potentially pull back further into the 2024 range.

Above: GBP/EUR at daily intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

ECB President Christine Lagarde emphasised in the press conference that the ECB would require more evidence of softer inflationary pressures before reducing interest rates again. The next set of staff forecasts are due in September, which has led a number of economists we follow to say this is when the next cut is likely.

"We now think the Bank will cut interest rates by only a further 50bp before the end of the year, with the next cut coming in September," says Andrew Kenningham, Chief Europe Economist at Capital Economics.

The ECB had little choice other than to cut on Thursday as they had been talking up a June cut as early as February, boxing them into the move.

Last month's above-consensus inflation print and data releases that show the Eurozone economy is recovering means the ECB will be cautious of cutting interest rates too fast from here, as this could stimulate inflation.

"Over the rest of 2024, our base case is for the ECB to pause in July before cutting rates again in September, October and December. However, we suspect ECB policymakers would prefer to see a return to an overall downward trend in wage growth and domestic inflation to be fully comfortable in lowering interest rates further, and thus view the risks as tilted toward lesser easing," says Nick Bennenbroek, International Economist at Wells Fargo Economics.

The next moves in Pound-Euro will likely be determined by next week's wage data, where an above-consensus print could push the exchange rate higher.

But the major June release is inflation figures, which are released the week after. They come a day before the Bank of England's June interest rate decision, where markets expect another 'no change' on interest rates.

The Bank could be inclined to signal it wants to cut rates in August. However, we note UK inflation has been running ahead of expectations and there is a risk this month's print is no exception.

This will make an August cut a hard sell for the Bank of England's doves, ensuring the Pound remains supported over the coming weeks.