Euro Rallies Against Pound and Dollar After Inflation Surprise

- Written by: Gary Howes

Image © Adobe Images

Euro exchange rates firmed ahead of the weekend courtesy of news Eurozone inflation printed on the upper end of expectations in April, lowering the odds of a succession of interest rate cuts from the European Central Bank.

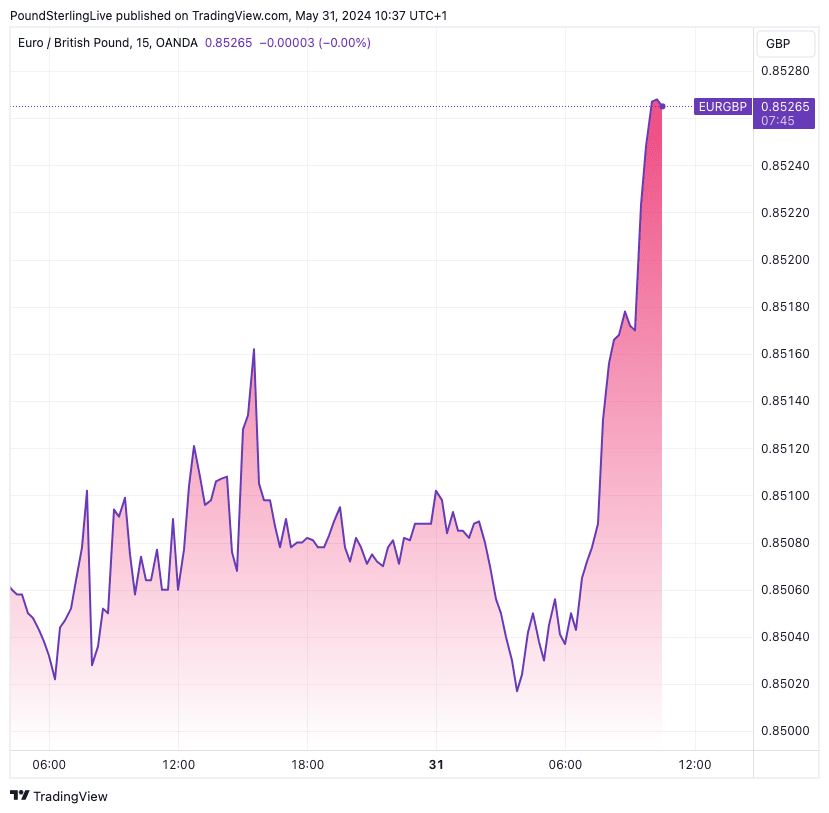

The Euro to Pound exchange rate rallied a quarter of a per cent to 0.8527 after Eurostat reported Eurozone HICP rose to 2.6% year-on-year from 2.4% and exceeded expectations for 2.5%.

Core HICP rose to 2.9% from 2.7% and exceeded estimates for 2.8%, and makes for potentially unwelcome reading at the European Central Bank just days ahead of an expected interest rate cut.

The Euro to Dollar exchange rate extended a two-day recovery to touch 1.0840.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ECB has all but committed to an interest rate cut at next Thursday's meeting, but what is uncertain is the timing of further rate cuts. There has been speculation that a consecutive rate cut could follow in July, a development that would likely weigh on the Euro.

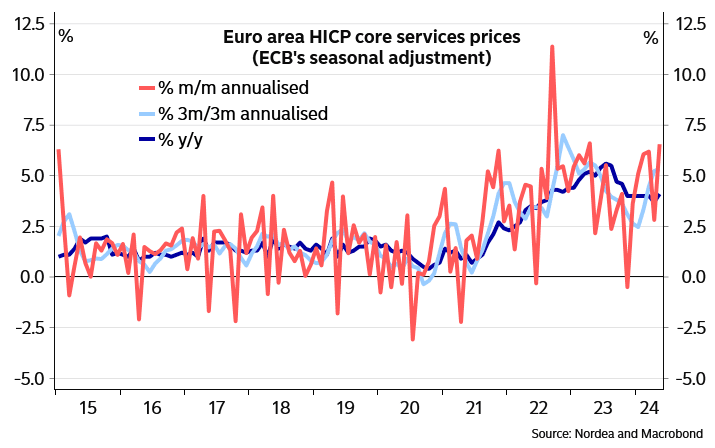

But these inflation data have killed such a prospect, which is reflected by the rise in the Euro. "This is going to worry the ECB somewhat and underscores our view that the risks to services prices have remained tilted to the upside," says a note from TD Securities following the release.

Above: Euro-Pound at 15-minute intervals showing the post-inflation reaction. Track GBP and EUR with your own custom rate alerts. Set Up Here

"Policymakers have backed themselves into a corner and the bar had been set too high for the May inflationary uptick to halt a rate cut next week, but blazing hot services inflation will embolden the case to hold off adding a second cut in July. This follows on from the hot wage growth from last week which, although quickly downplayed by the ECB, suggests that the road to 2% is going to be a bumpy one," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

Anders Svendsen, Chief Analyst at Nordea bank, says a rise in core services inflation adds to concerns that the labour market is too tight for inflation to gradually decline in line with the ECB's projections.

"The rise in core services inflation comes after negotiated wage data for Q1 also came in above expectations. Higher core services inflation thus adds to the worry that wage growth may be slower to decline compared with the ECBs projections and, in turn, that core services inflation will be slower to decline as well," he explains.

These inflation data and expectations for an ECB pushback against expectations for further rate cuts at next week's meeting could set the Euro up for a firm start to June.

Above: "Core services momentum remains too high" - Nordea.

"The question remains: how many cuts can follow, and the May inflation serves as a warning that next week might not mark the start of a traditional cutting cycle," says Bert Colijn, Senior Economist for the Eurozone at ING Bank.

He explains that with unemployment remaining at a record low of 6.4%, the decline in wage growth over the rest of the year remains uncertain. "For the ECB, the outlook for wages is encouraging enough to cut rates for the first time since 2019 next week."