GBP/EUR Rate Holds 17% Undervaluation, says BBH

- Written by: Gary Howes

Above: Rachel Reeves, Shadow Chancellor, said recently Labour is "a party of growth and of enterprise." File image. Source: Keir Starmer on Flickr. License: CC BY-NC-ND 2.0 Deed.

A Labour win on July 04 would be supportive of Pound Sterling, which remains significantly undervalued against the Euro, according to a new currency research note.

Analysis from Brown Brothers Harriman, the private banking and investment services provider, finds the Labour Party's return to the centre of the UK political space and the potential for improved relations with the EU can help the Pound unlock value.

We reported recently that other major institutions are constructive on the Pound on the assumption a Labour government will help reduce a Brexit overhang.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A Labour government would be positive for GBP," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman (BBH). "The Labour Party under Keir Starmer has moved away from left-leaning economic policies since taking over from Jeremy Corbyn."

Polls point to a consistent and stable 20-point lead for Labour over the Conservatives. Labour could be on course to win a 194-seat majority, the largest majority since 1924, according to a YouGov poll.

"In our view, a Conservative majority government is simply not a realistic scenario," says Haddad. Regarding policy, he notes Labour shadow chancellor Rachel Reeves's recent statement that the party is "a party of growth and of enterprise."

"Moreover, Labour leaders pledged to improve relations with the European Union," he adds. However, an improved political backdrop is just one pillar underpinning the Pound Sterling outlook.

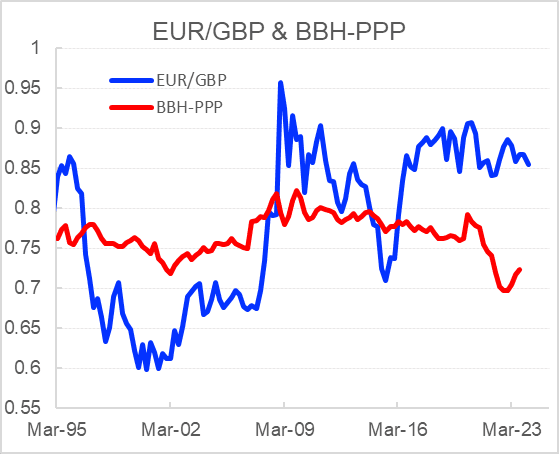

"Beyond the UK political landscape, we are constructive on GBP mostly versus EUR. We estimate long-term fundamental equilibrium for EUR/GBP at around 0.7300, implying a roughly 17% overvaluation relative to the current spot rate," says Haddad.

Image courtesy of BBH. Track GBP with your own custom rate alerts. Set Up Here

A EUR/GBP at 0.73 equates with a Pound to Euro exchange rate of 1.34. (Analysts use fair-value estimates as a guide and not necessarily an end-point target.)

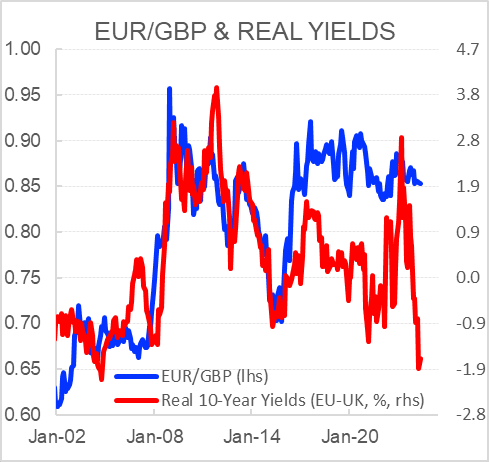

Drivers of Pound Sterling undervaluation include "deeply negative EU-UK real long-term interest rate differentials and the relative monetary policy rate outlook suggest EUR/GBP can correct some of this overvaluation."

BBH estimates the Bank of England has less scope to cut rates compared to the ECB because UK underlying inflation is higher than in the Eurozone. In April, UK core CPI was 3.9% y/y versus 2.7% in the Eurozone.

The Pound recently rose to fresh 21-month highs against the Euro after May's inflation figures showed April inflation was stronger than had been expected. This prompted markets to erase expectations for a June interest rate hike, which boosted the Pound.

The immediate concern for Pound-Euro is this week's European Central Bank (ECB) decision, where interest rates are to be cut by 25 basis points, confirming a clear divergence in monetary policy settings between the UK and Eurozone that favours GBP upside.

Because markets fully expect an interest rate cut at the ECB on Thursday, the decision itself won't be a market-moving surprise; what will move the market is the guidance pertaining to future rate cuts.

"The highlight is the ECB meeting, with a rate cut well anticipated, so the guidance for future policy moves will be a key driver. We think the euro will weaken, especially given its strong rally in recent weeks," says Dominic Schnider, a strategist with UBS' Chief Investment Office.

However, other analysts are wary the ECB strikes a more 'hawkish' tone regarding the outlook, which can support the Euro. The Eurozone economy is rebounding, and inflation continues to prove sticky, suggesting there is little need to rush into another cut as early as July.

Expect the ECB to confirm that it remains data-dependent and argue that it is prudent to allow some time before cutting rates again.

This would be a status-quo outcome for the Euro and could result in further near-term strength as Eurozone bond yields firm, likely sending Pound-Euro back towards 1.17 again.