GBP/EUR Week Ahead Forecast: Big Week, Big Resistance

- Written by: Gary Howes

- GBPEUR rally might be near its limits

- Hefty UK data calendar to look forward to

- Bank of England is the highlight for GBP

- But ECB decision could be more instrumental

Image © Adobe Images

The Pound to Euro exchange rate faces an action-packed week of data releases and central bank decisions, which will determine whether or not it can have a crack at the 2023 highs or is relegated back to the well-trod range of recent months.

Pound-Euro saw a remarkably strong rally over the course of the final two weeks of November, which took the exchange rate into overbought territory and required a period to cool off and see those overbought conditions unwind.

As we move into December's most instrumental week, these overbought conditions have indeed unwound, and Sterling bulls will ask whether the uptrend can resume.

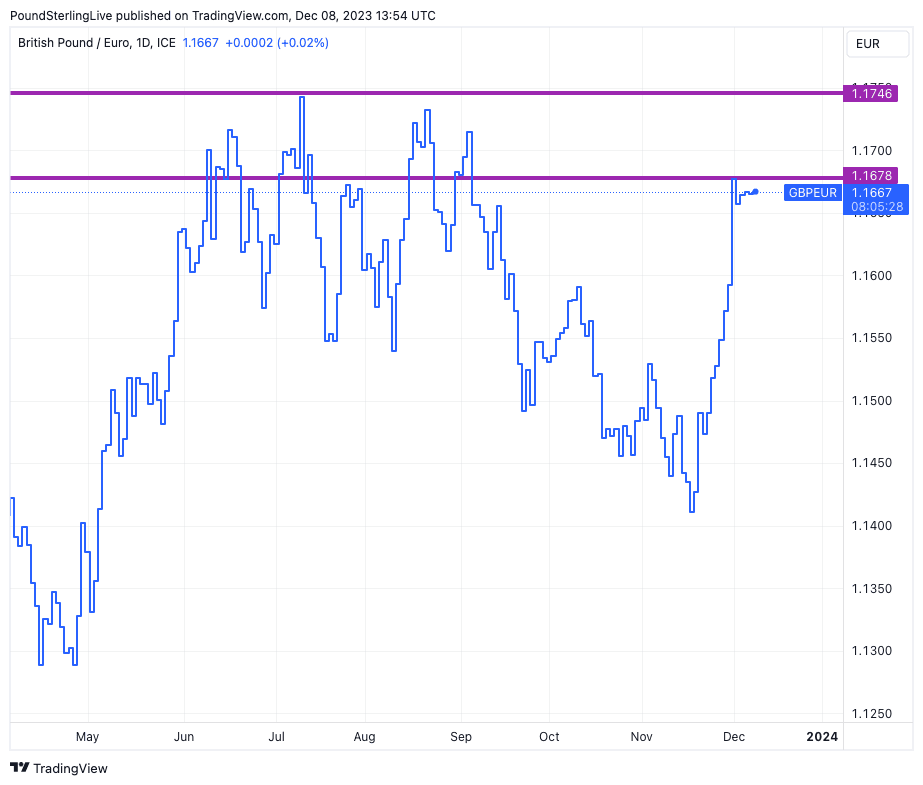

We note the pair is now knocking on the door of an important resistance zone, and as the chart below shows, levels above 1.1680 don't tend to be held for any lengthy spell:

Above: GBPEUR at daily intervals, showing open to close levels. Track GBPEUR with your own custom rate alerts. Set Up Here.

Upside could also prove challenging to achieve given Pound-Euro has detached from yield spreads and looks precarious at these levels. Those looking to buy euros should consider levels above €1.1780 as strategically opportunistic in this regard.

But, should UK data land above expectation, and the European Central Bank fail to inspire a Euro rebound, then Pound-Euro could eye a return to levels at 1.1750.

From a strategic perspective, such highs are unlikely to hold, and Euro buyers should be nimble.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

For Pound-Euro, it could be the Euro side of the equation where the action lies over the coming days, as there are indications that the recent broad-based selloff in the single currency is overdone.

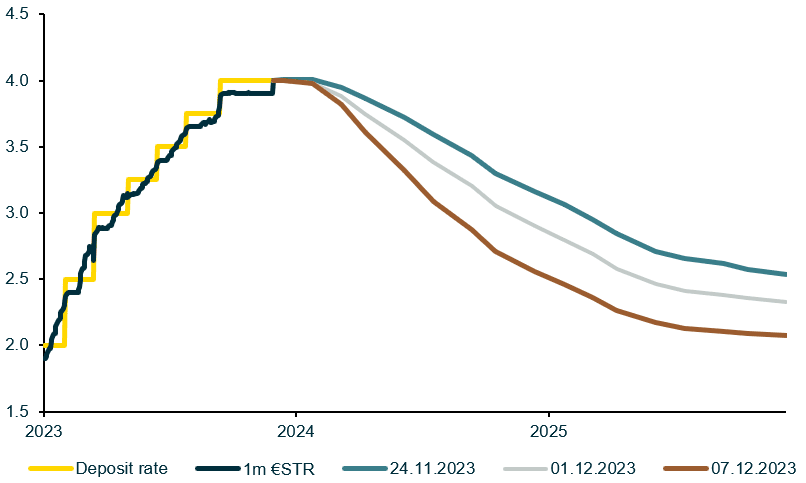

The Euro has fallen as markets aggressively brought forward the timing and scale of ECB rate cuts in 2024.

"Market repricing has been less aggressive for the Bank of England. Investors are expecting three rate cuts next year compared to more than five over at the ECB. The first move is seen in June, as opposed to March over in Frankfurt," says James Smith, an economist at ING Bank.

These developments encapsulate why the Pound has risen against the Euro over the past few weeks.

Above: Money market pricing shows expected interest rate levels in the Eurozone have fallen notably over recent days. Image courtesy of Commerzbank.

But, a Euro comeback is possible as the dovish repricing of European interest rates reaches its limits as it is difficult to see how markets can get more aggressive on such pregnant pricing; can we seriously expect expectations to come forward ahead of March?

"We expect the ECB on hold. Communication and forecasts will suggest cuts are next, but not immediate. Risks of an April cut are up, but still not obvious. We stick to a first quarterly cut in June, faster moves in 2025," says Ruben Segura-Cayuela, Europe Economist at Bank of America.

The Euro could find itself better supported as markets cool their expectations regarding the ECB and push back rate cut expectations on Thursday.

Economists at Commerzbank - the German lender and investment bank - say the ECB "will endeavour to limit market expectations of faster interest rate cuts" as inflation will only fall to the 2.0% target in 2025.

"Some reasons speak against rapid rate cuts," says Jörg Krämer, Chief Economist at Commerzbank. "The strong rise in wages continues to argue against a sustainable return of the inflation rate to the ECB's target in the near future."

It's A Big Data Week

This is an action-packed week regarding UK data, and the rule of thumb is that the Pound will likely rise if the actual figure comes in higher than the expected reading.

But we suspect the currency will experience a greater downside reaction to disappointments. This is simply because the Pound has risen strongly over the past two weeks, and the market has adjusted to a run of recent upside surprises in the data.

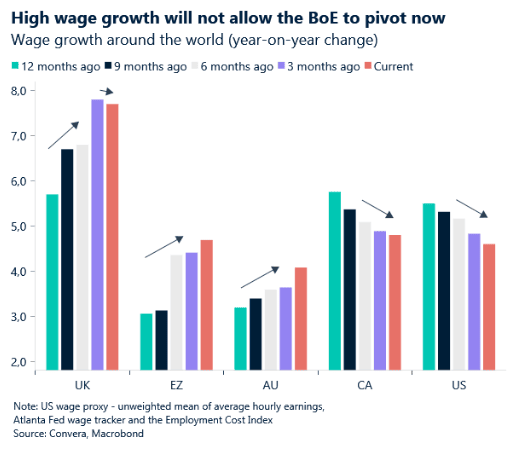

Tuesday sees the release of wage data, with average earnings (total pay) expected by the market to come in at 7.5% for October, down from 7.9% previously.

Average earnings (regular pay) are expected at 7.4%, down from 7.7% in September.

Track GBPEUR with your own custom rate alerts. Set Up Here.

Wednesday sees the release of UK GDP figures for October, where the consensus sees a figure of 0.2% month-on-month in October, up from -0.1% in September.

The rolling three month rate is expected at 0.3%, up from 0.1%.

Thursday sees the Bank of England interest rate decision and guidance update, please see below for more details on what to expect.

The week is rounded off with the S&P Global PMI release for December, which falls a week earlier than usual due to the impending Christmas holiday.

Manufacturing is expected to read at 47.5, services at 51.2 and the composite at 51.

The Bank of England: The Battle Continues

Above: File image of Governor Andrew Bailey. Photo by Zara Farrar / HM Treasury.

No rate change is expected, but the currency market reaction will rest on the tone of the guidance, particularly regarding the issue of potential rate cuts.

The Bank of England has been a source of support for Pound Sterling of late, as most policymakers have made it clear they are uncomfortable with the market raising expectations for interest rate cuts in 2024.

Heightened expectations for cuts act on real-time bond yields and thus lending rates, thereby easing financial conditions and risking the Bank's efforts in bringing inflation down.

"Markets are pricing three rate cuts in 2024 and we doubt the Bank will be too happy about that. Expect policymakers to reiterate that rates need to stay restrictive for some time," says James Smith, Developed Markets Economist at ING Bank.

Image courtesy of Convera.

ING says to expect some "hawkish forward guidance", including the line on keeping rates restrictive for a prolonged period of time.

"To prevent financial conditions loosening further and to send a signal ahead of the new year pay round, the committee will likely double down on its 'high for longer' message," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

But could the Bank be tempted to go further and formally say that markets have got it wrong in expecting three rate cuts?

If the Bank opts to do so via more strident wording in the statement, the Pound could advance.

"In terms of the risk to sterling market interest rates and the currency from the December BoE meeting, we tend to think it is too early for the Bank of England to condone easing expectations," says Chris Turner, Global Head of Markets at ING.

"This could mean that EUR/GBP continues to trade on the weak side into year-end - probably in the 0.8500-0.8600 range," says Turner.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes