GBP/EUR Rate: A Rally Too Far? Asks Deutsche Bank

- Written by: Gary Howes

- GBPEUR is trading well above rate spreads

- Draws questions on rally's sustainability

- GBPEUR also testing bottom of major resistance zone

- But Indeed jobs data points to a 'tight' labour market

- This can sustain GBP over the coming weeks

Image © Adobe Images

Pound Sterling's recent rally against the Euro is impressive by 2023's standards, but a new analysis shows the exchange rate has dislocated from a key driver that could place a ceiling on how further it can extend.

Deutsche Bank strategist Shreyas Gopal says the Pound's recent rise against the Euro has left the UK-Eurozone rate spread behind, raising questions about the exchange rate's sustainability at current levels.

The Pound to Euro exchange rate (the inverse of EURGBP) has risen by 2.20% since November 20, which amounts to an unusually strong rally for a pair that has tended to trend gently within the confines of a well-defined range over the recent months.

Gopal notes that the Pound appears to have benefited from a number of positive UK data surprises, marking a sharp contrast with the Eurozone. "The FX market has reacted accordingly, with last week seeing the biggest weekly fall in EURGBP this year," says Gopal.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But, Gopal raises a concern that those looking for a stronger Pound should heed.

Since last autumn, the pound has generally held a very tight relationship with real rate differentials against the euro, notes the Deutsche Bank analyst.

Interest rate differentials explain the difference between the yield of UK and Eurozone bonds. Typically, short-term bonds of two years duration are compared, with the German bund often used to represent the broader Eurozone.

When the spread widens in favour of the Pound, the Pound to Euro rate can be expected to rise.

"What's a little surprising therefore, is that the latest repricing in (real) rate space has not been as large as would have been implied by the currency," says Gopal.

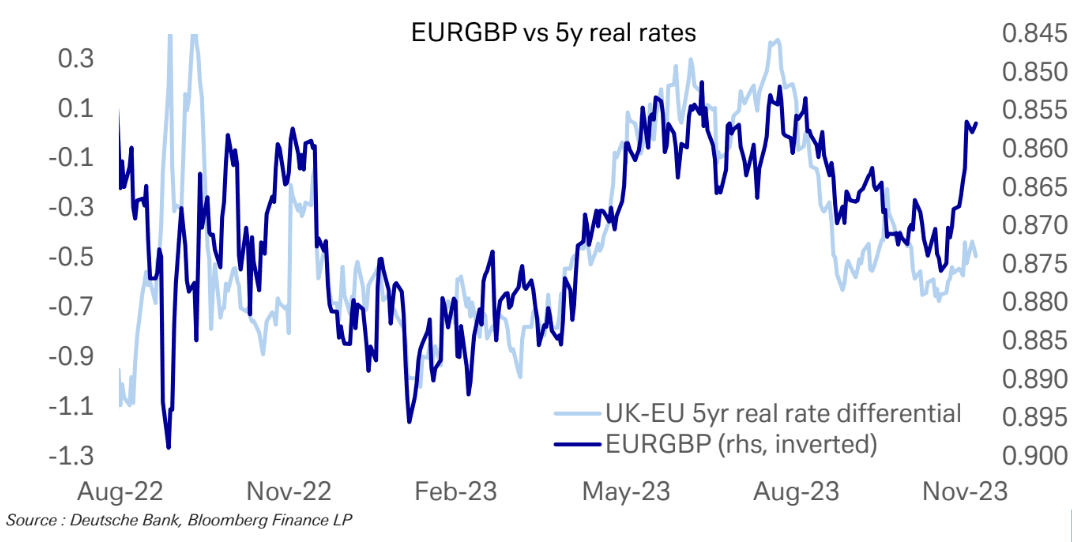

Above: "First notable gap between UK real rates and the currency this year" - Deutsche Bank.

"This has led to the first notable FX-rates divergence of the year opening up," says Gopal, referencing the above chart.

The analyst also notes a similar, albeit slightly less pronounced gap, is also evident when looking at relative central bank pricing out to the end of next year.

What does this mean for the Pound's rally against the Euro?

"If rate differentials fail to catch up to FX, this could place a floor on how far the recent fall in EURGBP can extend," warns Gopal (limit to how high GBPEUR can go).

The Pound-Euro is meanwhile rising into a notable technical resistance area which can only add to the sense the rally might have limited potential from here on.

Track GBP with your own custom rate alerts. Set Up Here.

The above chart shows the Pound-Euro is approaching a zone it has struggled to hold through 2023, which helps build a case against expecting any major gains from here.

Although the upside is likely to become more difficult to achieve, Pound Sterling can remain supported by ongoing UK economic resilience, something Gopal references earlier in this article (positive economic surprises are a potent driver of currency strength).

Indeed, the world's biggest job site, said on Thursday the UK labour market remains 'tight', which suggests upcoming job and wage figures should underpin the Bank of England's desire to maintain rates at 5.25% for an extended period.

2024 is about which central banks cut sooner and harder; if the Bank of England hesitates to cut, the Pound can stay supported.

Indeed said, although job postings over the course of 2023 have fallen, there are still 10% more job postings at the start of December than before the Covid-19 pandemic.

Although this is down from the 48% recorded at the start of December 2022, Indeed says it suggests ongoing resilience, with the imbalance of labour demand and supply only gradually easing.

"The labour market is a key variable in the Bank of England’s inflation judgement. Wage growth in particular is considered a critical component to the notoriously more sticky services inflation," says a note from KBC Bank, regarding the job data.

Indeed also said salaries in the UK were 7% higher in the three months to the end of October, compared to 4.2% in the U.S. and 3.8% in the Eurozone.

The data underpins a market expectation that the Bank of England will cut rates after the ECB and U.S. Fed, which is supportive of the Pound's outlook over the coming months.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes