GBP/EUR Week Ahead Forecast: Flipping Positive, Eurozone CPI In Focus

- Written by: Gary Howes

- GBPEUR entering a new uptrend

- Watch for a break of 200 day MA

- Eurozone inflation is week's key event

Image © Adobe Images

The Pound to Euro exchange rate last week recorded its largest weekly gain since August and could be entering a new uptrend in a week that will be dominated by the release of Eurozone inflation data.

Pound Sterling rose by one per cent last week, helped by some better-than-expected UK economic survey data that suggested the UK economy grew again in November, while the pro-growth budget announced by Chancellor Jeremy Hunt improves the UK's economic prospects.

The UK November PMI survey signalled a return to economic growth for the first time in four months, while GfK consumer confidence posted the biggest rise since April. "Sterling was also lifted by the news as it rose against both the euro and the US dollar," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

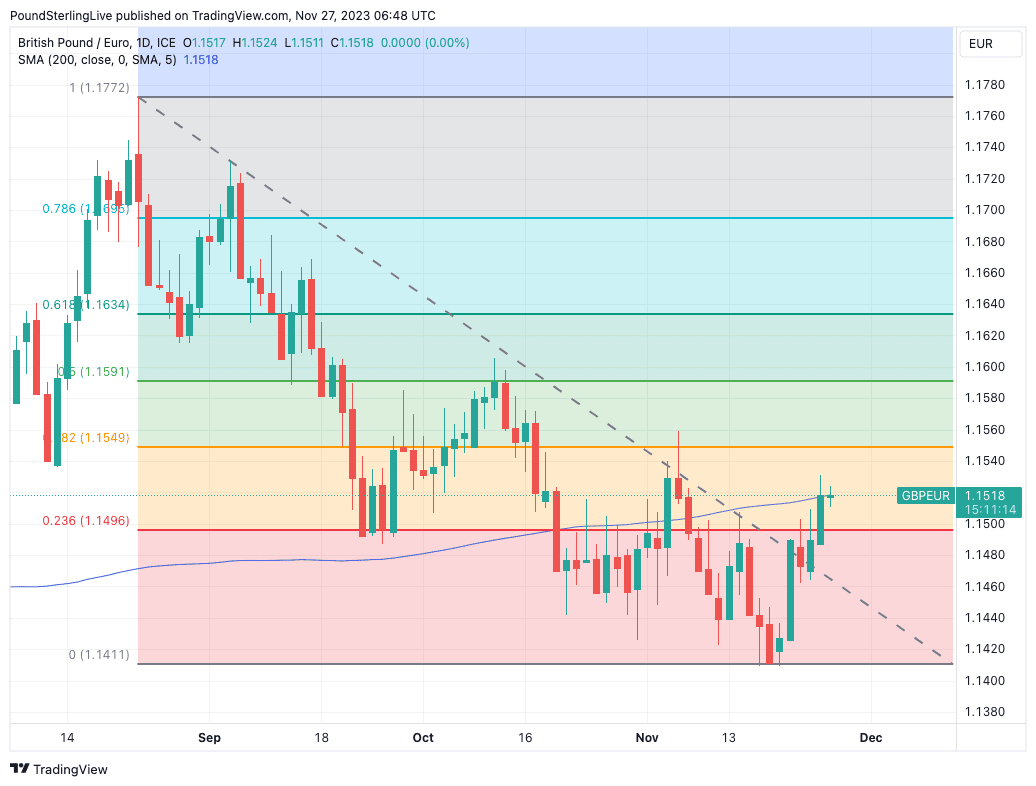

Pound-Euro has now risen to meet the 200-day moving average at 1.1518, and we look for a break above this line to signal a flip in trend from negative to positive:

Above: GBPEUR at daily intervals with technical indicators. Track GBPEUR with your own custom rate alerts. Set Up Here.

"GBP also outperforming vs. EUR with EUR/GBP down to 0.8684 where we have the 50dma/200dma convergence area. A break of 0.8680 opens some more downside there," says W. Brad Bechtel

Global Head of FX at Jefferies.

Although Bechtel is looking at the inverse exchange rate, the key technical message is the same: the breach of the 200-day moving average signals a potential extension of gains by Pound Sterling.

Further gains can extend to just below the 38.2% Fibonacci retracement level of the August-November sell-off, which is at 1.1550.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

There are no market-moving events in the UK calendar this week, apart from some speeches by members of the Bank of England, which leaves Pound Sterling counting on a benign global backdrop to further its gains.

Should global stock markets continue rising, the Pound can benefit against both the Euro and Dollar as it tends to be supported by positive market sentiment.

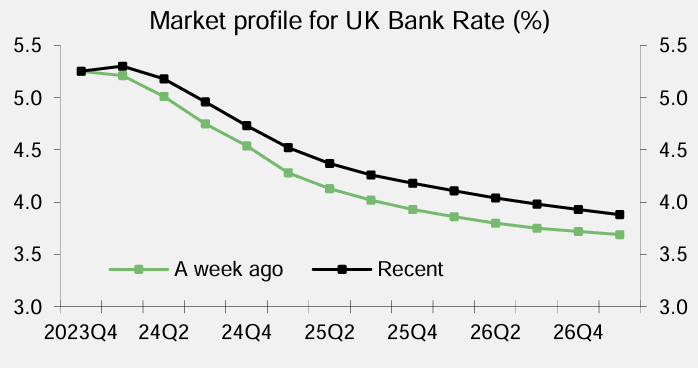

What has changed in the last week is that UK government bond yields have picked up as markets anticipate less by way of interest rate cuts at the Bank of England in 2024 than had been the case just seven days ago.

"UK government bond yields rose sharply... in contrast with more moderate changes in their US and European counterparts. Markets pushed back the expected date for a first Bank of England interest rate cut to later in 2024 in the wake of stronger-than-expected PMI business and GfK consumer survey data and the Autumn Statement," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

Above: UK rate expectations have risen, aiding the Pound. Image courtesy of Lloyds Bank.

With this in mind, watch speeches by Bank of England Governor Andrew Bailey, David Ramsden, Jonathan Haskel, Andrew Hauser and Megan Greene.

"Given that the latest UK data has come in largely in line with the BoE expectations, we believe that the MPC members will continue to push back against the market rate cut expectations," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

In the Eurozone, the European Central Bank President Christine Lagarde testifies to the European Parliament’s Economic and Monetary Affairs Committee on Monday, which could attract some attention in financial circles.

However, we expect her to maintain a line that it is too soon to talk about interest rate cuts at the ECB.

The most important data release is Eurozone flash CPI inflation for November, due Thursday and expected to show further falls in the headline and core measures to 2.8% and 3.9%, respectively.

Should the data beat expectations, expect the market to reverse some of its bets for ECB rate cuts, which have grown of late and would boost the Euro.

But the Eurozone's CPI reporting cycle begins a day before with the release of German state-level figures, which have often set the tone for the market.

Spain, often considered a leading indicator for broader Eurozone inflation trends, also releases figures on Wednesday, which means FX action could commence midweek.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes