Pound Sterling's Ceiling vs. Euro Reinforced by Bank of England's Bailey

- Written by: Gary Howes

Image: Pound Sterling Live, Parliament TV

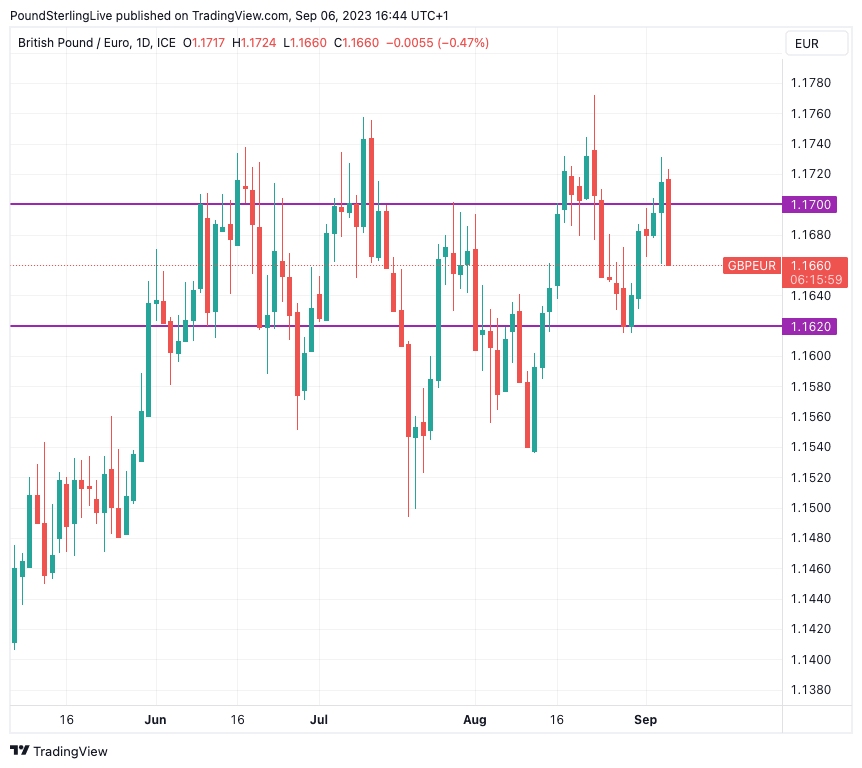

The Pound to Euro exchange rate was once again unable to maintain levels above 1.17 on a sustained basis following comments from the Bank of England that interest rates were close to a peak in developments that underscore Pound Sterling's inability to make a decisive break higher.

Governor of the Bank of England Andrew Bailey told lawmakers in Britain's parliament that rates would not rise much further and that inflation was set to come down markedly over the coming months, prompting a retreat in interest rate expectations.

The commentary fulfilled a technical rejection of Pound-Euro's recent advance in the area around 1.1740 and in the process reinforced a hard ceiling for the exchange rate that looks unlikely to break anytime soon.

"Bailey is confident that the disinflation process will continue. Sterling underperforms," says Mathias Van der Jeugt, an analyst at KBC Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The failure at €1.1732 and subsequent retreat now opens the door to a pullback to the 1.1620 level which has been identified as an interim source of support for the exchange rate.

Appearing before members of Parliament, Bailey said the Bank of England was "much nearer now to the top of the cycle", which meant he believed the peak in interest rates was close.

"I'm not saying we’re at the top because we’ve got a meeting to come, but I think we are much nearer to it on interest rates on the basis of the current evidence," he said.

Above: Daily chart showing forays above 1.17 in GBPEUR don't tend to stick in the current environment.

The call reaffirms market expectations that another 25 basis point interest rate hike in September could prove to be the final hike of the current cycle.

Pound Sterling was struggling ahead of Bailey's appearance before Parliament's Treasury Select Committee and his observations triggered renewed selling.

Bailey said he expects a marked fall in inflation from here. "The fall in inflation will continue... and I think will be quite marked by the end of this year."

The market entered the testimony by Bailey and Monetary Policy Colleagues expecting 50 basis points worth of interest rate hikes before the end of the year. But the comments will draw doubts on whether a November rate hike will follow that of September, which remains a sure bet amongst market participants.

To be sure Bailey was clear that the job was not yet done and committed to raising rates further if needed. This is textbook central bank communication that seeks to ensure markets do not bring forward their expectations for the commencement of the rate-cutting cycle.

Such a development would be counterproductive for a central bank that is still fighting the highest inflation rates in the developed world.

Indeed, the Bank of England looks set to remain one of the more 'hawkish' central banks owing to the persistence of inflation in the UK, which should limit any potential downside pressures in the Pound.

"We expect sticky inflation will delay the first rate cut until the summer of 2024, months later than the Fed and ECB," says Andrew Goodwin, Chief UK Economist at Oxford Economics. "High wage growth means that the Bank of England is likely to maintain a restrictive monetary policy stance."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes