Euro Sellers Should Lock in These Levels: Citi

- Written by: Gary Howes

Image © BruceG1001 @ Flickr, reproduced under CC licensing.

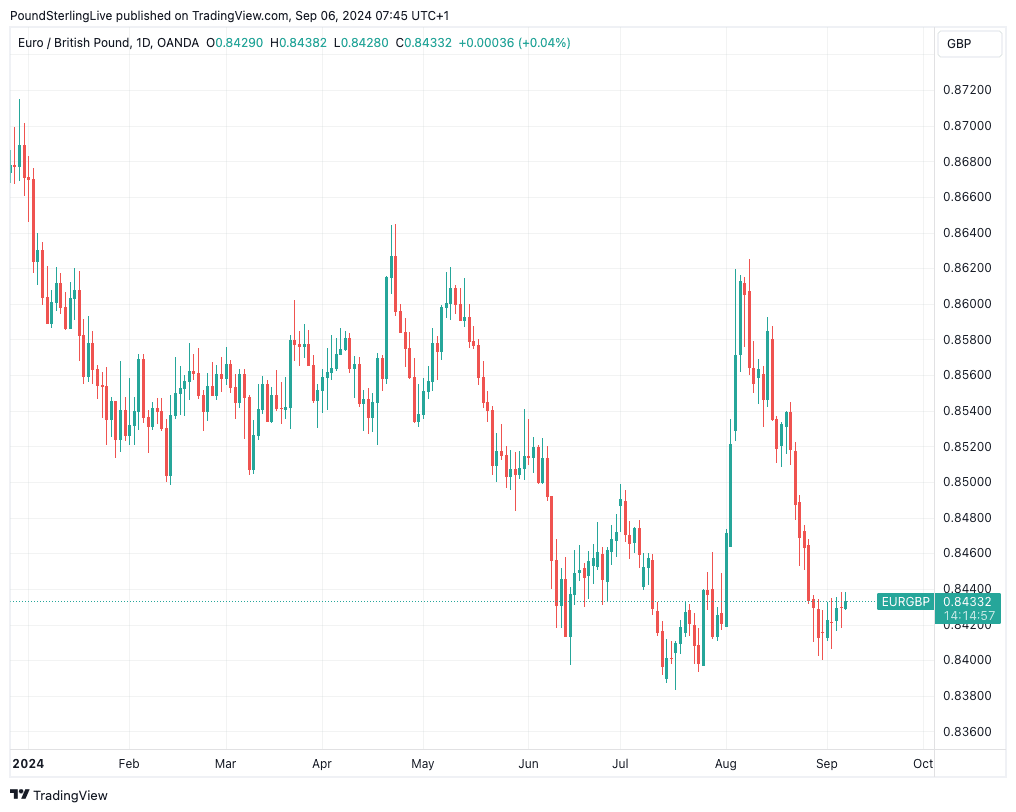

For those selling euros and buying pounds, Citibank's currency trading desk has some advice, telling its clients to lock in the recent gains in EUR/GBP and "anticipates a gradual move lower."

"Recent economic developments (UK robust performance vs German slowdown) should continue to indicate downside," says a note from Citi, released Thursday.

That said, traders at the bank acknowledge much of this negative outlook is already priced and for a more significant move lower, be on the lookout for a close below 0.8383.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A break below 0.8383 would open up further downside towards support in the 0.8200-0.8250 range," says Citi. For those watching Pound-Euro, this equates to a move higher to 1.21-1.22.

The Euro to Pound exchange rate spiked higher to 0.86200 in early August amidst a global equity market selloff and following a Bank of England rate cut.

Above: EUR/GBP at daily intervals.

The strength of the move suggested Pound Sterling's solid run against the Euro might have ended. But the UK currency then staged a strong recovery over the remainder of the month, returning the market back to pre-Bank of England levels.

But stability above the key 0.84 mark confirms this is acting as a significant source of support that can frustrate EUR/GBP sellers.