EUR/USD Bull Trend Still Intact

- Written by: Sam Coventry

Image © Adobe Images

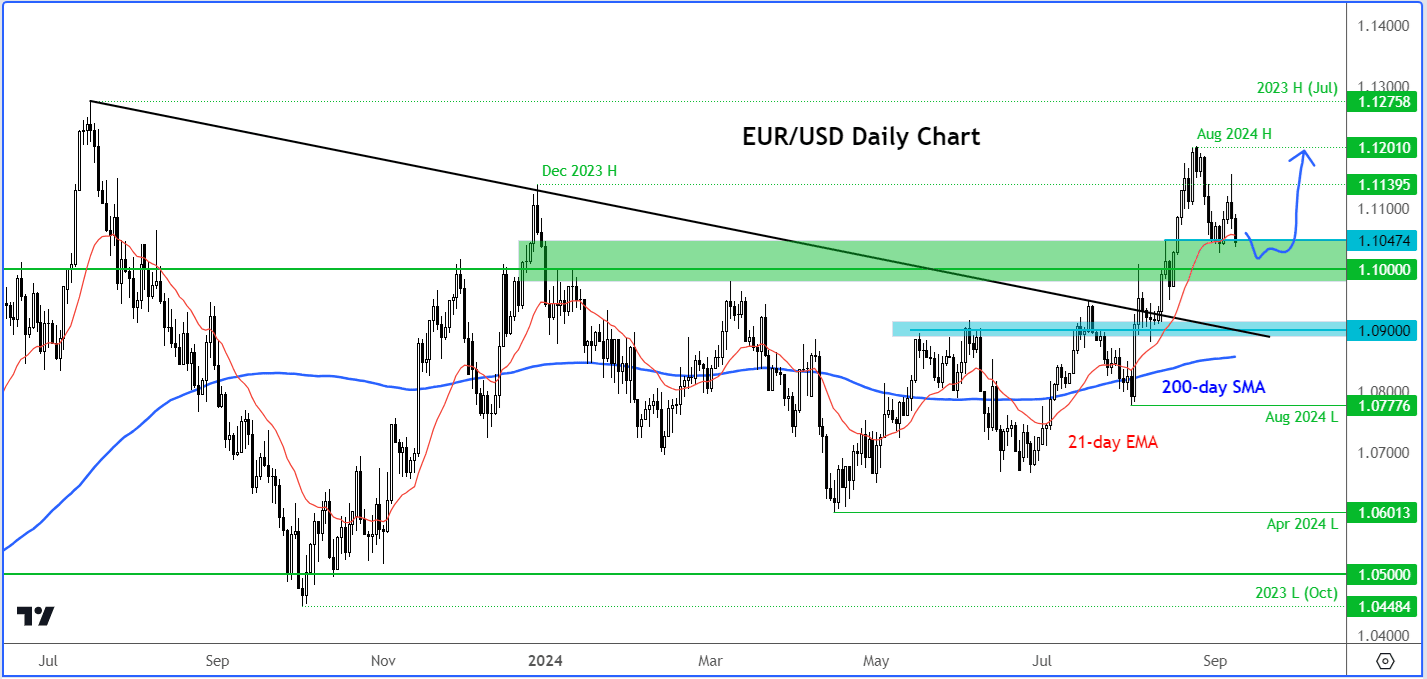

Euro-Dollar hasn't created a bearish reversal pattern to suggest that bullish trend has ended, according to a new analysis.

"The loss of bullish momentum means the EUR/USD is not looking as rosy as it did towards the end of August," says Fawad Razaqzada, a technical analyst with City Index. "However, it hasn’t yet created a bearish reversal pattern to suggest that bullish trend has ended."

The Euro is down 0.38% on Monday at 1.1039, meaning it has erased all of the prior week's advance in just one day. It peaked at 1.12 in late August.

"Since hitting a low in April, the EUR/USD has been forming a series of higher lows and highs, with the 200-day moving average starting to slope upward. The pair has also broken through several resistance levels and bearish trend lines, indicating that the path of least resistance has been bullish," says Razaqzada.

He explains that unless we see a significant reversal pattern or a breakdown in the market structure of higher lows, neither of which has occurred yet, the EUR/USD is still arguably inside a larger bullish trend.

"Therefore, the technical outlook for EUR/USD is far from bearish yet," he adds.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The City Index analyst says the key support area for EUR/USD is now between 1.1000 and 1.1045, an area that previously acted as resistance.

He also points out that 21-day exponential moving average is also just above this zone. Traders are watching for a bullish price candle to form here this week, to potentially signal a continuation of the uptrend.

"If this doesn’t materialise—perhaps due to unexpectedly strong US CPI data or a dovish ECB —it could lead to a deeper pullback towards the next support level around 1.09," says Razaqzada.

On the resistance side, he says potential levels are seen at 1.1100 and 1.1140, with the August high of 1.1200 serving as the next major target for the bulls if those levels are breached.