GBP/EUR: Eurozone's Growth Headache Prompts Rebound Towards Key Resistance Level

- Written by: Gary Howes

Image © Adobe Stock

The strong rebound by Pound Sterling against the Euro over recent hours confirms a view that the UK currency might remain in touching distance with its 2023 highs over the near future.

The Euro was sold widely after a raft of downward revisions to Eurozone economic activity data for August proved more severe than the market was expecting, spooking investors and boosting expectations that the European Central Bank (ECB) would hold interest rates unchanged in September.

By contrast, UK economic activity data beat expectations, offering the British Pound an edge over its European counterpart on a day both currencies were coming under pressure against the safe-haven U.S. Dollar which extends a winning streak.

Having dipped to 1.1657 on Tuesday, the Pound to Euro exchange rate rebounded to above 1.17 amidst the broader pullback in the Euro complex that followed news S&P Global revised its composite PMI reading for the Eurozone to 46.7 from 48.6.

This outcome undershot the consensus expectation for 47 and suggests the Eurozone economy had fallen into contraction mode in August.

"Mounting signs of a slowing euro zone economy continue to take a toll on the euro," says Joe Manimbo, Senior Currency Analyst at Convera.

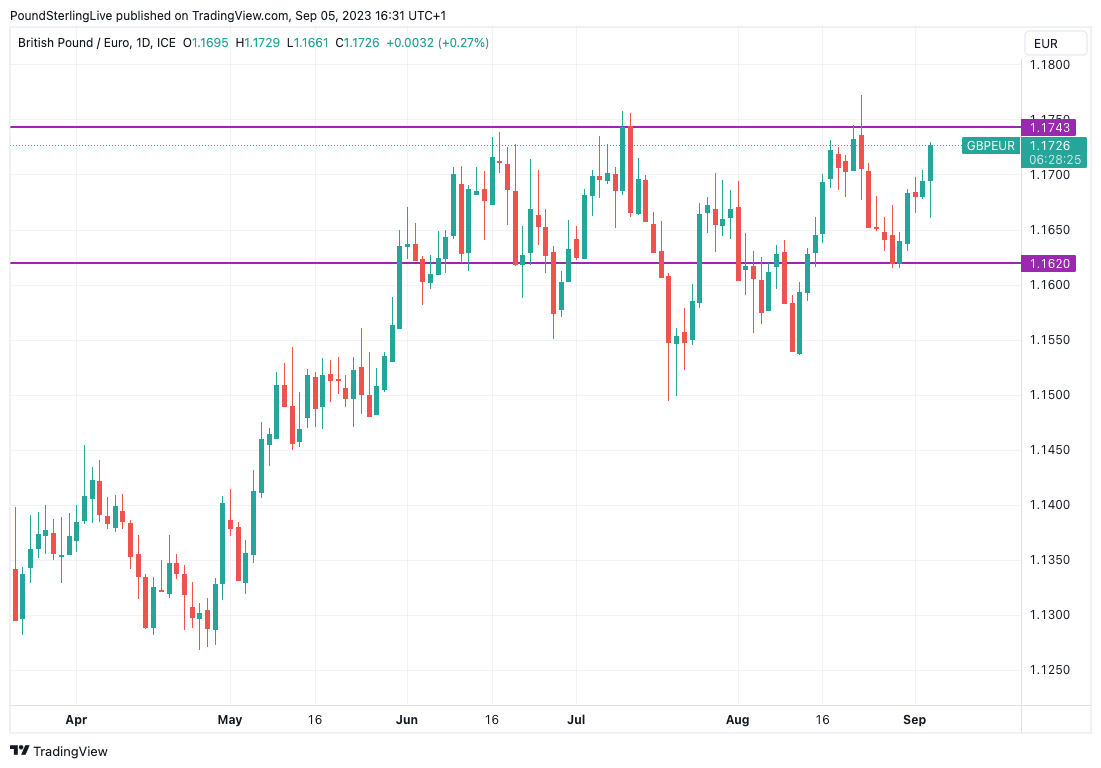

Above: GBPEUR is looking to the 2023 'ceiling' area. It tends to revert from here. But a break above it could reboot the 2023 uptrend.

Germany's composite PMI was revised lower to 44.6 from 48.5 previously (vs. 44.7 expected), a significant downgrade that would imply the economy is deep within recessionary territory. For France, the downgrade was from 46.6 to 46 (46.6 expected).

"The news on growth in the Eurozone is not good and just seems to be getting worse," says Brad Bechtel, Head of FX Strategy at Jefferies.

The UK also saw its composite PMI revised lower into contraction territory to 48.6, but crucially this was above expectations for a print of 47.9.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Bechtel says the Euro will remain on the back foot until the Eurozone's growth problem resolves, something that he says is not likely for several months.

"We have been gearing up for a big down move in EUR/USD this fall and right now the table is set for that very thing," he says.

How EUR/GBP evolves will depend on whether the fall in EUR/USD exceeds that of GBP/USD, a possibility should the UK's growth prove more resilient than that of the Eurozone.

Near-term, the Pound-Euro exchange rate is forecast to remain supported above 1.16 after the late-August pullback ran out of steam at around 1.1620 and the subsequent rebound opens the door to another test of the 2023 highs.

This rebound will have found some sustenance from the reversal seen on Tuesday that followed the release of the final PMI figures.

More broadly, price action in GBPEUR remains characteristically choppy, albeit within a relatively well-defined range that allows for a relative degree of confidence in planning upcoming payments.

To the upside, the 1.1772 level is in reach again, although the pair has not closed above 1.1743 in 2023 which serves as a reminder that there is significant resistance in this area that tends to ultimately result in Pound Sterling capitulation and pullbacks in the exchange rate below 1.17.

As mentioned in the annotations to the above chart, a breach and close above this high-water mark could send a strong hint that Pound Sterling is in the process of rebooting its 2023 uptrend and fresh highs could be on the cards.

To the downside, the daily close above 1.1620 last week, followed by Thursday's strong uptick (+0.37%) to 1.1683, suggests this to be an interim level of support that will be an important downside marker over the coming days.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes