Euro-Dollar Held Aloft by "Huge" Option Hedging

- Written by: Sam Coventry

Image © Adobe Images

The Euro is being held aloft against the Dollar and other currencies amidst significant demand from traders to hedge against options bets that are about to expire.

This is according to an analysis of the options market by Richard Pace, a Reuters market analyst.

Pace explains that soon-to-expire FX option strikes often attract the most cash hedging flows. The strike is the level that traders and investors are targetting when they take out an option in the foreign exchange markets.

If Euro-Dollar reaches the strike level, the traders are in the money. But if it is clear the strike won't be reached, the trader might try to minimise losses by buying or selling at spot exchange rate levels i.e. the exchange rate you typically see quoted on financial websites.

"These hedging flows tend to keep FX contained near the option strikes," says Pace.

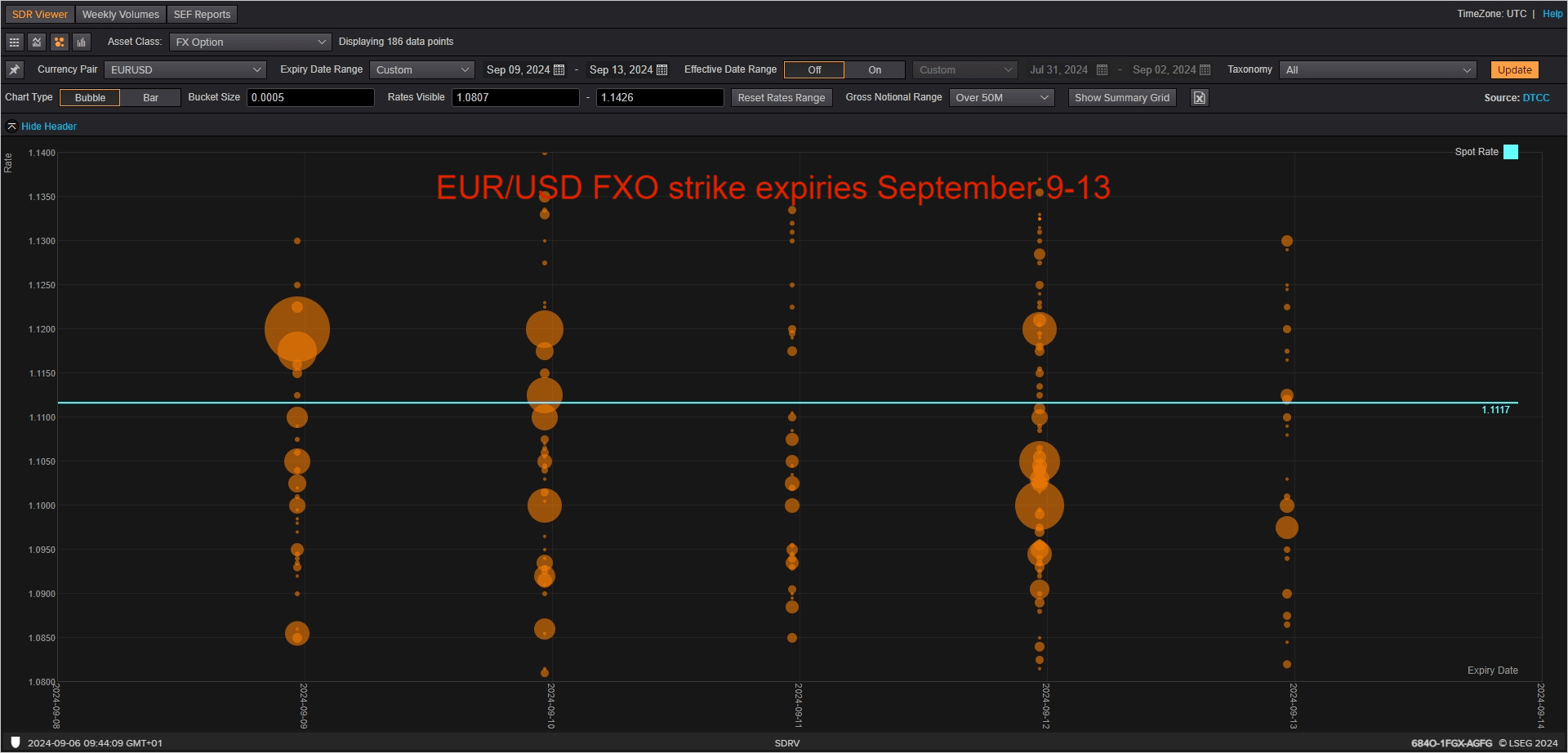

Image courtesy of Reuters.

Looking at the current setup, Pace says there are billions of euros of soon to expire EUR/USD option strikes near-by.

Drilling down, there were 2.4BN EUR strikes at 1.1050 that expired on Monday and there's 2BN at 1.1040-50 falling on Tuesday.

Thursday sees almost 5BN between 1.1045-55, "that's huge," says Pace.

FX volatility looks set to be becalmed this week, now that the U.S. jobs report is in the rear view mirror. Volatility markets show there is little volatility expected from Wednesday's U.S. inflation report and Thursday's ECB decision.

"If Thurs ECB fails to move EUR/USD, options should continue to dominate," says Pace.