Swiss Franc to Do Well, Despite 3 More SNB Rate Cuts

- Written by: Gary Howes

Image © Adobe Images

The Swiss Franc is forecasted to rise against the Pound, Euro and Dollar into year-end and through 2025 as Switzerland's yield disadvantage to the rest of the world fades and investors seek safe haven assets.

This is according to a research update from J. Safra Sarasin, a private Swiss bank. The currency is expected to outperform despite expectations for three further rate cuts from the Swiss National Bank in 2024 and follows a path that would typically be associated with currency underperformance.

"The Swiss National Bank is likely to ease policy faster than previously anticipated. We expect rate cuts in September, December and March as inflation is clearly falling too quickly," says Dr. Karsten Junius, Chief Economist at J. Safra Sarasin.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, further rate cuts from the SNB will arrive as other central banks cut their own rates, while an uncertain sentiment backdrop is tipped to underpin demand for the ultimate safe haven currency.

"While a near-term dip is possible, we expect the Swiss franc to be supported by a highly uncertain global macro outlook. A retracement in global yield levels should similarly help the currency, while also providing a hedge against geopolitical uncertainty," says Dr. Claudio Wewel FX Strategist at the bank.

"The Swiss franc should continue to do well," he adds.

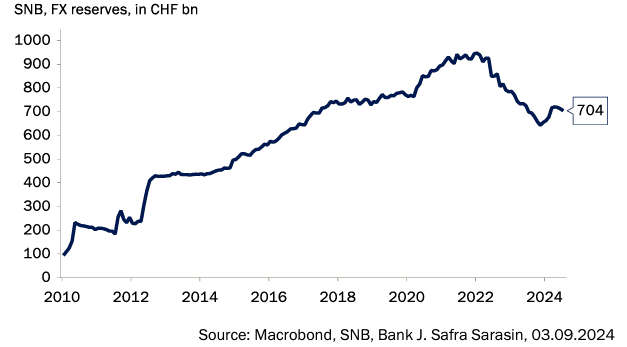

In terms of FX market intervention by the central bank, research suggests CHF's real exchange rate is roughly at its long-term average, meaning the prospect of intervention from the SNB in the currency market is limited.

"The SNB is fairly comfortable with its currency’s current valuation. In the absence of an SNB intervention, we think there is further upside for the Swiss franc into the coming year," says Junius.

However, he concedes that the issue of intervention could arise next year once the SNB is getting closer to the zero lower bound of interest rates.

J. Safra Sarasin holds a Pound to Franc forecast of 1.13 for end-2024, 1.11 for the end of Q1 2025, 1.09 for the end of Q2 and 1.06 for the end of 2025.

For the Euro to Franc exchange rate the forecast at these points is 0.94, 0.94, 0.93 and 0.92.

For the Dollar to Franc rate, the points to watch are 0.87, 0.86, 0.85 and 0.82.