Euro Rises Against Dollar and Pound Despite Surge in Gas Prices: RBC and CBA Analysts Explain Why

- Written by: Gary Howes

Image © Adobe Images

Euro exchange rates are proving resilient in the face of a sudden increase in the price of European gas prices with some analysts saying the episode "is being over-played".

Global gas prices spiked after news that key Australian liquified natural gas (LNG) facilities might be shut down over a dispute between workers and owners at Woodside and Chevron.

The developments serve as a reminder of the fragility of the global gas market which went parabolic in 2022 following Russia's invasion of Ukraine and resulted in a sharp slump in Eurozone activity and the Euro.

The potential Australian shutdown would come as traders expect solid demand from Japan to keep prices bid as it seeks to fill storage facilities, currently filled to below the five-year average for this time of year, ahead of the winter.

This all has a knock-on effect for Europe which now relies heavily on LNG cargoes in the absence of Russian pipeline supplies.

Yet, despite the gas price rise, the Euro has actually risen against the Dollar and Pound: the Euro to Dollar exchange rate is currently back above 1.10 and the Euro to Pound rate is above 0.8630.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"So far EUR/USD has shrugged off yesterday’s surge in European gas futures prices. The lift in European gas futures primarily reflects concerns over gas supply. Europe is likely to weather tighter gas supply reasonably well with Europe’s gas storage levels well above their five‑year average for this time of year," says Kristina Clifton, a foreign exchange strategist at Commonwealth Bank of Australia.

"The rise in natural gas prices in the last two days is being widely reported as a negative for the Eurozone. It is, but needs to be kept in context," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

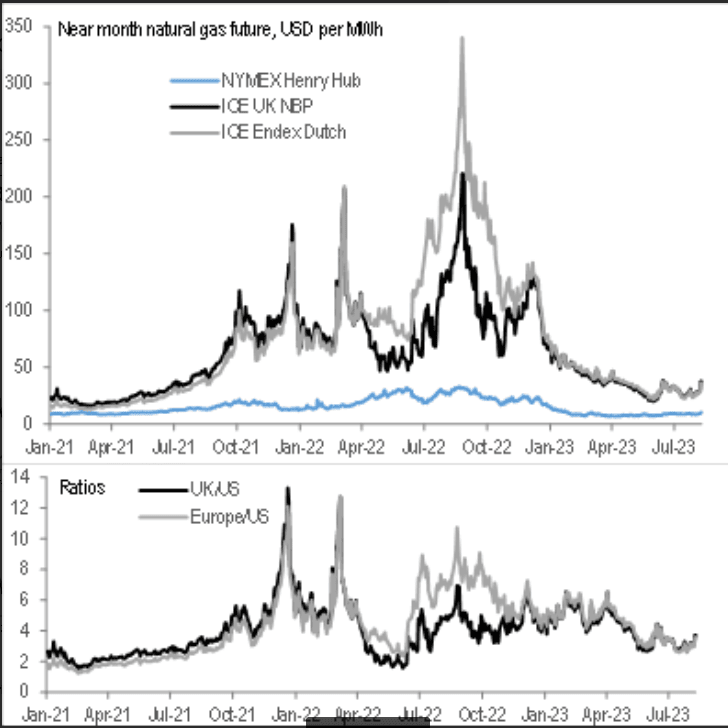

The analyst presents the following chart which shows the near-month natural gas futures for delivery in the U.S. (blue), Europe (grey) and UK (black), converted into common units (MWh) and a common currency (USD):

Image courtesy of RBC Capital Markets.

The lower panel is the ratio of European and UK prices to US prices – ie a measure of the premium carried by European prices.

"The cause of yesterday’s spike (potential disruption to Australian LNG supply by strikes) is affecting prices globally, with the price of gas for delivery in the US also jumping, albeit by less than Europe," says Cole.

The Henry Hub natural gas price - the U.S. benchmark - jumped around 10%.

The premium for European delivery did increase yesterday, but the ratio (3.7x US delivery) is still around lows for the last year and far from the 12x seen at last year’s peak, observes Cole.

"There are good medium-term reasons to be negative on EUR/USD," says Cole, "but the rise in nat gas prices in the last couple of days is being over-played."

CBA's Clifton says Europe has been able to mitigate the impact of lower Russian gas pipeline imports this year by increasing LNG imports and reducing gas use.

"At this stage we don’t expect to see a repeat of last year, where EUR/USD fell below parity because of concerns around gas supply ahead of winter," she says.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes