Natural Gas Price Jump: What Happened and Will Prices Fall Again?

- Written by: Gary Howes

Image © Adobe Images

European natural gas prices surged by as much as 40% on Wednesday, before closing the day 27% higher, in a move that reignited fears of another potential gas-driven inflationary crisis for European households and industry.

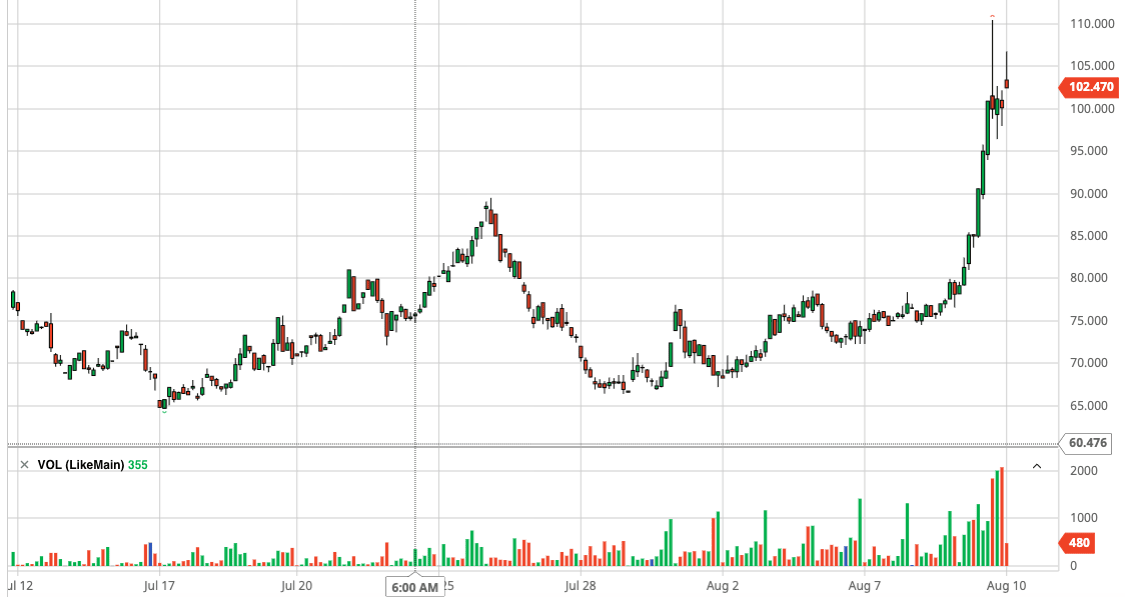

The spike in European TTF benchmark prices to ~40 EUR/Mwh at the time of writing meant UK wholesale prices also surged to 100 GBP/Therm, thanks to the interconnectivity of these two gas markets.

What caused the rise in gas prices and, importantly, are they likely to last?

The cause of the gas price rise appears to be news that Australian gas plant workers could soon go on strike, at a time when Japan's gas storage levels are unseasonally low.

This is a big deal given the impacted sector accounts for as much as 12% of global Liquified Natural Gas (LNG) cargoes.

"North West Shelf, Pluto, Gorgon and Wheatstone LNG plants accounted for ~12% of global LNG exports last year according to ship‑tracking data. With the northern winter season (1 October 2023 to 31 March 2024) fast approaching, any sustained outage at these facilities threatens to meaningfully tighten traded gas markets," says Vivek Dhar, an analyst at Commonwealth Bank of Australia.

Above: UK wholesale gas for month-ahead delivery.

"The scale of LNG volumes at risk is significant," says Samantha Dart, an economist at Goldman Sachs. "Price implications of such strikes going ahead would be relevant across the curve. For the balance of summer, we believe TTF would move out of coal-to-gas (C2G) substitution economics to at least 50 EUR/MWh to incentivize a reduction in gas burns."

Workers at Woodside Energy Group and Chevron's LNG facilities in Australia voted to strike on Wednesday, Australian media reported.

About 99% of 180 production employees at Woodside’s facilities voted for action, including indefinite strikes, and they shall be soon joined by hundreds of other employees at Chevron’s facilities, Australia's Financial Review newspaper reported.

Unions representing workers at Chevron’s Wheatstone and Gorgon LNG facilities have filed for a protected action ballot for plant workers on Tuesday.

Dhar says if the outcome mirrors Woodside’s result, LNG production at Chevron’s LNG facilities could be disrupted soon too.

He points out that industrial action at Shell’s Prelude Floating LNG facility lasted 76 days last year and gas markets are justifiably worried over industrial action at LNG facilities.

But Dhar also points out that it's not just Australia that is driving supply concerns.

Peru LNG (~0.8% of global LNG exports in 2022) doesn’t appear to have loaded a cargo since 25 July. U.S. LNG facility Corpus Christi (~4% of global LNG exports in 2022) is running 15% below its average utilisation rate.

"Some demand side factors have also pointed to a tighter market. Japan’s LNG stockpiles are currently 7% below the 5‑year average," says Dhar. Japan accounted for about 18% of global LNG imports last year.

Will these price spikes last? Of course, much depends on the industrial action underway in Australia and how this is resolved. For now, the strikes can yet be resolved between management and workers and any good news on this front would potentially see the recent rally reverse.

Another reason the spike might fail to sustain is because Europe's gas storage is well above five-year averages, even as gas is being shipped to empty facilities in Ukraine as utility suppliers look for additional storage.

"Europe’s gas stockpiles will ultimately determine how shortage fears materialise in coming months. Europe’s gas storage levels were 87% of capacity at 6 August," says Dhar.

"The ample headroom means that Europe is most likely to enter the winter season with more than enough gas. Europe has been able to mitigate the impact of lower Russian gas pipeline imports this year by increasing LNG imports and reducing gas use," he adds.

He notes too that Europe was in a much more vulnerable position last year with gas storage levels tracking in line with the 5‑year average (2017‑2021) and Russian gas pipeline imports were shifting even lower.

"We see little risk of prices returning to those highs, let alone above EUR 100/MWh, given how high Europe’s gas storage levels are tracking," says Dhar.

Analysts at Goldman Sachs recently slashed their European wholesale gas price forecasts noting that industrial demand for the product has not rebounded as fast as previously expected.

The Wall Street bank now forecasts prices of 48 EUR/MWh for winter 2023 and 45 EUR/MWh for summer 2024, down from 93/94 EUR previously.

This means the recent spike in prices to about ~40 EUR/MWh for month-ahead contracts brings the market close to the Goldman Sachs target levels.

Goldman Sachs expected both European domestic demand and Asia LNG imports to respond positively to lower gas prices year-on-year and to China's reopening to justify previously higher forecasts.

While demand is certainly underpinning recent moves the impact of a supply-side shock in the form of Australian industrial action serves as a reminder this market will be prone to high volatility that will have potentially negative implications for UK and European consumers and businesses.