Rise in Inflation Shouldn't Stop Bank of England Speeding Up Rate Cuts

- Written by: Sam Coventry

Image © Adobe Images

An economist at the Institute of Economic Affairs (IEA) says the Bank of England should step up the pace it cuts interest rates, despite inflation accelerating in October.

Julian Jessop, IEA Economics Fellow, says interest rates are too high in the UK and can continue bearing down on inflation if the Bank cuts them further.

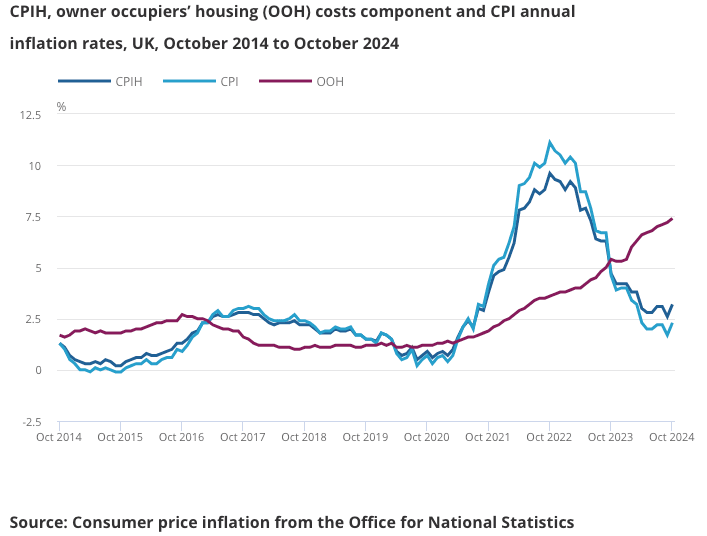

The call comes after it was reported UK inflation rose to 2.3% year-on-year in October from 1.7%, with core inflation climbing to 3.3% from 3.2% and services inflation rising to 5.0% from 4.9%.

"The increase in the ‘core’ measure was largely due to higher airfares – an erratic component which the Monetary Policy Committee should look through," says Jessop.

The Bank of England targets a 2.0% inflation level and has said it will cut interest rates further, as it anticipates inflation will fall back to the target over the next two years.

However, it recently raised its inflation forecasts in response to the government's budget, which saw a significant rise in job taxes, which could be inflationary.

"Today’s news will add to nervousness about the outlook for inflation in the first half of next year when the main impact of the increases in taxes and other business costs in the Budget will kick in," says Jessop.

The Bank expects the Budget measures to lift inflation above 2.5%, taking it further away from the MPC's 2% target.

Jessop thinks this increase should only be temporary and may not materialise at all, particularly if the main impact of the Budget is actually to undermine confidence and growth.

He explains the current official interest rate of 4.75% is still higher than it needs to be to continue bearing down on inflation, especially when the full effects of past monetary tightening have yet to feed through.

"If anything, the Bank of England should step up the pace of easing. But at the very least, the MPC should stick to the current path of ‘gradual’ rate cuts," says Jessop.

Money market pricing shows investors currently anticipate just two more 25 basis point cuts from the Bank of England in 2025, which is less than one cut a quarter.

Following the inflation numbers, economists at Goldman Sachs say the market is underestimating the pace the Bank cuts rates and they still see one cut a quarter next year.