Job Cuts Deepen as Demand Weakens Shows UK PMI Report

- Written by: Gary Howes

Image © Adobe Images

The UK economy remained stagnant in February, as weak demand and rising costs led to the sharpest private sector job cuts since November 2020, a survey showed on Wednesday.

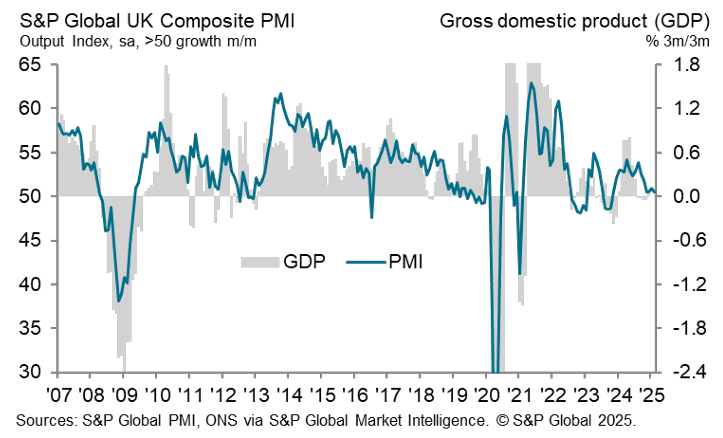

The S&P Global Flash UK Composite PMI fell slightly to 50.5 from 50.6 in January, indicating marginal growth for the second month running. However, business confidence remained fragile, and inflationary pressures intensified.

“The UK economy is struggling to gain momentum, with job losses mounting and demand faltering,” said Chris Williamson, chief business economist at S&P Global Market Intelligence, which compiles the report. “The lack of growth alongside rising price pressures presents a stagflationary dilemma for the Bank of England.”

The UK's largest sector, services, saw its PMI rise to 51.1 from 50.8, expanding at a modest pace, beating expectations for 50.8.

The Manufacturing PMI fell to 46.4, a 14-month low, signalling a deeper contraction.

New orders fell for the third month, marking the sharpest decline in 18 months.

Private sector employment fell at the fastest rate in over four years, with one in three firms linking layoffs to higher National Insurance and wage costs.

"The PMI employment index is now plumbing catastrophic depths," says Wood. "The employment balance is almost as weak as in Q4 2008, after Lehman’s bankruptcy."

However, Pantheon Macroeconomics says it has doubts that jobs are falling as fast as they were back in the financial crisis, citing official payrolls that are holding up much better than the PMI.

"The PMI signals a major risk to our optimistic growth outlook, but we suspect the qualitative nature of the survey - asking how many firms are cutting employment, rather than how much - is likely to exaggerate weakness after the payroll tax hikes," says Wood.

Businesses will have to pay more taxes on employee wages in April while increasing minimum wage payouts.

Input cost inflation hit a 21-month high, fueled by higher wages, energy bills, and supplier price hikes.

Selling prices surged, with manufacturers reporting the steepest factory gate inflation since April 2023.

While business confidence improved slightly, firms remain cautious amid rising costs and economic uncertainty.

"With inflationary pressures mounting and demand weakening, the Bank of England faces a difficult balancing act," Williamson added.

The UK’s economic stagnation, coupled with rising costs and job losses, raises concerns over further weakness in the months ahead.