Investment Intentions at 2019 Lows at UK's Battered Retailers

- Written by: Gary Howes

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons.

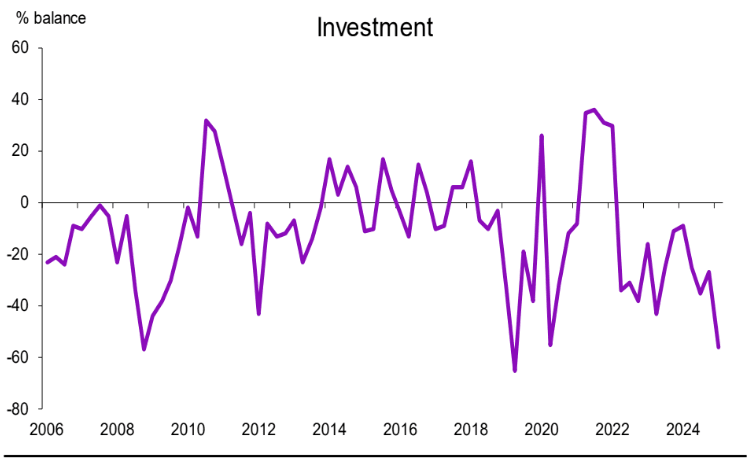

UK retailers are scaling back investment plans at the fastest rate since May 2019 as sales struggles persist and business sentiment worsens, according to the latest Confederation of British Industry (CBI) Distributive Trades Survey.

Retailers expect capital expenditure over the next 12 months to decline more sharply than in the past year, reflecting deteriorating confidence across the sector.

The CBI report stated, “Retailers expect to scale back on capital expenditure in the next 12 months (compared to the past 12 months) to the greatest extent since May 2019.”

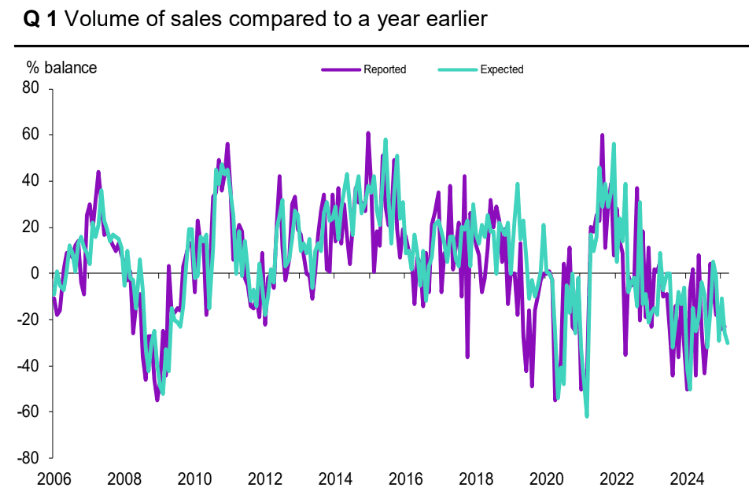

The retail downturn has now stretched into its fifth consecutive month, with year-on-year sales volumes falling at a rate similar to January.

“Retailers also judged February sales to be ‘poor’ for the time of year, to a greater extent than last month,” the CBI noted. Online sales also continued to contract, declining at a slightly faster pace.

Above: Retailers' investment intentions slump.

Looking ahead, the report highlighted that retailers “expect that annual retail sales will contract at a faster pace in March and continue to fall short of seasonal norms.”

Orders placed on suppliers were also cut back significantly in February and are expected to be reduced at an even steeper rate next month. “Orders are expected to be cut back at an accelerated rate in March, marking the weakest expectations since March 2021,” the CBI said.

The decline in retail sales has also weighed on employment, which fell at a moderate pace in the year to February. Retailers expect headcount reductions to continue at a similar rate next month.

Meanwhile, selling price inflation remained below its long-term average for the fourth consecutive quarter. The report stated, “Selling prices are expected to increase at an unchanged rate next month.”

The struggles extend beyond retail, with wholesalers reporting declining annual sales volumes, albeit at a more moderate pace. In contrast, the motor trade sector saw another sharp fall in sales, with traders expecting a “considerable” easing in the rate of decline next month.

Despite some signs of stabilization in certain areas, the CBI survey signals a challenging outlook for UK retailers. The combination of weaker sales, investment cutbacks, and declining employment suggests that the sector is bracing for further difficulties in the months ahead.