Pound Sterling Set for a Strong 2025 Against the Euro: Commerzbank

- Written by: Gary Howes

Image credit: Luke Hayter. Sourced: Flickr. Licensed under CC 2.0 conditions.

One of Germany's largest banks thinks the British Pound is set for another strong year against the Euro. However, a key risk is an economic slowdown following Rachel Reeves' budget.

"The Pound should remain well supported in 2025," says Michael Pfister, FX Analyst at Commerzbank.

He tips the Pound to Euro exchange rate (GBP/EUR) to steadily advance in value; however, against the Dollar, a flatter performance is expected.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

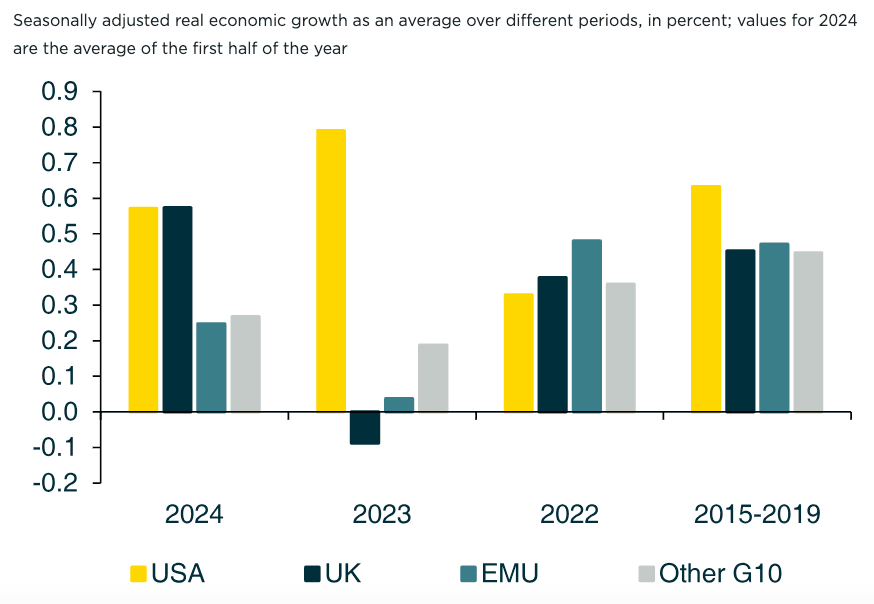

This is largely because the UK's economic growth and inflation rates are expected to be above those of the Eurozone but below those of the U.S.

"We expect the pound to remain strong next year. This is supported by the fact that underlying inflationary pressures are likely to remain somewhat higher than in the euro area," says Pfister.

The call comes after the British Pound was described as "a diamond in the rough," by Goldman Sachs in their new year-ahead forecast publication, in which a new set of post-election forecast targets suggest solid gains in the coming months.

"We think a bullish set-up for Sterling should see it keep pace with a broader appreciation in the Dollar," says Kamakshya Trivedi, Head of Global Foreign Exchange at Goldman Sachs.

(If you would like to see Goldman Sachs' forecasts, we would ask you to submit a request here.)

Commerzbank says the pound can extend its rally against the Euro next year because "underlying inflationary pressures are likely to remain somewhat higher than in the euro area, while growth is also likely to be stronger."

The Pound is 2024's second-best performing currency, helped by superior UK economic growth rates (particularly in the first half of the year) and elevated core inflation and interest rates at the Bank of England.

The market expects the Bank of England to cut interest rates by 50 basis points in 2025, which would mean two more 25bp cuts. Commerzbank and most analysts we follow think this is unlikely and that the Bank will cut further, which could pose a headwind to the Pound.

Above image courtesy of Commerzbank.

But, according to Pfister, this Bank should still be more 'hawkish' on rates than the European Central Bank which will respond to slowing growth in the Eurozone by cutting rates further.

The Bank of England and Office for Budget Responsibility raised inflation forecasts in the wake of the government's budget, which saw it commit to significantly more spending next year than was previously assumed.

However, job tax hikes announced in the budget are a potential headwind as they could slow the economy and pressure inflation if employers absorb the tax by offering lower pay rises.

At the same time, they could pass the cost onto consumers via higher prices, which would boost inflation.

There is much uncertainty around this matter, and this is where risks to the Pound's 2025 outlook emerge.

For now, Commerzbank expects the pound to strengthen to 0.81 against the euro by the end of 2025 (1.2350 in GBP/EUR).

GBP/USD is expected to stay relatively flat, although Commerzbank's forecasts see it ending the next year at 1.32.

"Given the huge growth advantage and the likely inflationary impact of trade policy, we see little fundamental upside for the pound (against USD). However, our economists do not expect the Fed to respond to the return of inflation at the end of 2025 by tightening monetary policy, which is unlikely to be positive for the US dollar," says Pfister.