Goldman Sachs Downgrades Pound Sterling Outlook against Euro in Wake of Bank of England Downshift

- Written by: Gary Howes

Image © Adobe Stock

Goldman Sachs foreign exchange strategists say they are still Pound Sterling bulls, but they have lowered their forecasts for the Pound to Euro exchange rate in the wake of the Bank of England's August decision.

The Wall Street bank says the Pound still has supportive drivers in its corner, but the downshift in tempo at the Bank of England's most recent decision and guidance update suggests upside forces have been tempered.

"We found the BoE's decision (last) week a bit disappointing and confusing, albeit not surprising," says Kamakshya Trivedi, Co-head of Global Foreign Exchange at Goldman Sachs.

Goldman Sachs has been bullish on the Pound's prospects over recent months thanks to the Bank of England's combative stance on inflation that culminated in a surprise 50 basis point interest rate hike in June.

This boosted UK bond yields - as investors discounted a higher base lending rate - which in turn encourages capital inflows that are supportive of the Pound.

Prior to 2023 analysts at the bank had been critical of the apparent reluctance by policymakers at Threadneedle Street to show the proactive aggression required to send markets the message that it was determined to get on top of inflation, which is important for creating the market conditions that can support Sterling upside.

The downshift to a 25bp hike in August, as the Bank cited the softer July inflation figures, reverses some of the long-awaited 'hawkish' intent that had driven the Pound to new 14-month highs against the Euro in mid-July.

"The Bank attributed the more restrained 25bp hike to better data since the June meeting - an incredible turnaround from the recent focus on a longer policy lag - despite dialling up concerns about inflation persistence and noting that inflation is much higher than anticipated in the May projections round," says Trivedi.

He notes the Bank also shifted the focus to holding Bank Rate at a sufficiently restrictive level for a lengthy period rather than necessarily making further adjustments to the rate.

Some analysts note that the shift to a 'higher for longer' guidance reduces the odds of notable rate cuts at the Bank of England in 2024, a supportive factor for the Pound in forward-looking FX markets.

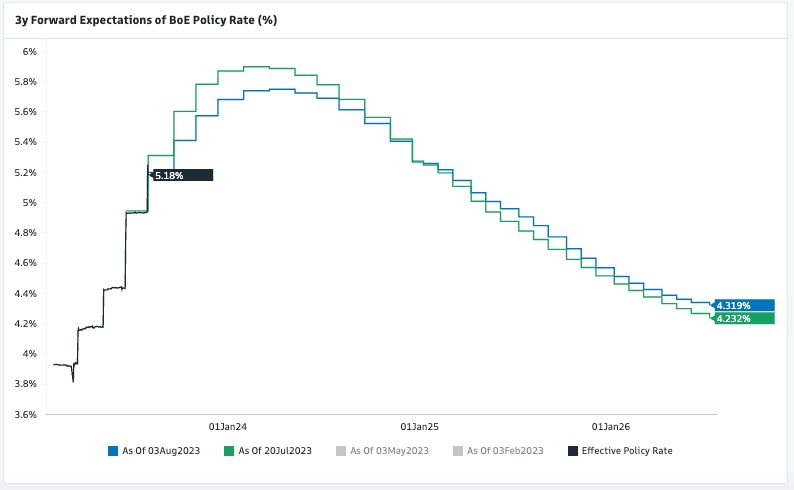

Above: The odds of rate cuts in 2024 have declined, (blue line lifts in 2024) even as the peak in Bank Rate expectations has shifted lower. Image courtesy of Goldman Sachs.

But Trivedi says the overall shift in approach tempers the Pound's upside potential as the Bank has lost some of the forcefulness noted in previous policy updates.

Nevertheless, he says there remain factors that can keep the Pound supported, albeit with diminished upside potential.

"We still think that the domestic conditions in the UK are not yet in the same position as most other DM economies and the case for pausing is weaker than elsewhere. That, combined with its cyclical beta, should still pull GBP stronger over time," says Trivedi.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

All eyes now turn to the August 16 inflation data that should be of great interest to foreign exchange markets that now realise the future of UK policy rests with upcoming inflation prints.

Money market pricing shows investors lowered the expected peak in Bank Rate following the guidance with slightly less than two further hikes now expected.

Goldman Sachs' economists meanwhile revised lower their terminal rate forecast last week and now see further downside risk to the policy outlook following the Bank's decision.

Consistent with this, the foreign exchange strategy team adjusting higher their Euro-Pound forecast to 0.86, 0.85 and 0.84 in 3, 6 and 12 months, up from 0.85, 0.84 and 0.84 previously.

This gives a Pound-Euro profile of 1.1630, 1.1765 and 1.19, down from 1.1765, 1.19 and 1.19.

"We are still Sterling bulls and think there will be more rounds in this fight, but (last) week demonstrated less urgency than the previous decision implied," says Trivedi.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes