GBP/EUR Jumps as UK Two-year Bond Yield Slide Offers Relief

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling received a strong bid against the Euro on Friday amidst falling bond yields in the UK with gains then being sustained following the release of below-consensus Eurozone economic surveys.

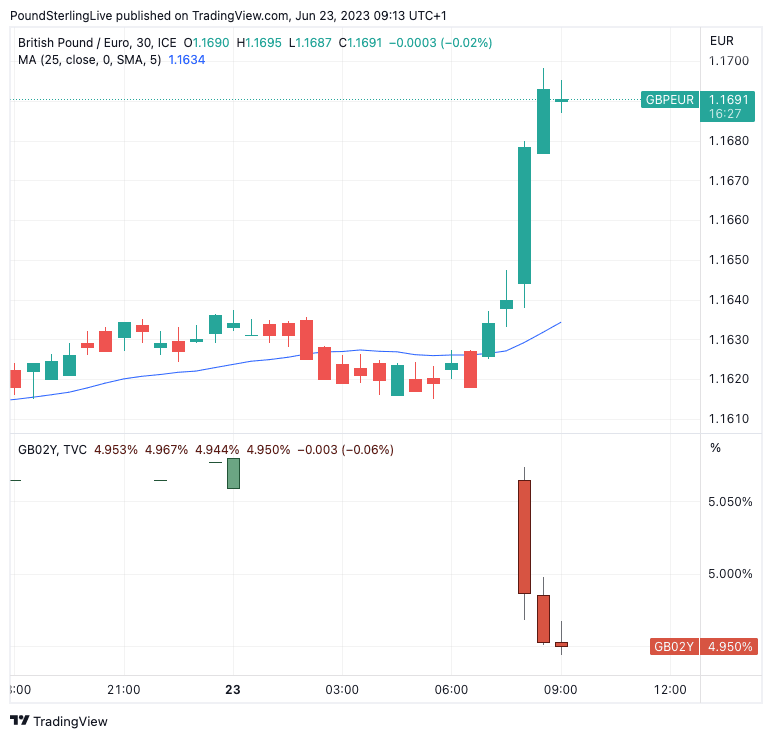

The Pound to Euro exchange rate rose sharply around 8AM BST as bond yields on the two-year UK government bond fell sharply, suggesting an easing in investor concerns on the outlook facing the UK economy.

Above: GBPEUR (top) and UK two-year bond yields.

Bond yields have been a source of concern of late given they are critical in pricing mortgage and other forms of debt and their rise of late has raised concerns the UK faces a sharp economic slowdown in coming months.

But a fall in UK yields suggests an easing of such concerns, perhaps on a view that decisive action by the Bank of England on Thursday can effectively deal with the UK's inflation problem.

Support will also have come via a better-than-expected UK retail sales report for May and additional news that UK consumer confidence recovered further in May.

The GBPEUR was seen holding its advance at 9AM after Eurozone PMI data for June undershot expectations, leading to wider losses in the Euro.

The Eurozone composite PMI for June read at 50.3, below expectations for 52.5 and below May's 52.8. A reading above 50 denotes growth but a reading below signals decline. The figures suggest the Eurozone's recession has further to run.

"The pound is a winner against the euro this morning because the Eurozone PMI data were, as my colleague Anatoli Annenkov put it this morning, ‘lousy’," says Kit Juckes, head of FX research at Société Générale.

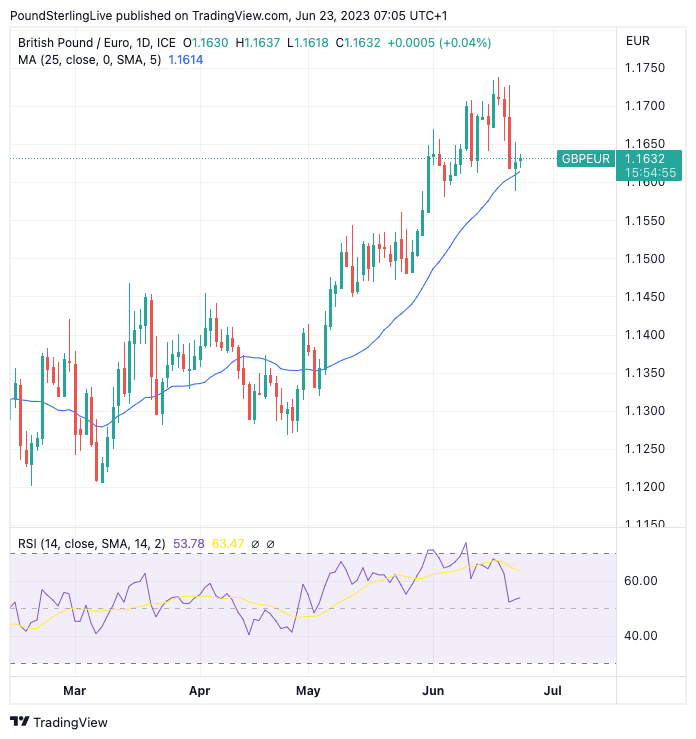

A brief look at some technical indicators can offer some useful context given the intense data and event-driven action in the market of the past few days:

Above: GBPEUR at daily intervals with 25-day moving average. Lower pane shows the RSI.

The above shows the pair had been testing support on the 25-day moving average located at approximately 1.1633, which will give some additional relevance to the round-number 1.16 support located just below.

GBPEUR bulls will want to see these levels defended to maintain a near-term constructive feel as failure here opens the door to further consolidation, and the 0.50% day-on-day rise seen at the time of writing confirms this.

Also note that the Relative Strength Index (RSI) in the lower panel has fallen back from extended levels: readings above and near 70 (which indicates overbought) dominated the mid-June period.

The recent retracement therefore suggests that strong buying interest is cooling, however, because the RSI remains above 50 momentum remains slightly positive, for now at least.

In the context of the broader technical uptrend, we are yet to see material evidence that the trend has been broken, therefore a recovery back to 2023 highs cannot be ruled out. But given this week's setback some patience will be required as a period of consolidation and sideways trading could be the ultimate outcome of recent developments.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound Sterling bulls will nevertheless take something away from the fact that the Pound actually ended Bank of England day with a slight gain (+0.12%), given the significant downside risks involved.

It appears much of the losses were sustained in the run-up to the Bank of England as a hotter-than-expected inflation reading gave investors reason to book recent profits and reduce exposure.

In the end, the Bank of England's 50 basis point hike met the market's minimum requirement to avoid a more protracted selloff. Furthermore, guidance from the Bank that it stood ready to do what is needed to bring inflation lower also offered support.

"The MPC shocked the markets with a 50bp increase in Bank Rate to 5.0%. The driving forces of inflation that have prompted this action are unlikely to moderate quickly enough to remove the need for further rate increases," says Brian Hilliard, Chief UK Economist at Société Générale.

To be sure, there are concerns that raising Bank Rate rate to 6.0% will prompt an economic recession, which is hardly a supportive environment for the Pound and we note a number of economists have revised their expectations lower for the economic outlook.

"Rate differentials have been a tailwind for the pound in June, but enthusiasm has been replaced this week by concerns over the adverse impact of spiralling mortgage and borrowing rates for home-owners and households on consumption and the broader economy," says Kenneth Broux, a currency strategist at Société Générale.

The UK looks on course to end the current cycle with one of the highest central bank interest rates, which could ultimately keep the currency bid in the near term and keep GBP downside limited.

However, currency strategists are increasingly nervous about the medium-term outlook for the Pound given building recession risks which suggest 2023's outperformance by Sterling might not be repeated in the second half of the year.

"For the U.K., a low growth/high inflation mix, combined with an outlook for aggressive Bank of England easing next year, are reasons we remain cautious on the pound's prospects versus the greenback over the medium-term," says Nick Bennenbroek, International Economist at Wells Fargo.

Currency strategists at Danske Bank say, on balance, relative rates are seen as a positive for the Euro relative to the Pound from here, "which is one of several reasons behind our fundamental predisposition of buying EUR/GBP dips," says Kirstine Kundby-Nielsen, Analyst at Danske Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes