UK Retail Sales Surprisingly Strong as Consumer Sentiment Continues to Rebound

- Written by: Gary Howes

Image © Adobe Stock

UK retail sales unexpectedly rose by 0.3% in May according to ONS data released ahead of the weekend while another report revealed another month of improved consumer confidence.

The retail sales figure represents a slowdown on April's 0.5% growth but nevertheless exceeds expectations for a -0.2% reading.

Retail sales are now down 2.1% on a year-on-year basis, which makes for an improvement on April's -3.4% and an outcome that is better than the -2.6% the market was looking for.

The ONS says the boost to sales was largely driven by the warmer weather that comes on the back of a cool and wet spring.

"The shift towards good weather has boosted volume – primarily through online purchases, kicking off shoppers' summer clothing sprees and a need for outdoor equipment. The trend for fuel has also reversed, verses April likely due to falling prices and an increase in travel post-industrial action," says Samantha Phillips, partner at McKinsey & Company.

Core retail sales rose 0.1% m/m in May, which was better than the -0.3% the market was looking for.

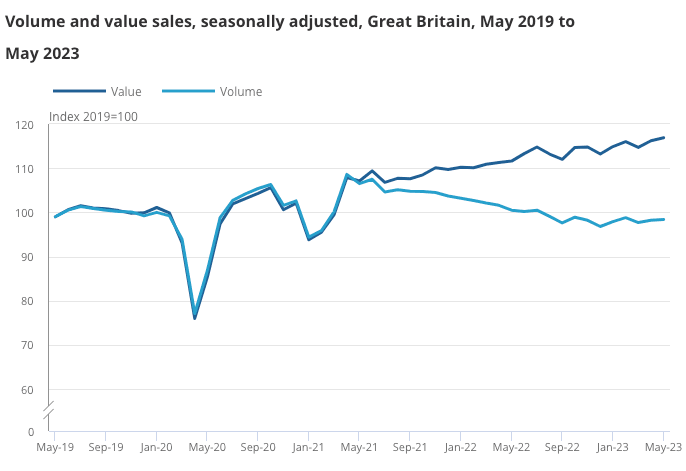

Volumes passing through UK retailers nevertheless remain suppressed amidst elevated inflation, suggesting there has been no real growth for the sector since 2021.

Image courtesy of the ONS.

"While retail sales increased by 7.7% compared with last year in pound note terms, we now know from the inflation numbers announced earlier this week that shoppers are continuing to get less for the money they are spending," says Jacqueline Windsor, Head of Retail at PwC.

The ONS data comes alongside a separate report that reveals UK consumer confidence improved more than expected in May, reaching its strongest level in 17 months.

The market research firm GfK said its measure of sentiment rose 3 points to minus 24 in June. Economists had expected a reading of minus 26.

"The cost-of-living crisis has been part of our daily financial reality for a long time, with double-digit inflation and record-high food prices. But despite those pressures, May sees an encouraging three-point uptick in consumer confidence. This is the fourth monthly increase in a row from January’s score of -45," says Joe Staton, Client Strategy Director GfK.

Looking ahead, some economists are wary of the outlook facing retailers given persistent inflationary pressures and higher interest rates.

"This week's Bank of England interest rates rise is explicitly aimed at putting the brakes on the economy with the base rate rising from 4.5% to 5.0%, the highest level in 15 years. Mortgage holders are likely to feel the brunt of the pain in coming months," says Windsor.

As a result, PwC says it is almost inevitable that consumers will rein in their discretionary spending over the rest of the year.

But Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says a gradual recovery in retail sales can be expected over the remainder of the year.

"We continue to think that a consumer-led downturn will be avoided, but expect growth in real expenditure to be modest. The good news is that households’ real disposable incomes will be boosted by 0.8% in July by a sharp fall in energy prices. This boost should outweigh the drag from mortgage refinancing," says Tombs.

Pantheon Macroeconomics say the drag from mortgage refinancing will subtract a mere 0.2pp from quarter-on-quarter growth in households' real disposable incomes over the coming quarters, given that only 30% of households have a mortgage and only 7% of fixed-rate mortgages need to be refinanced every quarter.

"The big unknowns for the near-term outlook for households’ spending are whether higher interest rates finally will spur businesses to reduce employment and whether the household saving ratio will rise sharply, as people replenish their savings and borrowers prioritise paying off debt. Our view is that the latest job market indicators are consistent with employment holding steady," says Tombs.