GBP/EUR Week Ahead Forecast: Contemplating Risks to BoE Outlook

- Written by: James Skinner

- GBP/EUR gains a toehold near 1.13 but upside limited

- Meeting resistance around 1.1374 & 1.1389 short-term

- Repricing of BoE & upside risks for Bank Rate support

- BoE speeches & UK-EU negotiations highlights ahead

The Pound to Euro exchange rate has climbed further off February's lows in recent trade and could attempt to solidify a tentative toehold on the 1.13 handle this week though the upside for Sterling is potentially limited by the scope for and the risk of fresh political tail-risks emerging in London.

Sterling climbed against most comparable currencies including the Euro during the week to Monday following a sharp bounce in S&P Global PMI survey indices for February as well as hawkish economic and monetary policy commentary from Catherine Mann at the Bank of England (BoE).

In addition, other data has indicated a less bleak picture of the public finances just weeks out from the March budget and at a point when inflation risks are still widely perceived to remain very much on the upside for the UK, with possible implications for Bank Rate in the weeks and months ahead.

"Slightly better growth prospects, sticky inflation and some further monetary tightening are the story across the US, the eurozone and the UK at the moment – suggesting bilateral FX rates do not need to move too much," says Chris Turner, regional head of research for UK & CEE at ING.

"This has seen three-month GBP/USD implied volatility drift under 10% and would tend to favour more modest moves in spot," he adds in Friday commentary.

Above: Pound to Euro rate shown at daily intervals with selected moving averages and Fibonacci retracements indicating possible areas of technical support and resistance. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Upside risks to the outlook for Bank Rate are balanced with the prospect of Downing Street and Brussels agreeing to a new negotiated solution for differences over post-Brexit administrative arrangements for Northern Ireland.

Despite being positive for the economic outlook over time, another 'Brexit deal' would also potentially introduce political tail-risks into the shortest-term horizon for GBP/EUR if there is any parliamentary controversy over the proposition.

"The BoE’s reluctance is already well understood. Finally, given current sentiment, it is especially important to carefully consider what could actually go right for the currency," says Michael Cahill, a strategist at Goldman Sachs.

"Most notably, negotiations on the Northern Ireland Protocol are reportedly advancing with some concessions. Whether it is enough to secure an agreement seems unlikely, based on recent precedent, but an important risk," Cahill and colleagues write in a Friday research briefing.

The economic outlook and balance of risk for Bank Rate are likely to remain in focus for the market throughout the week ahead when around half of the Monetary Policy Committee's nine members are scheduled to speak publicly about topics relevant to their own individual policy stances.

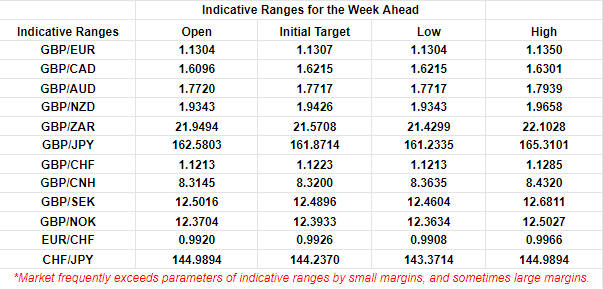

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

In the BoE policy sphere, the week gets underway with an appearance but MPC member and deputy governor Ben Broadbent who delivers opening remarks at the Bank of England Agenda for Research Conference from 09:30 on Monday.

Other appointments include on Tuesday an outing for chief economist Huw Pill, who delivers closing remarks at the same conference around 12:15 and is followed on the speaking circuit by Catherin Mann's participation a short time later in a panel discussion titled "Interaction of monetary and fiscal policy and financing conditions" at the European Investment Bank Forum in Luxembourg.

The highlight is a Wednesday address from Governor Andrew Bailey at the Cost of Living Crisis Conference organized by the Brunswick Group in London, though this appearance is followed soon after by a speech from Huw Pill titled "2023 economic outlook – a year of growth or survival?" at Wales Week.

"There will be plenty of excitement to keep us going in the week ahead. A full suite of survey data will be coming (PMI, BRC), and we will get the latest credit data," says Sanjay Raja, a senior economist at Deutsche Bank.

"We will have a lot of MPC speakers spread across the week to keep an eye on. Finally, we will get Ofgem's announcement of the April Price Cap on Monday – something keen inflation watchers will be paying attention to," Raja writes in a Friday research briefing.

Above: Pound to Euro rate shown at weekly intervals with selected moving averages and spread or gap between 02-year GB and German government bond yields. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes