Pound Sterling Rallies as Northern Ireland Brexit Deal is Agreed

- Written by: Gary Howes

Above: File image of von der Leyen and Sunak. Photographer: Christophe Licoppe. Copyright: European Union, 2023. Source: EC - Audiovisual Service.

The British Pound has firmed against its major peers on confirmation a final deal on the Northern Ireland protocol has been agreed upon between the UK and EU.

"We have now made a decisive breakthrough," said Sunak in a press conference alongside Ursula von der Leyen, EU Commission President. "We have removed any sense of a border in the Irish Sea".

The reworked protocol is to be known as the Windsor Framework, according to Sunak who welcomed "the beginning of a new chapter in our relationship."

In an attempt to bring Northern Ireland's DUP aboard, Sunak and von der Leyen announced "The Stormont Break", which will allow Northern Ireland politicians "to pull an emergency brake" to EU goods laws that might have a negative impact on Northern Ireland.

Northern Ireland will now return to UK jurisdiction for tax laws and a new medicines agreement will ensure that all drugs approved in the UK will be available in Northern Ireland.

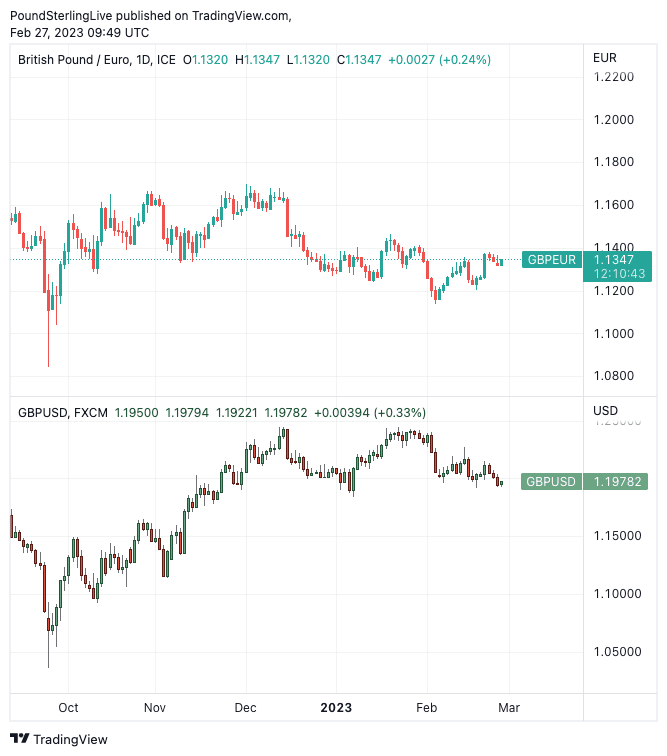

The Pound liked the news and was a clear outperformer on Monday, rising against all the G10 majors.

Above: GBP was a clear outperformer on Feb. 27 as news of a deal between the EU and UK was made known.

"The pound has jumped above $1.20 in a small relief rally that the deadlock has been broken, but there is still a long way to go before these better relations will herald a significant recovery in cross-border trade," says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

The Pound to Euro exchange rate has rallied a third of a per cent to 1.1362, and the Pound to Dollar exchange rate is two-thirds of a per cent higher at 1.2020.

"On the announcement of a deal, and then again following any sign-off in UK parliament, we would expect to see modest positive moves for both sterling and UK equities," says Kallum Pickering, Economist at Berenberg Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sunak said time would now be granted for UK lawmakers and Northern Ireland's parties to work through the legal text.

The UK Parliament will have a vote on the deal but because Sunak commands a large majority in the House of Commons pockets of resistance will unlikely scupper his plans, as was the fate suffered by Theresa May.

Adam Cole, Chief Currency Strategist at RBC Capital Markets, says the deal could allow for some near-term upside and he makes the Pound a buy against the Euro as his "trade of the week".

"This week, we position against our longer-term bearish GBP view. Although it would be easy to dismiss this week’s likely agreement on GB-NI trade as no more than lipstick on the Brexit pig, there are potentially positive implications for GBP," he explains.

He explains that a direct positive impact of the agreement would be very small, but it would nevertheless be a significant step away from an outright UK-EU trade war.

Kallum Pickering, an economist at Berenberg Bank agrees and says the Brexit deal fits a longer-term trend of normalisation in British politics following years of upheaval.

"After nearly six years of noise and chaos, the UK seems to be returning to something resembling a more normal political environment," says Pickering.

"Following the failures of two populists (Boris Johnson and Liz Truss), the typically sensible Conservatives have put a safe pair of hands (Rishi Sunak) back in the prime minister’s seat. Sunak is combining fiscal restraint with a genuine effort to end UK-EU tensions over the Irish border," he adds.

Berenberg expects a deal would lift the threat of a tit-for-tat trade war with the UK's biggest market, the EU, which "is exactly what UK businesses and financial markets need."

RBC Capital's Cole says the Pound is probably still carrying a risk premium over lingering fears of an EU-UK trade war.

"In agreeing to the deal we expect this week, the EU is likely to demand former PM Johnson’s NI Protocol bill (currently in the Lords) is killed off and headlines that the UK government has agreed to this would likely be a catalyst for GBP gains," says Cole.

RBC Capital looks for EUR/GBP to target 0.8650 in the event of a positive reaction by Sterling. This gives a Pound to Euro exchange rate of ~1.1560.

The pair is currently quoted at 1.1326, the Pound to Dollar rate is at 1.1953.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: GBP/EUR (top) and GBP/USD (bottom) at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

The Pound was one of the better-performing major currencies last week following stronger-than-expected domestic economic data, with February's Flash PMI readings suggesting the economy returned to growth in February.

The data prompted investors to reassess their prior convictions that a March rate hike at the Bank of England would be the last of the cycle.

It is therefore economic data, Bank of England expectations and the broader trends in the Dollar that is important for the Pound at present, but Lee Hardman, Senior Currency Analyst at MUFG is not discounting the impact of a Brexit deal.

"The recent modest improvement in sentiment towards the UK could be further improved in the near-term by reports that the UK is close to agreeing a deal with the EU over a post-Brexit settlement for Northern Ireland," he says in a regular morning briefing.

But like most of his analyst peers, Hardman looks for any currency reaction to be short-term in nature.

"While the announcement of a deal could temporarily support the pound, it is unlikely to have a significant and lasting impact on pound performance," he says.

This is particularly true of the Pound-Dollar exchange rate, which strongly correlates with broader global investor sentiment.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks