Pound / Euro Week Ahead Forecast: Upside Risks Linger as CPI Data Looms

- Written by: James Skinner

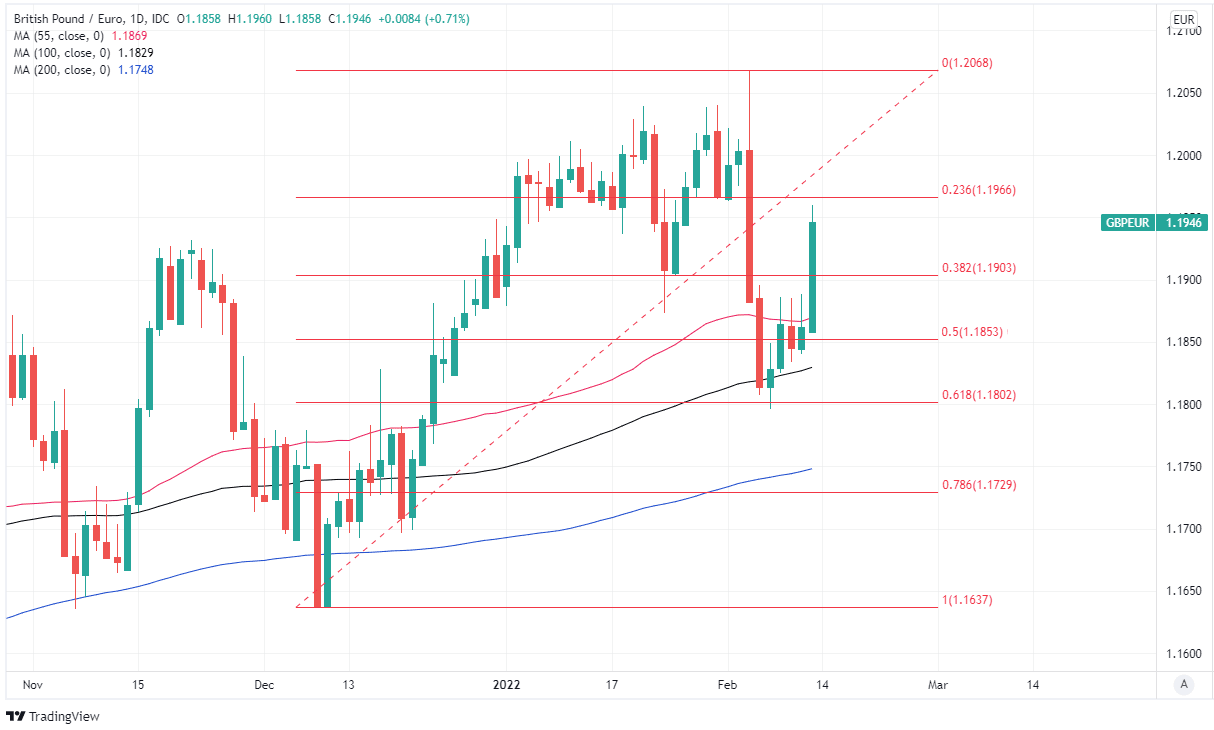

- GBP/EUR supported at 1.1870, could retest 1.20

- Looks for footing near 1.1890 as CPI data looms

- Upside surprise could see GBP/EUR holding 1.19

- ECB & Fed speeches an upside risk for GBP/EUR

- Easing of Ukraine fears could hamper GBP/EUR

Image © Adobe Images

The Pound to Euro exchange rate pared prior losses sharply last week and may look to cement its recovery of the 1.19 handle over the coming days, although with developments around Ukraine dominating headlines and January’s inflation data looming, the risk may be on the upside for Sterling.

Pound Sterling’s early February decline against the single currency was arrested by dip-buyers just above the 1.18 handle from the open last week, enabling it to pare earlier losses before Friday’s rally lifted the Pound to Euro rate more than 100 points to around 1.1950 in time for the weekend close.

Almost the entirety of Friday's advance was driven by a sell-off in the influential EUR/USD exchange rate that appeared to have multiple drivers including remarks from European Central Bank Chief Economist Philip Lane, which appeared to suggest that a recent hawkish lift in market expectations for ECB interest rates may have been misplaced.

“Lane may not have used the term ‘transitory’ but he has clearly not completely stepped away from the concept. The combination of these comments suggest that while the ECB may have opened the door to a rate hike this year, it is in no rush,” says Jane Foley, head of FX strategy at Rabobank.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of December rally indicating possible areas of technical support for Sterling. Selected moving-averages also denote possible areas of technical support for Sterling.

- Reference rates at publication:

GBP to EUR: 1.1936 - High street bank rates (indicative): 1.1618 - 1.1702

- Payment specialist rates (indicative): 1.1829 - 1.1876

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

Chief economist Lane reiterated in a blog post that Europe’s inflation is still expected to fade later in the year without any increase in the ECB’s interest rates in part because “second round effects” have remained largely absent in Europe, suggesting that any eventual changes in ECB policy are likely to be on a lesser scale than those elsewhere.

“ECB President Lagarde and Chief Economist Lane are both scheduled to speak in the week ahead. Market participants will continue to monitor the comments to assess the ECB’s hawkish policy shift and likely shift to tighter policy at the next meeting on 10th March. Comments over the past week have signalled some discomfort over the scale of hawkish pricing in the euro-zone rate market,” says Lee Hardman, a currency analyst at MUFG.

Friday’s pushback was a dampener for the European single currency and a tailwind for the Pound to Euro exchange rate, which might benefit this week if remarks from ECB board members President Christine Lagarde, chief economist Lane and Isabel Schnabel were to further temper market expectations for the bank’s interest rates when delivered over the course of Monday and Thursday.

While tempered expectations for the ECB’s interest rate to begin rising later in 2022 have helped, the Pound to Euro exchange rate has also been supported by a strengthening U.S. Dollar, which has hampered the single currency to a greater extent than it has Sterling.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Helping GBP is undoubtedly a hawkish central bank, which will stay hawkish to ride out the inflation hump into April/May. At the same time, UK equity benchmarks have a much higher weighting to the Materials sector than some (FTSE 100 has 12% weighting to Materials compared to 2% in the S&P 500), helping UK equities to outperform this year on the stronger commodity sector,” says Francesco Pesole, a strategist at ING.

All of the above factors will again be influential for the Pound to Euro rate this week, although Sterling could also be meaningfully impacted by this Wednesday’s release of inflation figures for January, which have the potential to surprise on the upside of market expectations and would do little to discourage speculators from betting on an aggressive interest rate response from the Bank of England (BoE) over the coming months.

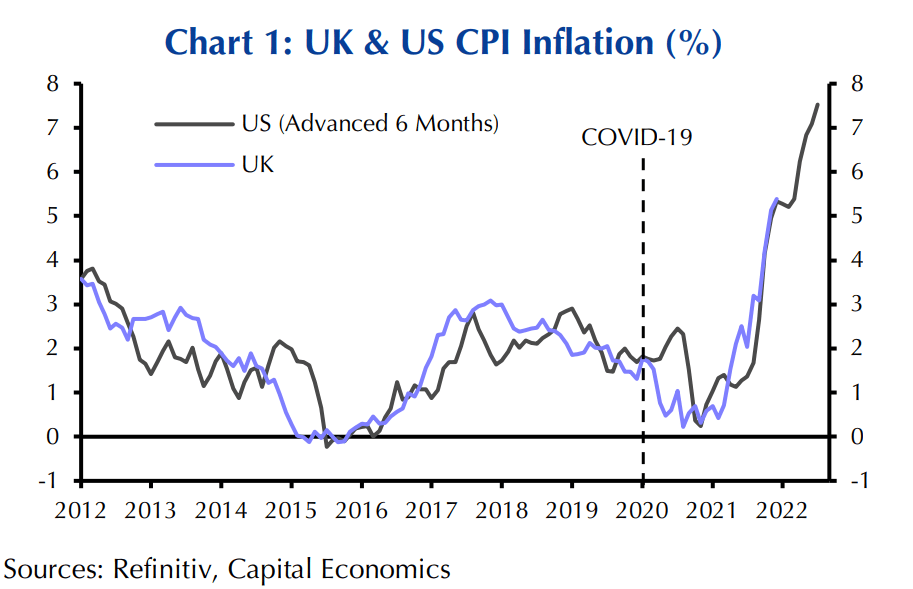

“We are not expecting much excitement as our forecast is that CPI inflation held steady at 5.4%. But the way the wind has been blowing both here and on the other side of the Atlantic suggests there is a good chance of an upside surprise,” says Paul Dales, chief UK economist at Capital Economics.

Wednesday’s inflation data is the highlight of the week for Sterling and consensus suggests it’s likely to have held steady around 5.4%, although January’s upside surprises from the U.S. and Eurozone suggest that economists and financial markets may be being too optimistic.

The risk is that Wednesday’s data shows inflation rising sooner than was anticipated by economists and could potentially help the Pound if it reinforces market expectations for an accelerated pace of interest rate rises at the BoE, which lifted Bank Rate back to 0.50% earlier in February but is widely expected to raise the benchmark further this year.

“It’s no surprise that inflation in both economies is moving in the same direction. This usually happens because the economic cycles in the US and the UK tend to be closely aligned and as inflation in both economies is influenced by the same global factors. But it is striking how over the past year inflation in the UK has followed inflation in the US with a lag of about six months,” Capital Economics’ Dales said on Friday.

Another factor that could influence the Pound to Euro exchange rate along the way this week is the market’s response to any further developments around Ukraine after governments in Washington and London suggested again on Friday that an extension of Russia’s 2014 incursion into the country could be likely this coming week.

White House officials later acknowledged that such an outcome is not actually certain although Friday’s price action suggests adverse developments could be a neutral-to-positive risk for the Pound to Euro exchange rate, potentially owing to Eurozone economies’ closer proximity to any conflict.

Ukraine’s Ministry of Foreign Affairs said in a statement on Saturday that “Right now it is critical to remain calm, stay united and consolidated within the country, and refrain from actions that undermine stability and sow panic. The Armed Forces of Ukraine are constantly monitoring the developments and are ready to repel any attack,” among other things.