Euro / Dollar Rate Nears 1.15 as Market Eyes End to Negative ECB Rates Era

- Written by: James Skinner

- EUR/USD could test 1.15 handle

- Supported near 1.13 short-term

- After ECB warns on inflation risk

- March forecasts key for outlook

ECB president Christine Lagarde addresses the audience during the ECB Governing Council Press Conference on February 3, 2022. Photo: Andrej Hanžekovič / ECB.

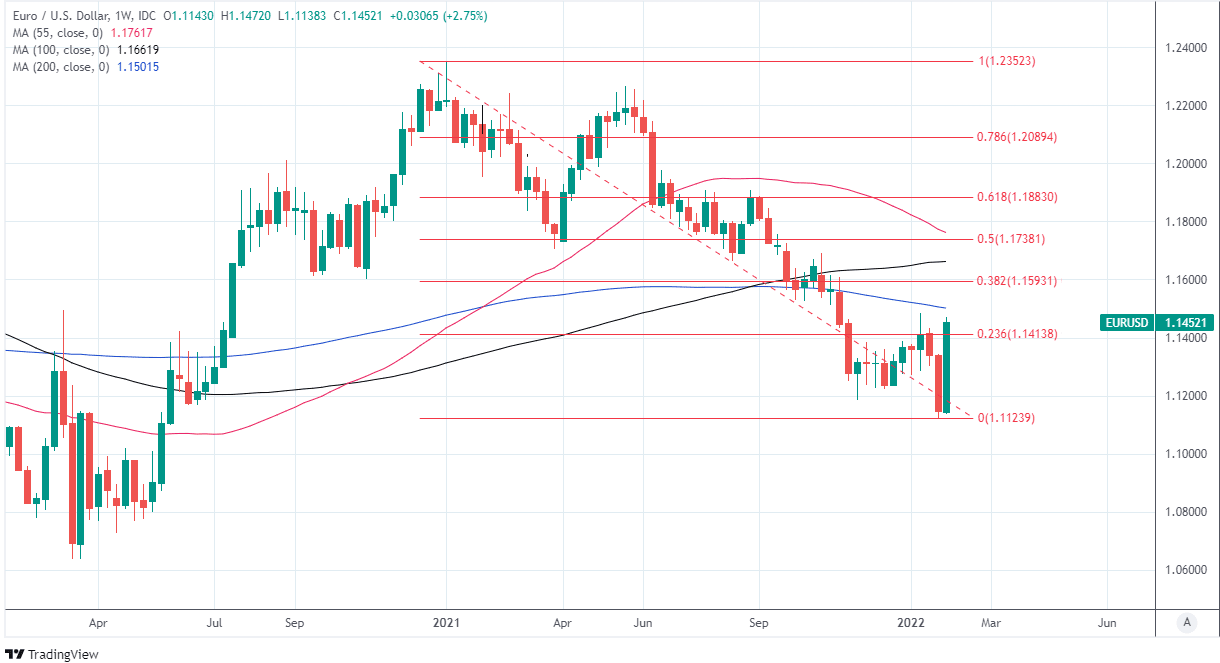

The Euro to Dollar rate was on course for a fifth consecutive gain in the final session of the week and could now have scope to reach three-month highs around 1.15, according to some strategists, who also see the single currency finding support around 1.13 in the short-term.

Europe’s single currency had entered the week trading near two-year lows not far from the 1.11 handle but was fast closing-in on 1.15 by Friday after the European Central Bank (ECB) warned of increased uncertainty and upside risks to its inflation outlook.

Thursday’s remarks from President Christine Lagarde appeared to be taken by the market as a precursor to a potential shift in the ECB’s policy stance, which has squeezed investors and traders who’d been betting against the single currency and got the market looking ahead to the March policy decision.

“While President Lagarde’s comments stressing the upside risks to inflation were not all that surprising considering the latest CPI reads in the eurozone, it was likely the ambiguity around the timing of the first hike (forward guidance for 2023 was implicitly dropped) that triggered the aggressively hawkish market reaction that ultimately led to another big leg higher in EUR/USD,” says Christ Turner, global head of markets and regional head of research for UK & CEE at ING.

“Our economics team now sees a material risk that the ECB will accelerate the unwinding of purchases under the APP and start hiking rates already in 4Q22. We think this warrants a change in our projected profile for EUR/USD,” Turner and colleagues said on Friday.

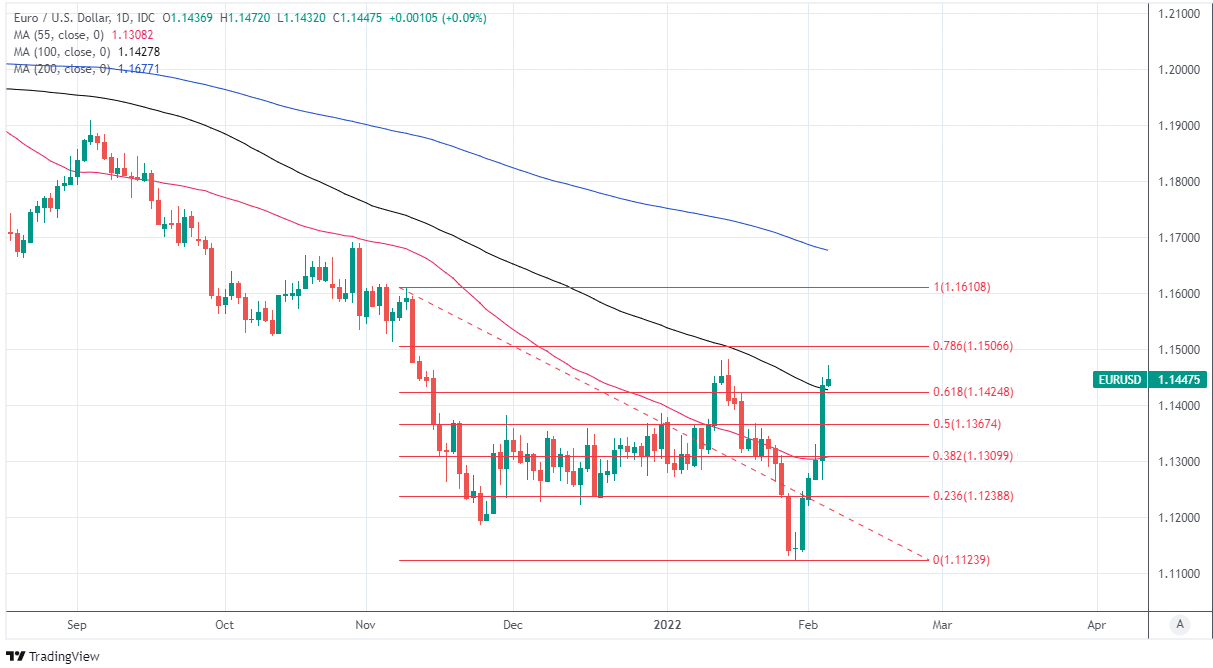

Above: Euro to Dollar rate shown at daily intervals major moving-averages and Fibonacci retracements of November decline indicating possible areas of technical resistance to a further recovery.

- EUR/USD reference rates at publication:

Spot: 1.1456 - High street bank rates (indicative band): 1.1055-1.1135

- Payment specialist rates (indicative band): 1.1353-1.1340

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

Turner and the ING team said Friday the Euro-Dollar rate could now be likely to establish itself in a rough 1.13 to 1.15 range as market attention turns to the March policy decision in which the ECB is expected to announce its next set of three-year economic forecasts.

Those will be crucial for market participants’ attempts at inferring the outlook for ECB monetary policy given the bank’s strategy specifies that its forecasts would need to envisage inflation sitting at or above the symmetric 2% target both in middle and at the end of the forecast horizon before the Governing Council could contemplate an increase in the bank’s interest rates.

Such forecasts would, if made in March or at any point after, signal that more immediate actions are in the pipeline because they’d necessitate an accelerated winding down of the ECB’s Asset Purchase Programme.

That’s the original quantitative easing programme of government bond buying that was first announced in January 2015 and for which the ECB announced in December a temporary increase the size of its monthly purchases to run between March 2022 and October 2022.

“The ECB's forecast of 4.1% inflation for the first quarter has become unachievable simply because of the high inflation in January; in the further course of this year, too, inflation is likely to be significantly higher than previously assumed,” says Dr Jorg Kramer, chief economist at Commerzbank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“As a result, the ECB is likely to raise its inflation forecasts significantly at the update of its projections due in March. This is likely to be the trigger for it to tighten monetary policy,” Kramer and colleagues said on Friday.

Kramer and the Commerzbank team announced a change in their forecasts for Eurozone interest rates on Friday and now envisage two 0.25% increases being announced this year, which would take the ECB’s negative -0.50% deposit rate back to zero.

They aren’t alone either as Thursday’s remarks from President Lagarde prompted a wave of upgrades to forecasts across the economist community, with many now envisaging a possibly imminent end to the era of negative benchmark interest rates in Europe.

“We change our ECB call and now expect the ECB to hike its deposit facility rate in December this year, and again in March 2023, by 25bp each, which will bring the deposit facility rate to 0%. For now, our call is for a 'two-and-done,' says Piets Haines Christiansen, chief strategist for ECB and fixed income research at Danske Bank.

“There is still elevated uncertainty on this call, but given that Lagarde highlighted the uncertainty of the model framework in its staff projections, that inflation will remain elevated for longer than previously expected, and a tight labour market, we change our view to acknowledge the increased risk, which now becomes our baseline,” Christiansen and colleagues said in a Friday note.

Above: Euro to Dollar rate shown at weekly intervals major moving-averages and Fibonacci retracements of 2021 decline indicating possible areas of technical resistance to a further recovery.