Pound-to-Euro Exchange Rate hits Highest Level Since June, Could go to 1.20 if Brexit Deal Reached before Year-End

Above: European Council President Donald Tusk has a Brexit offer for the U.K. that comes with a significant caveat. Image copyright: European Union.

- All eyes on E.U. Council meeting, outcome of Brexit talks.

- Brexit deal to trigger a meaningful recovery in Pound Sterling.

- Failure of negotiations would risk fall toward parity for GBP/EUR.

Pound Sterling rallied to a three-month high against the Euro ahead of the weekend amid growing confidence a Brexit deal covering the terms of the U.K.'s withdrawal from the EU will soon be struck.

Sterling rallied to record a high of 1.1392 on reports European Union negotiators see the outline of a compromise on the Irish border issue that is holding up Brexit talks; this is the best rate of exchange for those looking to purchase Euros since June 22

"Look who's on track to be an outperformer. Only GBP... a positive 'Dancing Queen' risk premium? (More the fact that Brexit Withdrawal Deal is close to being agreed but would like to think our currency rallied because our PM 'busted some moves')," says Viraj Patel, an FX strategist at ING Group, noting Sterling's broad-based outperformance.

Prime Minister Theresa May has promised new proposals and the sketchy details seen so far have found a tentative welcome in Brussels encouraging markets a 'no deal' Brexit scenario will be avoided.

"This is a step in the right direction," one E.U. source close to the negotiations told Reuters. "It makes finding a compromise possible."

The comments add to unconfirmed reports that officials in Dublin are looking favourably on yet-to-be-announced proposals being mooted by May, even as Ireland's Prime Minister Leo Varadkar publicly played down such a prospect at a meeting with the European Council's Donald Tusk on Thursday, October 04.

Yet, markets are reading between the lines and sensing progress.

"GBP outperformed across the board. Reports that Irish officials plan to back UK Prime Minister Theresa May’s Irish border backstop proposal (to ensure there is no hard border on the island of Ireland) raised hopes that a Brexit deal could be reach at the 18th October EU summit. Essentially, May’s proposal is for the whole of the U.K. to remain in the customs union until a U.K.-E.U. trade deal is finalised," says Elias Haddad, a foreign exchange strategist with CBA.

The optimism takes the GBP/EUR exchange rate well above levels it is currently forecast to be at in both three and six month timeframes according to a poll of 48 of the world's leading financial forecasters. Horizon Currency Ltd have compiled a report detailing these forecasts, as well as the targets placed by leading names such as Citi, Goldman Sachs and HSBC. It can be downloaded here.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Next Week's Date with Destiny

All eyes now turn to a meeting of European leaders at a dinner on October 17 when they review the state of negotiations with the U.K. ahead of the October European Council summit.

"In October we expect maximum progress and results in the Brexit talks. Then we will decide whether conditions are there to call an extraordinary summit in November to finalise and formalise the deal," European Council President Donald Tusk said at the Salzburg informal summit.

Expect market nerves to remain piqued over the next week as headlines, rumours, optimism and disappointment create an unstable environment for traders to navigate.

"Brexit remains the key driver for the GBP and uncertainty related to the outcome is likely to keep the GBP volatile," says Mikael Olai Milhøj, a foreign exchange strategist with Danske Bank.

While Sterling is increasingly confident of a deal - evidenced by the ongoing recovery against the Euro and resilience against the rampaging Dollar - the hurdles to reaching a deal are substantial and disappointment could well send the currency into reverse.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Tusk Pushes for Canada +++ Deal, but Plan has Major Drawback

European Council President Donald Tusk has been meeting European leaders ahead of next week's summit to formulate the E.U.'s position.

"From the very beginning, the EU offer has been a Canada+++ deal. Much further-reaching on trade, internal security and foreign policy cooperation. This is a true measure of respect. And this offer remains in place," says Tusk following Thursday's round of meetings.

The call for a Canada +++ deal by Tusk gels with the plans proposed by those members of the U.K.'s Conservative party who are advocating for a clean break from Brussels and who are opposed to Prime Minister May's current plans which allow for some E.U. oversight in order to facilitate smooth trade.

"This is a good solution for everyone and the ERG's proposals for the Irish border mean it could work for the U.K. as a whole," says Jacob Rees-Mogg, Chair of the European Research Group - a wing of the Conservative parliamentary party advocating for a clear break from Brussels.

That the E.U. and U.K. 'Brexiteers' have found common ground would suggest the obvious solution is for May to accept the Canada +++ deal on offer.

However, there is a crucial point to make here: the offer does not necessarily guarantee the integrity of the United Kingdom as it does rely on an Irish backstop solution that could cleave Northern Ireland away from the other three nations and into the European Union's customs regime.

There is no guarantee Rees-Mogg's solution for the Irish border would be accepted by the E.U., the Prime Minister knows this and is betting only her vision that says the backstop must include the whole of the U.K. has a shot at success.

Potential Outcomes for the Pound-to-Euro Exchange Rate

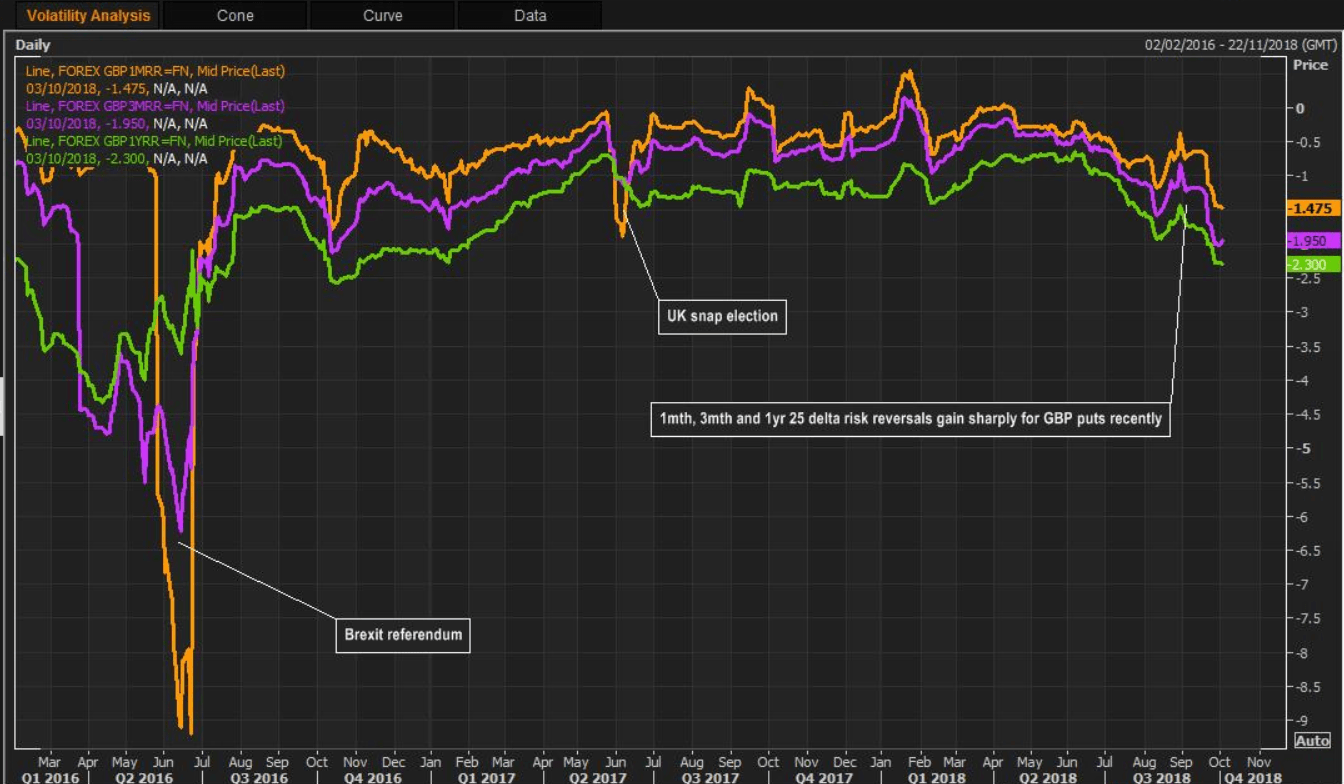

The stakes are high for the Pound. Data on the futures markets - where traders buy contracts to protect against big moves in a currency - are pricing in the possibility of big moves for Sterling on the horizon.

Hedging on foreign exchange markets confirm markets are wary of a significant rise in volatility. Image (C) Reuters.

Contracts to protect against downside are particularly elevated for December, when markets believe the real deadline for Brexit talks actually lies.

Risk reversals, a measure of expected future volatility and risk used by those hedging currency exposure, have reached levels similar to those put in place for the 2017 snap general election as traders figure the the only guarantee for Sterling near-term is volatility.

However, if a Brexit deal is struck some analysts expect a sizeable recovery in the Pound. Danske Bank expect EUR/GBP to break substantially lower when markets can start to price out a ‘no-deal’ Brexit risk premium.

Danske forecast 0.84 in six months and 0.83 in 12 months for the EUR/GBP. This gives a Pound-to-Euro exchange rate of 1.19 and 1.20.

In case of a ‘no-deal’ Brexit, Danske Bank expect EUR/GBP to spike higher and a test of 1.00 - or parity - should not be ruled out.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here