Pound to Dollar Forecast at 1.33 if Harris Wins

- Written by: Sam Coventry

Image © Adobe Images

The Dollar should weaken if Kamala Harris wins next week's U.S. election, but a balance of probabilities favours strength.

According to a new analysis from Crédit Agricole, the U.S. Dollar will retest 2024 highs in the event of a Donald Trump win next week but fall if Kamala Harris wins.

"A soft landing in the U.S. in 2025 could further suggest that the USD rate appeal could persist in the months after the elections. We subsequently see the USD moving closer to its 2024 highs in the wake of a Trump victory while suffering only limited losses following a Harris win," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Losses for the Dollar in the event of a Harris win would nevertheless put the GBP/USD comfortably back above the 1.30 marker, provided Sterling stabilises following its post-budget wobble.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"EUR/USD and GBP/USD could slump to their Q124 lows or head lower still in response to a Trump victory accompanied by a ‘red wave’ in the US Congress. In contrast, their upside could be limited to 1.10 and 1.33 in the event of a Harris victory and a divided US Congress," says Marinov.

Analysts at Barclays say a Harris win would see the USD erase the Trump premium, which they think amounts to a 2% drop (i.e. 2% recovery in GBP/USD and EUR/USD).

The market is currently expecting a Trump win, with odds set at about 60%.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Rising odds of a Trump victory are reflected in a strengthening U.S. Dollar through the course of October, which pushed the Pound to Dollar exchange rate to an October 31 low at 1.2843.

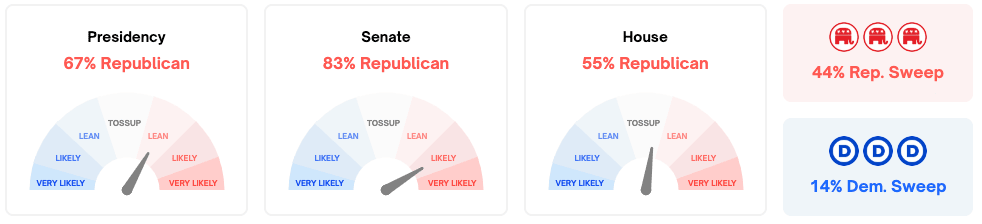

Also of significance to the market outlook is the outcome of votes for the Senate and House of Representatives. Should the Republicans win both houses, their control of Congress significantly boosts a Trump agenda.

A "red wave" outcome is increasingly likely, according to betting markets, where the odds of this outcome now sit at 44%.

"We see the most bullish dollar outcome as a red sweep and the most bearish dollar outcome as a blue sweep, but the magnitude of the moves is likely larger in the former," says George Saravelos, an analyst at Deutsche Bank.

"We see the dollar rising across all currency pairs in a red sweep," he says.

Analysts say Trump's policy agenda is more radical than that of his Democrat rival Kamala Harris, putting a number of USD-positive policies and scenarios in play.

"We suspect Trump's proposed curbs on immigration and new tariffs would be stagflationary," says Paul Ashworth, Chief North America Economist at Capital Economics.

Trump intends to impose significant import tariffs, which would raise domestic inflation and prevent the Federal Reserve from cutting as far and as fast as previously assumed.

"The proposed 10–20% increase in tariffs across the board has the potential to be inflationary," says Tom Kenny, Senior International Economist at ANZ Bank.