All-out Dollar Gains on a "Red Sweep" in November

- Written by: Gary Howes

File image: Official White House Photo by Shealah Craighead.

Foreign exchange strategists at Deutsche Bank see across-the-board U.S. Dollar gains if Donald Trump wins in November and his Republican party secures control of both the House and Senate.

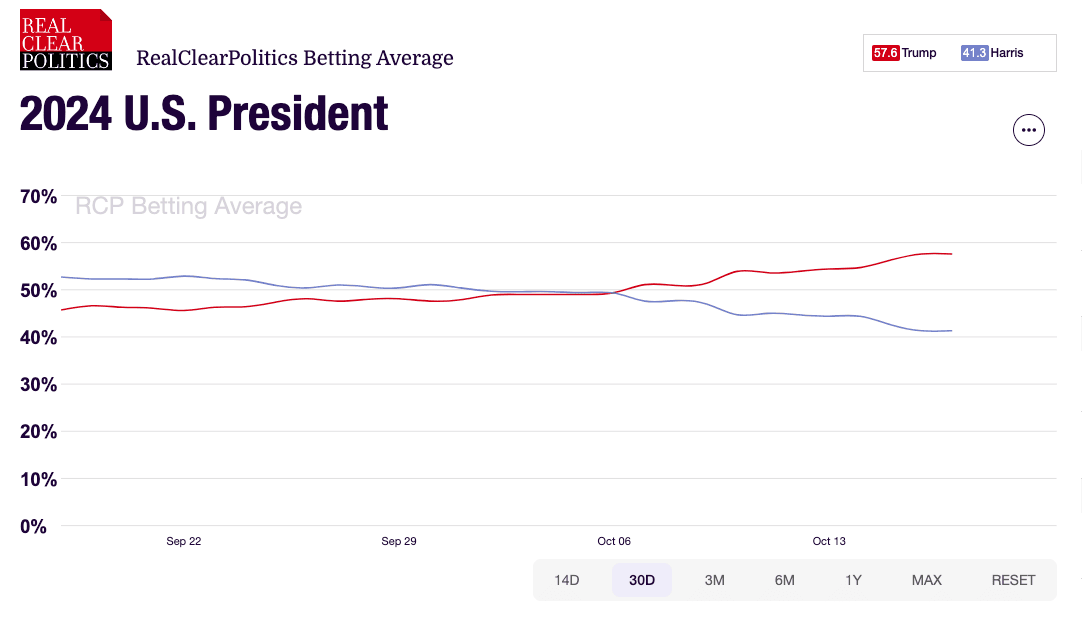

This "red sweep" outcome is increasingly likely according to odds markets which have started to move in favour of Trump and his party of late.

"We see the most bullish dollar outcome as a red sweep and the most bearish dollar outcome on a blue sweep, but the magnitude of the moves is likely larger in the former," says George Saravelos, an analyst at Deutsche Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"We see the dollar rising across all currency pairs in a red sweep," he says.

Having been a toss-up for so long, betting markets have started to move steadily in Trump's favour of late:

According to aggregates by Bookmakers Review, betting odds have accurately predicted 77% of the expected candidates winning over the last 35 years.

"Betting markets have evolved into reasonably accurate predictors of elections - even more than some polls - but they're far from foolproof," says Thomas Gift, a political scientist who runs the Centre on U.S. Politics at University College London.

Currency analysts are broadly in agreement that Trump winning is supportive of the USD outlook owing to the significant import tariffs he intends to enact, which would raise domestic inflation and prevent the Federal Reserve from cutting as far and as fast as previously assumed.

"The proposed 10–20% increase in tariffs across the board has the potential to be inflationary," says Tom Kenny, Senior International Economist at ANZ Bank.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

His stimulatory tax-cutting agenda would also bolster the economy, grow the country's debt and prolong the U.S. economic exceptionalism trade (which is USD-supportive) for longer.

"A red sweep would likely lead to the largest deficits," says Saravelos.

Strategy-wise, Deutsche Bank thinks selling Euro-Dollar makes sense under a 'red sweep' scenario.

Should Trump win but the legislature remain divided the USD is tipped to remain supported, although the outright bull case is dimmed.

Saravelos says buying the USD and selling NZD and GBP is in order.

Should Harris pip Trump to the post, the outcome is considered unsupportive of the Dollar as a status quo is maintained.